Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

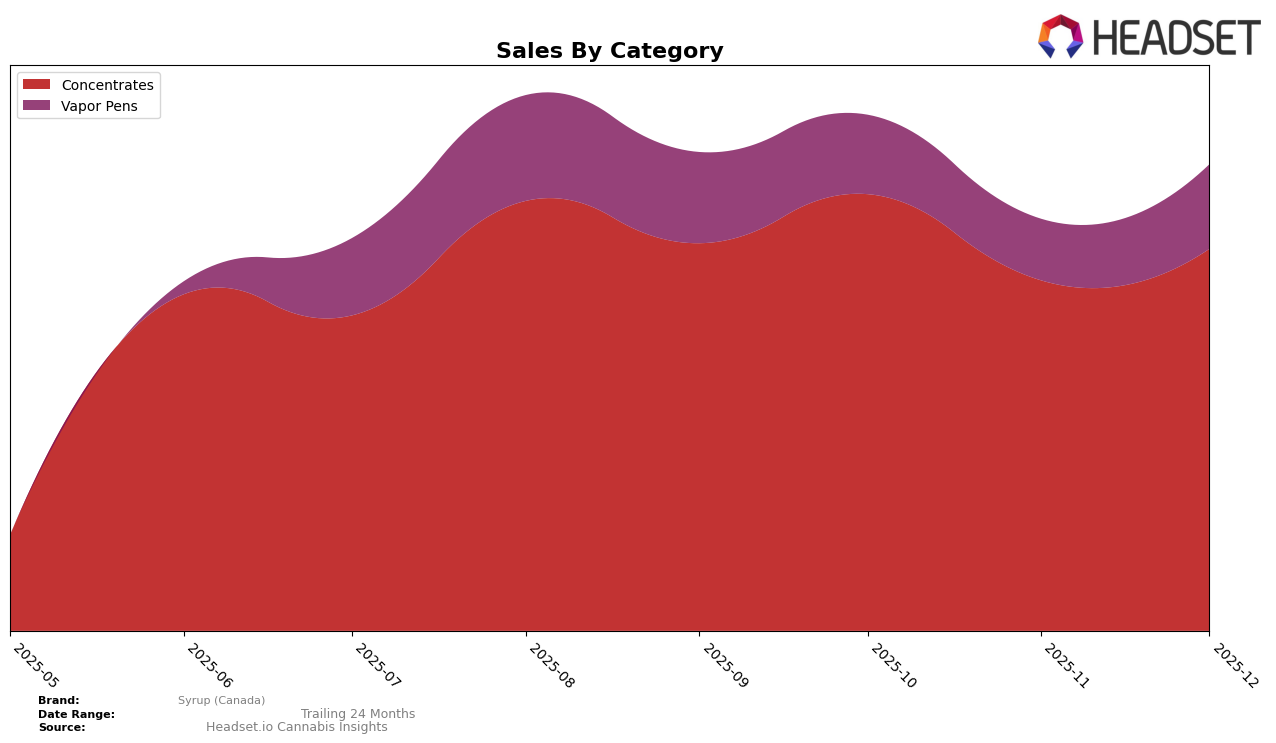

The performance of Syrup (Canada) in the Concentrates category across different provinces shows a mixed trend. In Alberta, the brand experienced a steady decline in rankings from September to December 2025, dropping from 16th to 24th place. This downward trend is mirrored in their sales figures, which decreased consistently over the four months. In contrast, Ontario presented a more positive outlook for Syrup (Canada), where the brand improved its position from 52nd in September to 39th in December. This upward movement in rankings aligns with a notable increase in sales during the same period, suggesting a growing market presence in Ontario.

In the Vapor Pens category within Ontario, Syrup (Canada) was ranked 98th in September 2025 but did not make it into the top 30 in subsequent months. This indicates a challenging market for Syrup (Canada) in this category, potentially highlighting competitive pressures or a need for strategic adjustments. The absence from the top 30 in later months could be seen as a setback, especially when compared to the relative success in the Concentrates category. These insights suggest that while Syrup (Canada) is gaining traction in some areas, there remain opportunities for growth and improvement in others.

Competitive Landscape

In the Alberta concentrates market, Syrup (Canada) has experienced a notable shift in its competitive positioning over the last few months. Initially ranked 16th in September 2025, Syrup (Canada) saw a decline to 18th in October, and further dropped to 24th in both November and December. This downward trend in rank coincides with a decrease in sales over the same period, suggesting potential challenges in maintaining market share. In contrast, Phyto Extractions showed resilience, improving its rank from 22nd in September to 18th in November, before slipping to 23rd in December. Meanwhile, Coterie maintained a stable presence, consistently ranking around the 22nd position, indicating steady performance. La Boca demonstrated significant upward momentum, climbing from 41st in September to 26th by December, which may pose a future threat to Syrup (Canada) if this trend continues. These dynamics highlight the competitive pressures Syrup (Canada) faces, emphasizing the need for strategic adjustments to regain its previous standing in the Alberta concentrates market.

Notable Products

In December 2025, Chem Bomb Live Terp (1g) from Syrup (Canada) maintained its position as the top-performing product in the Concentrates category, with sales reaching 2390 units, showing consistent dominance throughout the last four months. Zuper Kush Live Terp Dispenser (1g) also held steady in second place in the same category, despite a significant drop in sales compared to previous months. Little Tokyo Live Terp Dab (1g) remained in third place for December, continuing its stable performance from November. Velvet Lightning Live Resin Terp Cartridge (0.95g) showed a slight improvement in ranking, moving up to fourth place in the Vapor Pens category from fifth in November. A new entry, Little Tokyo Live Resin Terp Cartridge (2g), debuted in fifth place in December, indicating potential growth in the Vapor Pens market segment for Syrup (Canada).

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.