Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

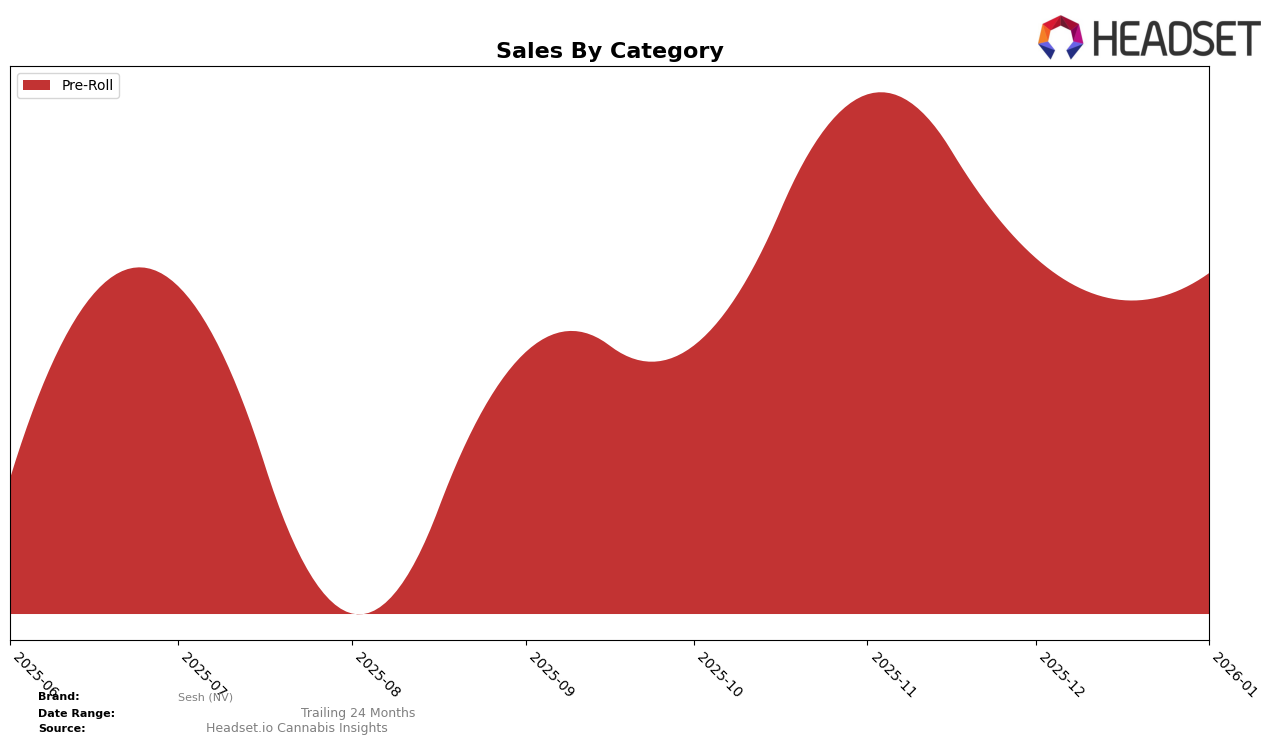

Sesh (NV) has shown a notable presence in the Nevada cannabis market, particularly within the Pre-Roll category. Over the past few months, the brand has experienced significant fluctuations in its rankings. In October 2025, Sesh (NV) was not in the top 30, ranking at 36th, but by November, it had climbed to 22nd, marking a substantial upward movement. However, the brand's position slightly declined in the following months, settling at 27th in December and 30th in January 2026. This oscillation in rankings indicates a competitive market environment and suggests that while Sesh (NV) has the potential to rise, maintaining a stable position remains a challenge.

Despite the fluctuations in rank, Sesh (NV) has demonstrated resilience in sales performance. For instance, the brand saw a significant increase in sales from October to November 2025, jumping from $45,740 to $72,928. Although there was a dip in December, with sales decreasing to $55,233, the brand managed to stabilize its sales at $53,604 in January 2026. The ability to maintain sales figures despite the competitive pressures in the Pre-Roll category speaks to the brand's potential to capture consumer interest. However, their absence from the top 30 in October highlights the need for strategic adjustments to sustain growth and improve market positioning consistently.

Competitive Landscape

In the Nevada pre-roll category, Sesh (NV) has experienced fluctuating rankings from October 2025 to January 2026, indicating a dynamic competitive landscape. Notably, Sesh (NV) improved its rank from 36th in October to 22nd in November, before settling at 30th in January. This suggests a competitive push during the holiday season, possibly driven by promotional efforts or product launches. Comparatively, Redwood showed a strong performance, climbing to 14th place in December before dropping to 33rd in January, highlighting its volatility. Meanwhile, Superior (NV) maintained a more stable presence, peaking at 26th in November and ending at 27th in January, which could indicate consistent consumer loyalty. Spiked Flamingo also demonstrated resilience, maintaining a steady rank around the high 20s, while Tyson 2.0 struggled to stay in the top 20, missing the December ranking entirely. These insights suggest that Sesh (NV) faces stiff competition, particularly from brands like Redwood and Spiked Flamingo, which have shown the ability to capture significant market share, potentially impacting Sesh's sales trajectory and necessitating strategic adjustments to maintain or improve its market position.

Notable Products

In January 2026, the top-performing product from Sesh (NV) was Sundae Driver Pre-Roll (1g), leading the sales rankings with a notable figure of 1508 units sold. Following closely, Animal Sherb Mints Pre-Roll (1g) secured the second position with 1427 units. Sub Zero #12 Pre-Roll (1g) ranked third, demonstrating a consistent performance with 1271 units. Lemon Bubblegum Pre-Roll (1g) and Shake Shack Pre-Roll (1g) both shared the fourth spot, each achieving sales of 1140 units. Compared to previous months, all these products have newly emerged in the rankings, indicating a strong performance in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.