Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

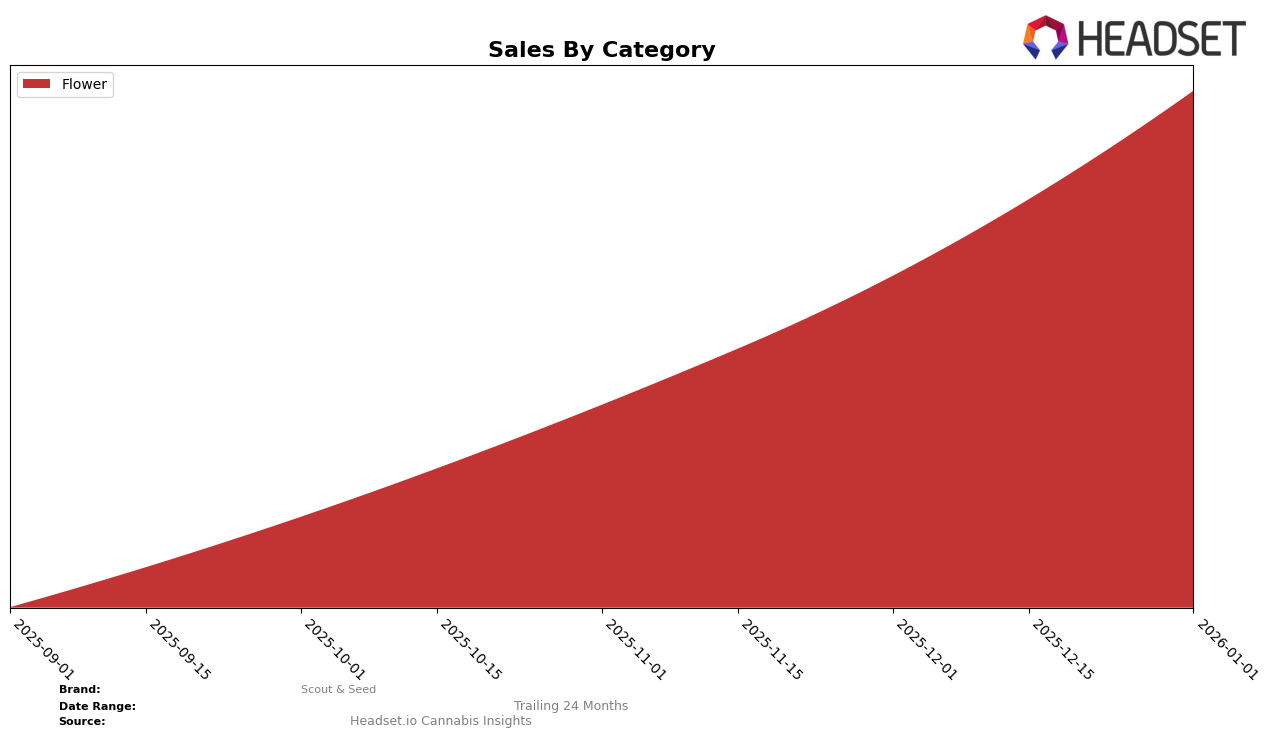

Scout & Seed has demonstrated a notable upward trajectory in the Missouri cannabis market, particularly in the Flower category. Over the last four months, the brand has climbed from a rank of 52 in October 2025 to breaking into the top 30 by January 2026. This consistent improvement in rankings suggests a growing consumer preference or effective market strategies that have propelled Scout & Seed into a more competitive position. The significant increase in sales from October to January further underscores this positive trend and reflects the brand's strengthening presence in the Missouri market.

Despite the encouraging progress in Missouri, Scout & Seed's absence from the top 30 in other states or provinces during this period indicates areas for potential growth. The lack of ranking data from other regions suggests that the brand either has not yet expanded beyond Missouri or is facing stiff competition in other markets. This presents both a challenge and an opportunity for Scout & Seed, as expanding its footprint could lead to increased market share and brand recognition. Understanding the factors behind their success in Missouri could be key to replicating similar results in other states or provinces.

Competitive Landscape

In the Missouri Flower category, Scout & Seed has shown a remarkable upward trajectory in brand ranking, moving from 52nd place in October 2025 to 29th place by January 2026. This impressive climb is indicative of a significant increase in sales, reflecting a growing consumer preference for Scout & Seed products. In contrast, competitors like Robust and Pinchy's have experienced a decline in their rankings, with Robust falling from 17th to 31st and Pinchy's dropping from 18th to 27th over the same period. This suggests that Scout & Seed is effectively capturing market share from these established brands. Meanwhile, Sundro Cannabis and CAMP Cannabis have maintained relatively stable positions, indicating a more consistent performance. The data highlights Scout & Seed's successful strategies in gaining traction in the competitive Missouri Flower market, potentially positioning it as a formidable player in the near future.

Notable Products

In January 2026, the top-performing product for Scout & Seed was Mad Honey (3.5g) in the Flower category, claiming the number one rank with sales of 1079 units. Honey Banana x Orange Mintz #2 (Bulk) followed closely in second place, showcasing a strong entry into the top rankings. Grape Gas (3.5g) maintained a steady position, remaining at third rank for two consecutive months, while Blue Platinum 41 (3.5g), which was previously the top seller in December, fell to fourth place. Blue Platinum 41 (7g) entered the top five for the first time, securing the fifth rank. These shifts indicate a dynamic change in consumer preferences, with Mad Honey (3.5g) rapidly rising to the top from an unranked position in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.