Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

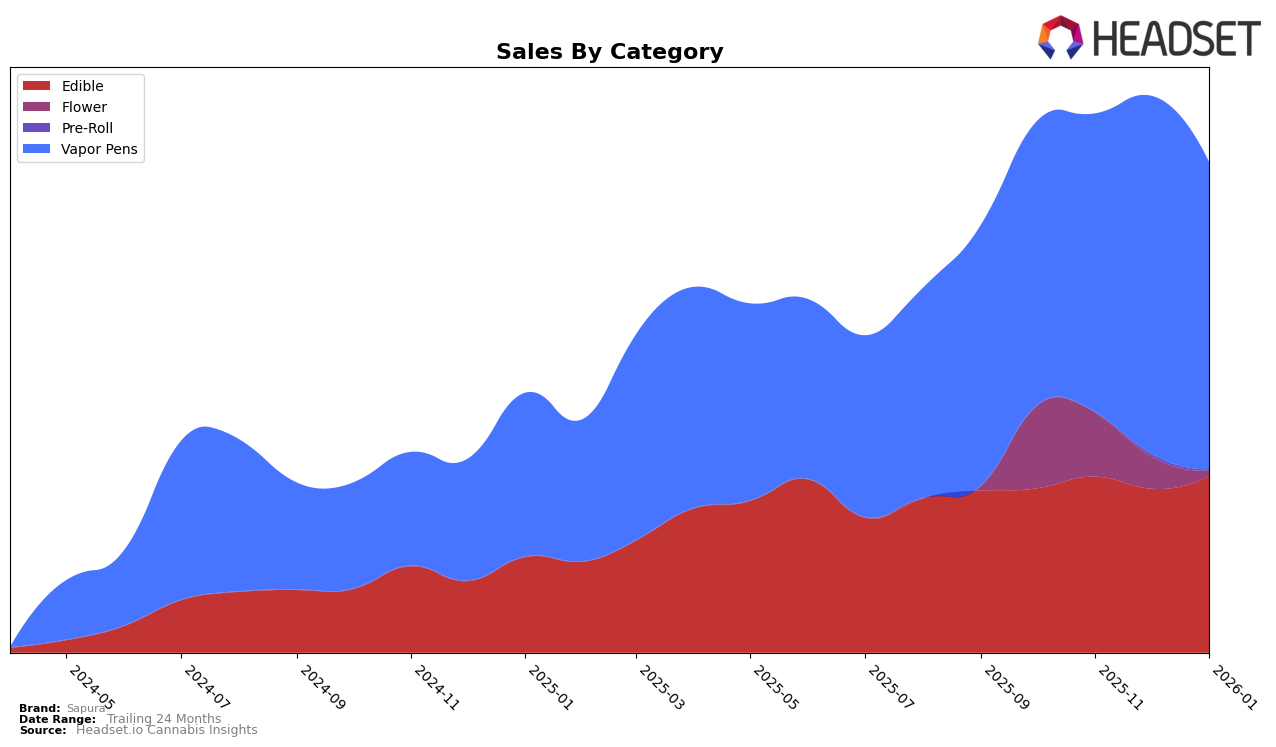

In the state of Massachusetts, Sapura's performance in the Edible category has remained relatively stable over the past few months. The brand held the 18th position in both October and November 2025 but experienced a slight drop to 20th in December 2025 and January 2026. Despite this minor decline in ranking, Sapura's sales in the Edible category showed resilience with a notable increase from December 2025 to January 2026, indicating a potential rebound in consumer interest. This consistent presence in the top 20 highlights the brand's steady hold in the market, even amidst minor fluctuations in ranking.

Meanwhile, Sapura's performance in the Vapor Pens category in Massachusetts presents a more dynamic picture. The brand improved its standing from 26th in October 2025 to 19th in December 2025, showcasing a significant upward trajectory. However, the ranking slightly dipped to 22nd in January 2026. This fluctuation suggests a competitive landscape within the Vapor Pens segment, where Sapura is actively vying for a stronger position. The increase in sales from October to December 2025 supports the notion of growing consumer interest, but the slight dip in January 2026 indicates potential challenges in maintaining momentum. Overall, Sapura's ability to remain within the top 30 across both categories underscores its competitive presence in the Massachusetts market.

Competitive Landscape

In the competitive landscape of vapor pens in Massachusetts, Sapura has shown a promising trajectory, especially when compared to its peers. From October 2025 to January 2026, Sapura improved its rank from 26th to 22nd, reflecting a positive trend in market presence. This upward movement is significant when juxtaposed with competitors like Good Chemistry Nurseries, which fluctuated between ranks 23 and 32, and Pioneer Valley, which saw a decline from 21st to 25th. Notably, In House maintained a relatively stable rank, peaking at 18th in December 2025, but Sapura's sales growth in December, surpassing its November figures, indicates a stronger demand trajectory. Meanwhile, Galactic improved its rank to 21st in January 2026, suggesting a competitive push that Sapura must consider. Overall, Sapura's consistent climb in rankings and sales highlights its growing influence in the Massachusetts vapor pen market, positioning it well against its competitors.

Notable Products

In January 2026, Sapura's Blazing Blue Raspberry Gummies 20-Pack (100mg) emerged as the top-performing product, maintaining its number one rank from November 2025, with sales reaching 3781 units. Super Charged Cherry Gummies 20-Pack (100mg) held steady in the second position, consistent with its ranking since November 2025, showing strong sales figures of 3498 units. Groovy Grapefruit Gummies 20-Pack (100mg) made an impressive debut in the rankings at third place, indicating a favorable reception. Amped Up Apple RSO Gummies 20-Pack (100mg) improved its position to fourth place from its previous fifth rank in November 2025. Outrageous Orange Gummies 20-Pack (100mg) dropped to the fifth position, a significant decline from its top rank in October 2025, reflecting a decrease in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.