Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

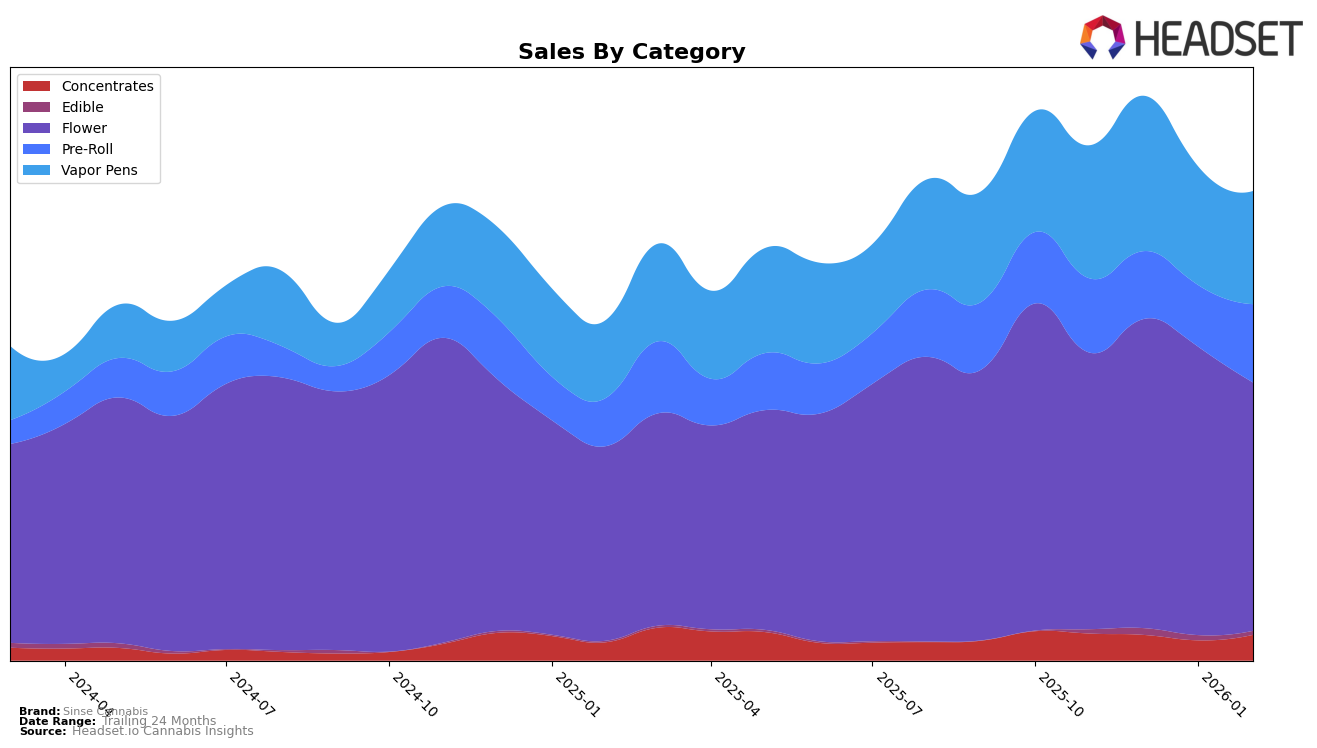

Sinse Cannabis has demonstrated a consistent presence in the Missouri market, particularly in the Flower and Pre-Roll categories, where they maintained a steady 4th and 5th rank respectively from November 2025 through February 2026. This stability in ranking suggests a strong brand loyalty and consistent consumer demand in these categories. However, in the Concentrates category, Sinse Cannabis experienced fluctuations, dropping from 5th in November 2025 to 10th in January 2026, before recovering to 6th in February 2026. Such volatility could indicate a competitive landscape or shifting consumer preferences within the Concentrates market.

In the Vapor Pens category, Sinse Cannabis faced a slight dip in rankings, moving from 4th place in both November and December 2025 to 6th place in January 2026, before climbing back to 5th in February 2026. Despite this fluctuation, the brand's sales performance in this category remained robust, with a notable increase in sales from November to December 2025. The ability to maintain a top 6 position in all categories across the months highlights the brand's resilience and adaptability in the Missouri market. However, the absence of Sinse Cannabis from the top 30 in any other state or province suggests room for growth and expansion beyond Missouri.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Sinse Cannabis has maintained a consistent rank of 4th place from November 2025 to February 2026. Despite a stable position, Sinse Cannabis faces pressure from both above and below in the rankings. CODES has consistently held the 2nd position, showing strong sales performance that surpasses Sinse Cannabis. Meanwhile, Illicit / Illicit Gardens remains in 3rd place, also ahead of Sinse Cannabis in sales. On the other hand, Sinse Cannabis has managed to outperform Amaze Cannabis, which slipped from 5th to 6th place by February 2026, and Good Day Farm, which improved its ranking from 8th to 5th place during the same period. The competitive dynamics indicate that while Sinse Cannabis holds a strong position, it must strategize to increase its sales to climb higher in the rankings, especially as competitors like Good Day Farm show upward momentum.

Notable Products

In February 2026, Cap Junky (Bulk) from Sinse Cannabis emerged as the top-performing product, climbing to the number one rank with impressive sales of 22,735 units. Blueberry Muffin (Bulk) maintained a strong presence, securing the second position, although it experienced a slight decline in sales compared to previous months. Jungle Cookies Pre-Roll 3-Pack (1.5g) made a notable entry into the top ranks, capturing the third spot after not being ranked in January. Lemon Royale (Bulk) also made a comeback, reaching the fourth position, having not been ranked in the previous two months. Lastly, Frosted Cooler Pre-Roll 3-Pack (1.5g) entered the rankings at fifth place, indicating a growing interest in pre-roll products from Sinse Cannabis.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.