Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

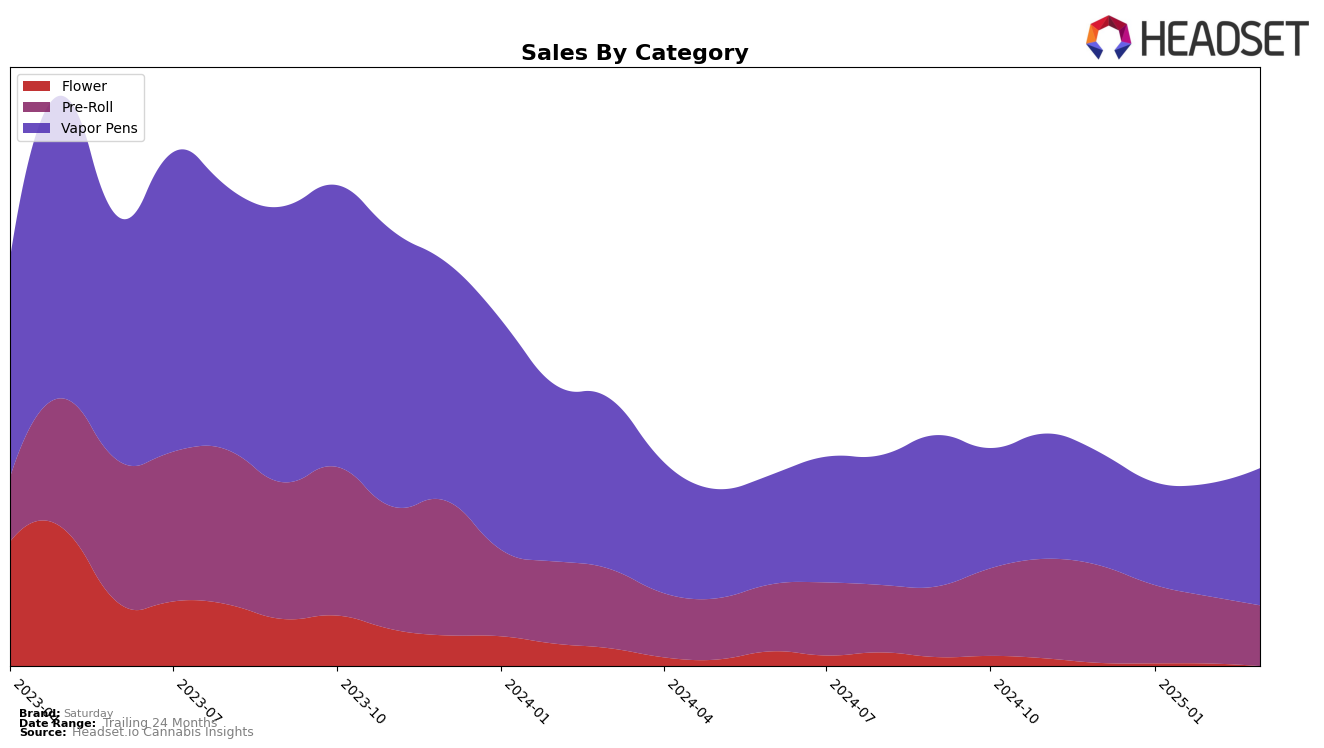

In the province of Alberta, Saturday's performance in the Pre-Roll category has seen some fluctuations over the past few months. Starting from a rank of 78 in December 2024, the brand improved to 62 in January 2025, only to dip slightly to 64 in February and then fall back to 79 by March. This indicates a volatile presence in the market, with sales peaking in January before declining in the following months. The absence of Saturday in the top 30 brands suggests that while they have a presence, they are struggling to maintain a strong competitive edge within the Pre-Roll category in Alberta.

In contrast, the performance of Saturday in the Vapor Pens category in Ontario paints a more optimistic picture. The brand has shown consistent improvement, moving from a rank of 41 in December 2024 to breaking into the top 30 by March 2025. This positive trend is further supported by increasing sales figures, with March sales reaching a notable high. Saturday's ability to secure a spot within the top 30 brands in Ontario's Vapor Pens category demonstrates their growing influence and potential for further market penetration, distinguishing them from their performance in Alberta.

Competitive Landscape

In the Ontario vapor pens category, Saturday has shown a steady improvement in its market position, climbing from a rank of 41 in December 2024 to 30 by March 2025. This upward trend is indicative of a positive reception and increasing consumer preference, as evidenced by a significant sales increase from December 2024 to March 2025. In contrast, Jonny Chronic and Ness, while maintaining higher sales figures, have experienced fluctuating ranks, with Jonny Chronic dropping from 23 to 28 and Ness from 25 to 29 over the same period. Meanwhile, Vortex Cannabis Inc. and Trippy Sips have shown less volatility, with Trippy Sips consistently ranking around 30-31. This competitive landscape suggests that while Saturday is still behind in sales compared to some competitors, its consistent rank improvement positions it well for continued growth in the Ontario market.

Notable Products

In March 2025, the top-performing product for Saturday was Night XL Infused Blunt (1g) in the Pre-Roll category, maintaining its number one rank consistently since December 2024 with sales of 4,985 units. Sour Blueberry Co2 Cartridge (1g) in the Vapor Pens category held steady at the second position, showing a notable increase in sales from February to March. Beached Mango Co2 Cartridge (1g) followed closely, ranked third, with significant sales growth noted in March. Watermelon CO2 Cartridge (1g) entered the rankings at fourth place, indicating strong initial performance. Toasted Hazelnut Infused Blunt (1g) experienced a decline, dropping to fifth place, with a notable decrease in sales figures over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.