Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

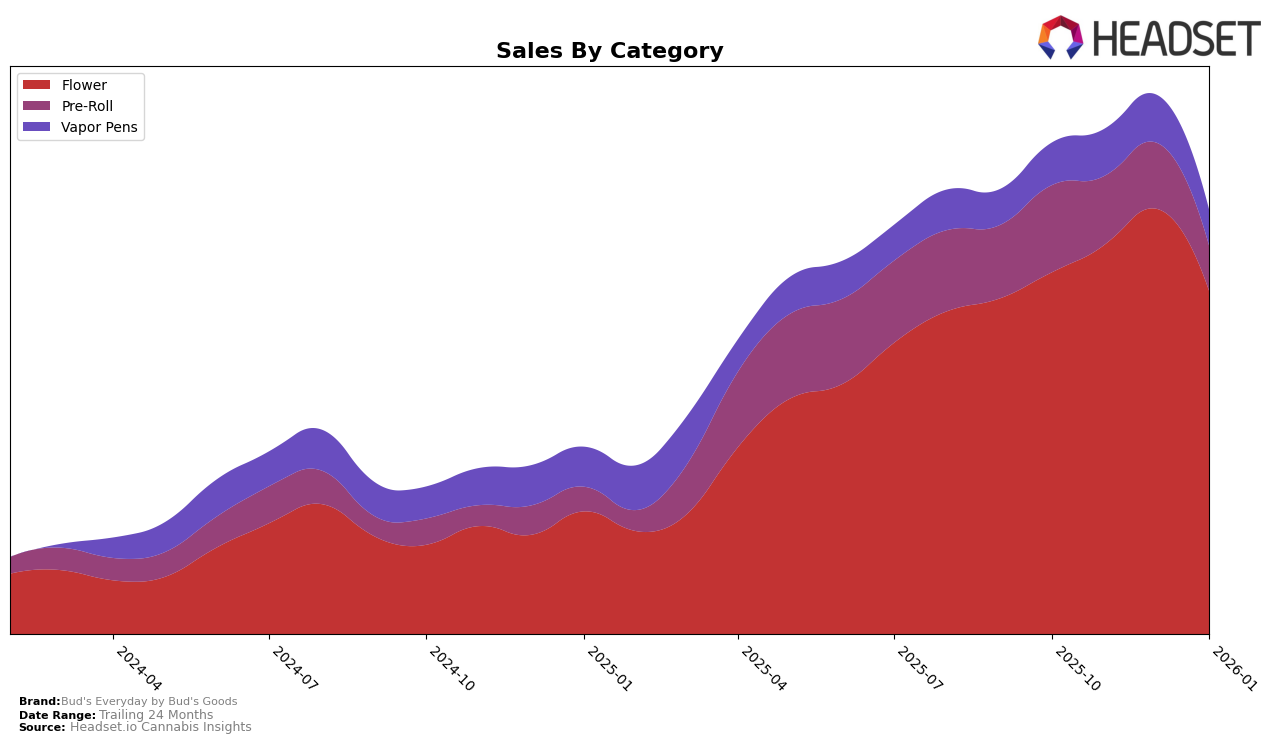

Bud's Everyday by Bud's Goods has shown varied performance across different states and product categories. In the California market, the brand's Vapor Pens have not managed to break into the top 30 rankings, with their position fluctuating between 68th and 79th from October 2025 to January 2026. This indicates a challenging competitive environment in California's vapor pen category, where the brand's ranking has seen a downward trend. Despite the slight increase in sales from October to December 2025, the brand experienced a significant drop in January 2026, which could be a concern for maintaining market presence in California.

In contrast, the performance of Bud's Everyday by Bud's Goods in Massachusetts tells a more promising story, particularly in the Flower category. The brand consistently held a position within the top 10, peaking at 7th place in November 2025 before returning to 10th by January 2026. This stability in ranking suggests a strong foothold in Massachusetts' flower market, even though there was a noticeable dip in sales in January 2026. However, the Pre-Roll category paints a different picture, as the brand slipped from the top 30 rankings by January 2026, indicating a potential area for growth or reevaluation in their strategy. The contrasting performances across these categories highlight the importance of targeted strategies tailored to specific market dynamics.

Competitive Landscape

In the competitive landscape of the Massachusetts flower category, Bud's Everyday by Bud's Goods has experienced some fluctuations in its ranking over the past few months, which may impact its market positioning and sales strategy. Starting from a rank of 10 in October 2025, Bud's Everyday climbed to 7 in November, before slightly dropping to 8 in December and then back to 10 in January 2026. This movement indicates a competitive pressure from brands like Cresco Labs, which improved its rank consistently from 13 to 8 over the same period, and Eleven, which made a notable jump from 14 to 9 by January. Meanwhile, RYTHM showed a decline in rank, moving from 9 to 11, which could suggest an opportunity for Bud's Everyday to capitalize on any potential market share shifts. Additionally, Ozone made a significant leap from being outside the top 20 to securing the 12th spot by December, maintaining it in January, indicating a rising competitor that Bud's Everyday should monitor closely. These dynamics suggest that while Bud's Everyday has maintained a strong position, the brand must continue to innovate and differentiate to sustain and potentially improve its market standing amidst a competitive and evolving landscape.

Notable Products

In January 2026, Blue Dream (3.5g) emerged as the top-performing product for Bud's Everyday by Bud's Goods, climbing from third place in December 2025 to first place with sales reaching 2971 units. The Blue Dream (14g) product, which held the top spot in December, moved to second place. Wedding Cake Distillate Cartridge (1g) maintained a strong presence, ranking third after being fourth in the previous month. Bananaconda (14g) entered the rankings at fourth place, while Jay's - Bad N' Boujee Pre-Roll 2-Pack (1g) secured the fifth position. These shifts highlight a dynamic competitive landscape, particularly within the Flower category, where Blue Dream products continue to dominate.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.