Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

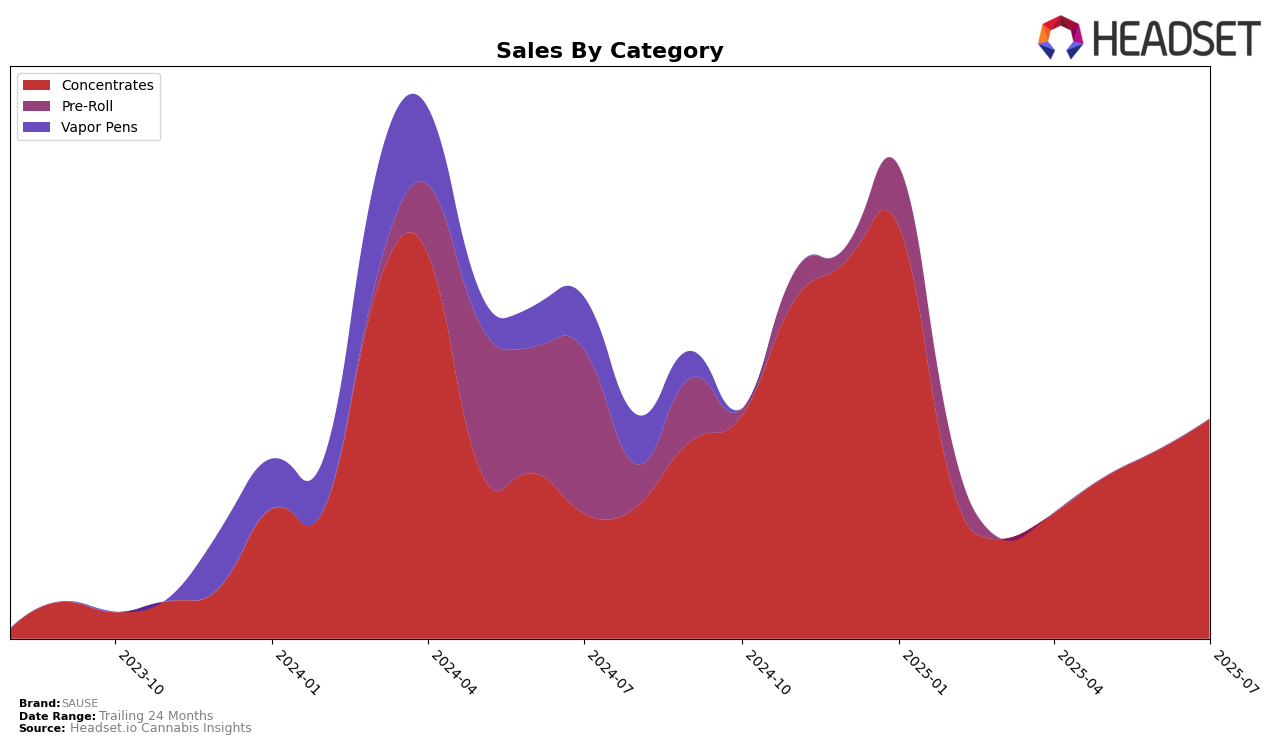

In the state of Massachusetts, SAUSE has shown a notable upward trajectory in the Concentrates category over the past few months. Starting from a rank of 38 in April 2025, the brand has climbed to the 25th position by July 2025. This consistent improvement reflects a strong market presence and growing consumer preference for SAUSE's products in this category. The brand's sales figures support this positive trend, with a steady increase from April through July, indicating effective market strategies and possibly an expanding consumer base.

Despite these gains in Massachusetts, it's important to note that SAUSE's absence from the top 30 brands in other states or provinces suggests potential areas for growth. The lack of ranking in other regions could be seen as a challenge or an opportunity for expansion, depending on the company's strategic goals. Focusing on what has driven success in Massachusetts could provide insights into replicating this performance in other markets, potentially enhancing SAUSE's overall brand footprint in the cannabis industry.

Competitive Landscape

In the Massachusetts concentrates market, SAUSE has shown a promising upward trajectory from April to July 2025, improving its rank from 38th to 25th. This positive trend is indicative of a significant increase in sales, positioning SAUSE as a rising competitor. Notably, Theory Wellness and Glazed have maintained higher ranks throughout this period, with Glazed consistently ranking in the top 25. Meanwhile, DRiP (MA) experienced a decline in rank from 9th in May to 26th in July, suggesting potential market volatility that SAUSE could capitalize on. Additionally, Native Sun entered the top 20 in June and July, indicating new competition. These dynamics highlight a competitive landscape where SAUSE's growth could be leveraged to further challenge established brands and capture additional market share.

Notable Products

In July 2025, SAUSE's top-performing product was Space Jam BX1 Live Resin Badder (1g) in the Concentrates category, maintaining its number one rank from the previous months with a notable sales figure of 881 units. Pineapple Runts Live Resin Badder (1g) rose to the second position from third in June, demonstrating a significant increase in popularity. Jelly Dog Live Resin Badder (1g) dropped one spot to third place, despite consistent sales growth. Mint Sherb Live Rosin Badder (1g) held steady at fourth place, showing modest sales improvement. Overall, the rankings highlight a stable top performer with dynamic shifts in the second and third positions.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.