Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

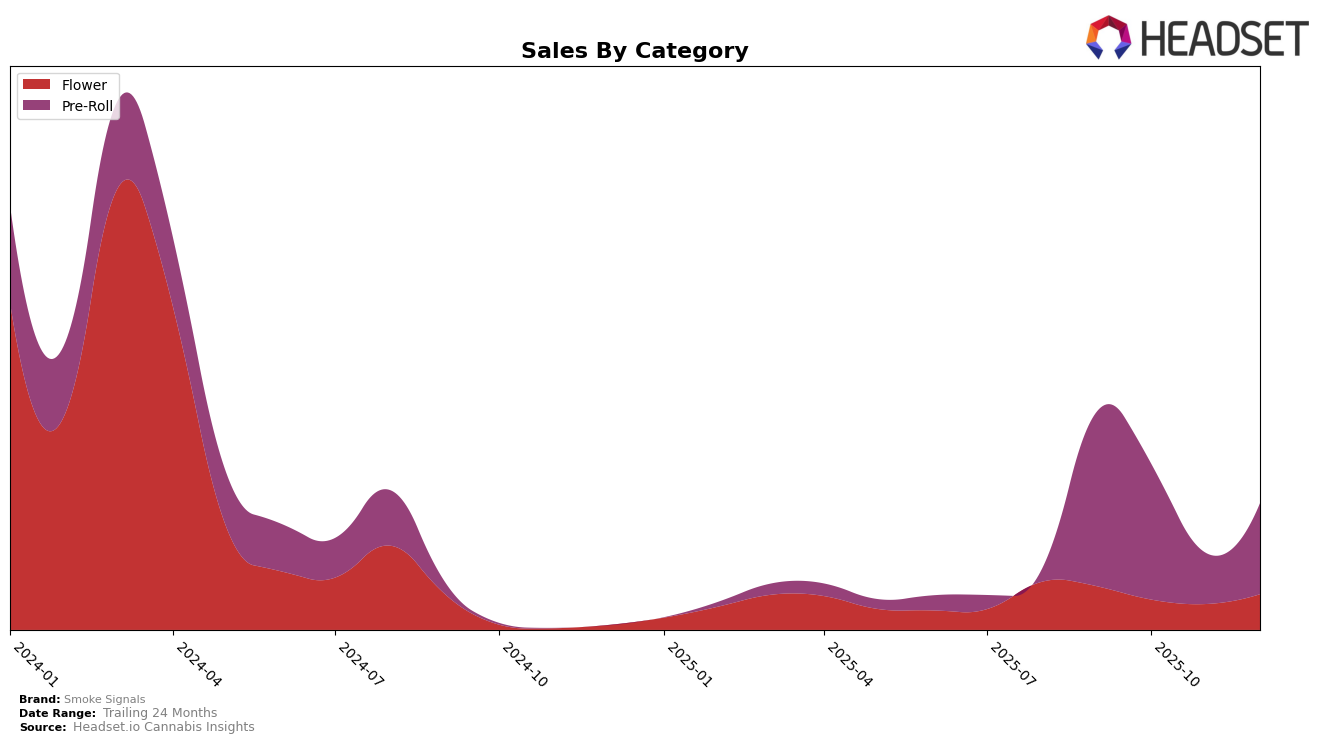

Smoke Signals has experienced varied performance across different categories and states, reflecting both challenges and opportunities. In the Nevada market, the brand's Flower category has struggled to break into the top 30 rankings, with positions hovering around the 75th to 80th mark over the last four months of 2025. This suggests a competitive landscape in the Flower category, where Smoke Signals is facing stiff competition. Despite this, there was a noticeable uptick in sales from November to December, indicating potential for growth or a successful promotional strategy during the holiday season.

Conversely, in the Pre-Roll category, Smoke Signals has shown more dynamic movements, with rankings fluctuating significantly between 15th and 38th place in Nevada. The brand's position dropped notably in November but rebounded in December, suggesting a possible recovery or strategic adjustment. The sales data indicates a decline from September to November, followed by a recovery in December, which might point to seasonal demand shifts or the impact of new product introductions. This variability highlights both the volatility in consumer preferences and the brand's ability to adapt to market conditions, offering insights into potential strategic areas to focus on for consistent performance improvement.

Competitive Landscape

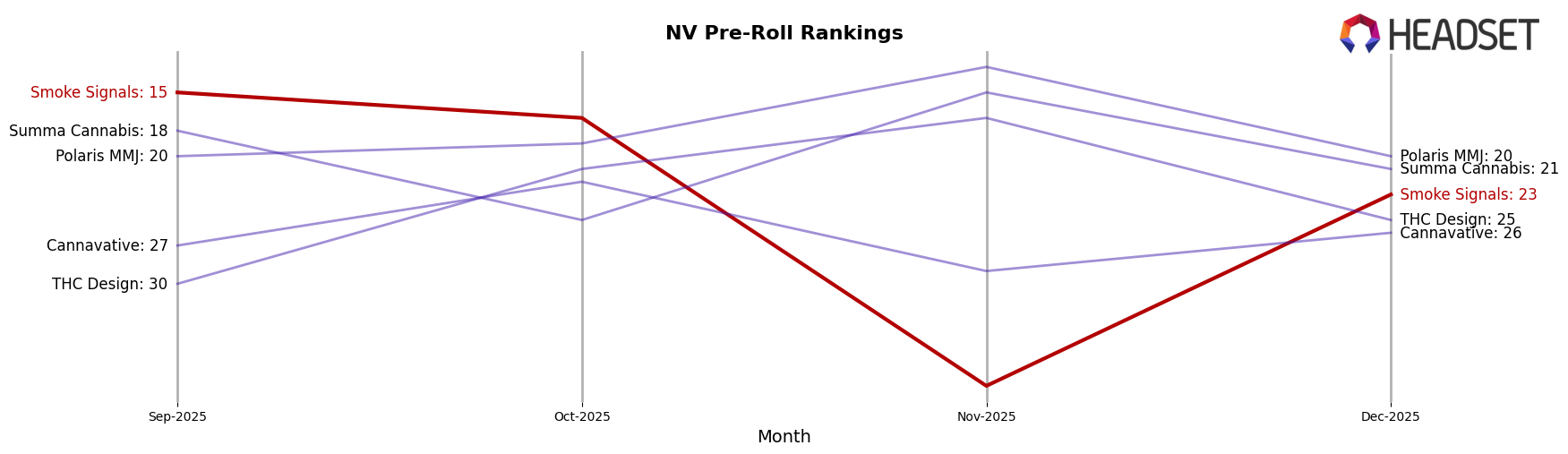

In the competitive landscape of the Nevada Pre-Roll category, Smoke Signals experienced notable fluctuations in its rank and sales from September to December 2025. Starting at 15th place in September, Smoke Signals saw a decline to 17th in October and a significant drop to 38th in November, before recovering slightly to 23rd in December. This volatility contrasts with the relatively stable performance of competitors like Polaris MMJ, which maintained a consistent presence in the top 20, peaking at 13th in November. Meanwhile, THC Design showed an upward trend, improving from 30th in September to 17th by November, before slightly dropping to 25th in December. Summa Cannabis and Cannavative also demonstrated competitive resilience, with Summa Cannabis reaching as high as 15th in November. These dynamics suggest that while Smoke Signals faces challenges in maintaining a stable rank, its competitors are capitalizing on market opportunities, potentially impacting Smoke Signals' market share and necessitating strategic adjustments to regain its competitive edge.

Notable Products

In December 2025, Gary Peyton Pre-Roll (0.7g) emerged as the top-performing product for Smoke Signals, achieving the number one rank with sales reaching 11,783 units. Frosted Sapphire Pre-Roll (0.7g) followed closely in second place, although it dropped from its previous first-place position in November. Glacier Punch Pre-Roll (0.7g) maintained a consistent presence in the top three, ranking third after a brief dip to fourth in November. Galaxy Glue Pre-Roll (0.7g) re-entered the rankings at fourth place, showing a significant recovery from its absence in October and November. M.A.C (3.5g) held steady in fifth place, maintaining its position from November with a modest increase in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.