Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

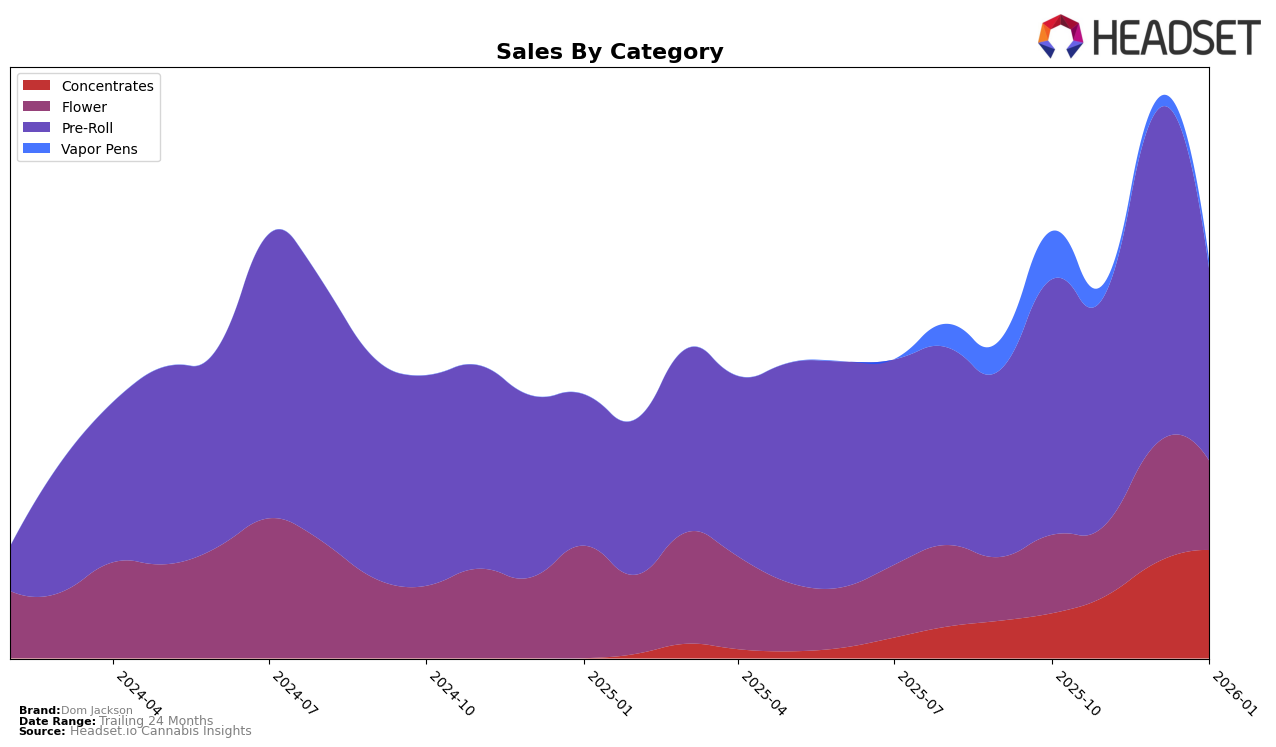

Dom Jackson has shown varied performance across different categories and regions, with notable movements in rankings. In the Ontario market, the brand's presence in the Concentrates category has improved, moving from not being in the top 30 to ranking 46th by January 2026. This indicates a positive trend, suggesting that Dom Jackson is gaining traction in this category. However, their performance in the Flower category has been inconsistent, with rankings fluctuating from 100th in October 2025 to 88th in December, then slightly dropping to 93rd in January 2026. This fluctuation highlights the competitive nature of the Flower market in Ontario. The Pre-Roll category also saw a dip from 61st in December 2025 to 77th by January 2026, which could be a point of concern for the brand.

In Saskatchewan, Dom Jackson has demonstrated a strong and improving presence in the Concentrates category, climbing from 6th position in October 2025 to an impressive 2nd place by January 2026. This consistent upward trajectory indicates a robust market strategy and consumer preference for their products in this category. Conversely, in the Pre-Roll category, the brand's ranking has been more volatile, with a notable improvement from 56th in November 2025 to 34th by January 2026. Despite this improvement, the fluctuating rankings suggest that while Dom Jackson is making headway, there remains significant competition and room for growth in the Pre-Roll category in Saskatchewan.

Competitive Landscape

In the competitive landscape of Pre-Roll brands in Ontario, Dom Jackson has experienced notable fluctuations in its rank and sales performance over the past few months. As of January 2026, Dom Jackson's rank dropped to 77th, a decline from its peak position of 61st in December 2025. This drop in rank coincides with a significant decrease in sales from December to January, indicating potential challenges in maintaining its market position. In contrast, Vox, despite a slight decline, maintained a relatively stronger position, ranking 75th in January 2026 with consistently higher sales figures compared to Dom Jackson. Meanwhile, EastCann improved its rank to 76th in January 2026, showcasing a gradual upward trend. Versus and Adults Only both experienced rank fluctuations but remained competitive, with sales figures that suggest they are formidable contenders in the market. These dynamics highlight the competitive pressures Dom Jackson faces in the Ontario Pre-Roll category, emphasizing the need for strategic adjustments to regain and sustain a higher market position.

Notable Products

In January 2026, the top-performing product for Dom Jackson was Ghost Banner Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its leading position from November 2025 despite a decrease in sales to 1493 units. Banjo Pre-Roll 3-Pack (1.5g) held steady at the second position, showing consistency in its performance. Mary-go-round (3.5g) in the Flower category made a notable entry into the rankings at third place, marking a significant improvement from its absence in December 2025. Gas Mask Pre-Roll 3-Pack (1.5g) dropped from the top spot in December 2025 to fourth place in January 2026, indicating a decline in its sales momentum. Bane Chamber Wax (1g) debuted in the rankings at fifth place, highlighting its introduction as a new contender in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.