Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

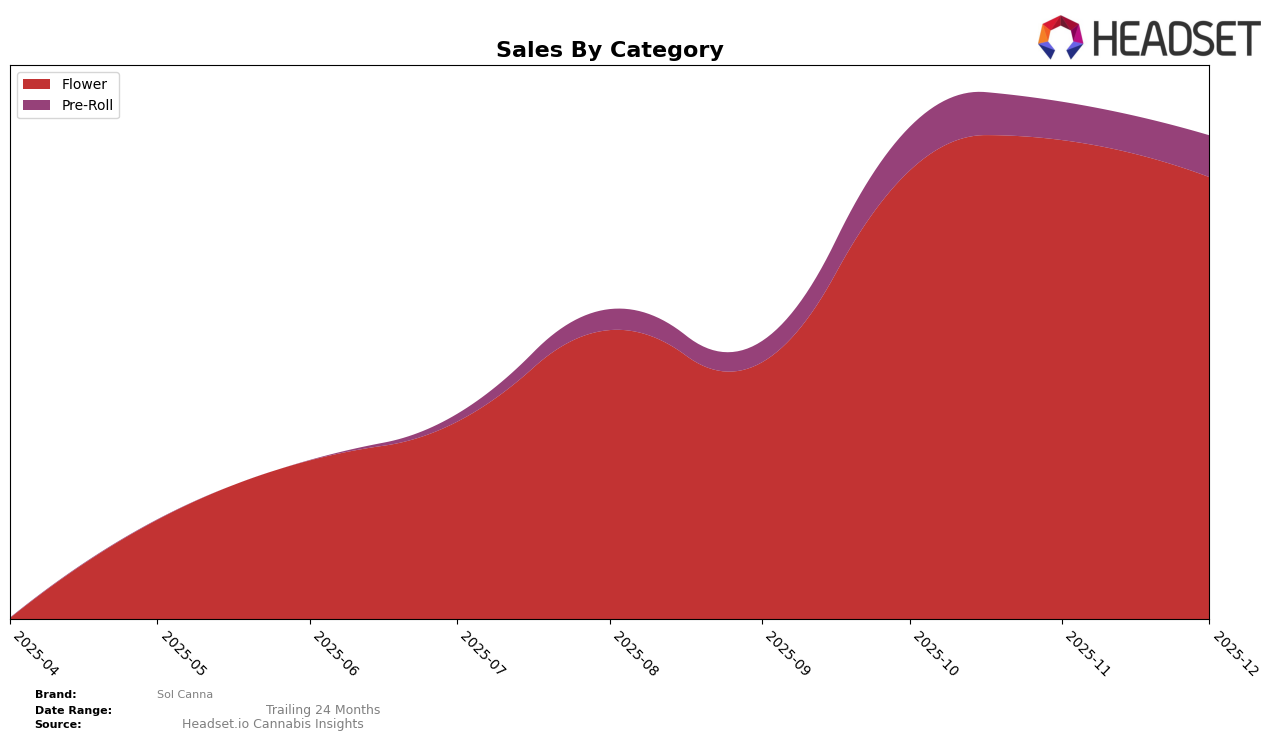

Sol Canna's performance in the Illinois market has shown notable improvements, particularly within the Flower category. Starting from a rank of 25 in September 2025, the brand climbed to the 14th position by October and maintained a steady presence within the top 15 through December 2025. This upward movement is complemented by a significant increase in sales, with October witnessing a remarkable surge that nearly doubled September's figures. Such a trend indicates a growing consumer preference and brand recognition in the Flower category, which could potentially signal further advancements if the brand continues its trajectory.

In contrast, Sol Canna's performance in the Pre-Roll category within Illinois has been less dynamic. The brand managed to break into the top 35 by October 2025 and maintained this rank through December. While this consistency is a positive sign, the absence of Sol Canna from the top 30 indicates room for growth in this category. The steady sales figures suggest a loyal customer base, but the brand may need to innovate or expand its offerings to climb higher in the rankings. This dual performance across categories highlights the varied reception of Sol Canna's products in the market, presenting both opportunities and challenges for the brand's strategic planning.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Sol Canna has demonstrated a remarkable upward trajectory in brand ranking from September to December 2025. Initially ranked at 25th in September, Sol Canna surged to 14th in October, peaked at 12th in November, and settled back to 14th in December. This improvement in rank is indicative of a significant boost in sales, as evidenced by the brand's sales figures which nearly doubled from September to October. In comparison, Nature's Grace and Wellness experienced a decline, dropping from 10th in September to 12th in December, with a corresponding decrease in sales. Similarly, Midweek Friday saw a downward trend, moving from 11th to 16th place over the same period. On the other hand, Cresco Labs showed a more stable performance, fluctuating slightly but maintaining a competitive edge by consistently ranking within the top 13. Meanwhile, Savvy remained in the lower ranks, indicating less competitive pressure on Sol Canna from this brand. These dynamics suggest that Sol Canna's strategic initiatives are effectively enhancing its market position, making it a formidable player in the Illinois flower market.

Notable Products

In December 2025, Sol Canna's top-performing product was Sweetie Pie Pre-Roll 2-Pack 1g, which achieved the number one rank with sales figures reaching 1732 units. Cadillac Rainbows 3.5g climbed to second place, marking a significant rise from its fifth rank in October and third in November, with sales increasing to 1553 units. Pluto 51 Pre-Roll 2-Pack 1g secured the third spot, demonstrating strong performance in its debut month. Wingsuit 3.5g and High Frutose Corn Syrup 3.5g ranked fourth and fifth, respectively, with High Frutose Corn Syrup experiencing a drop from its first-place position in September. Overall, Sol Canna's product lineup showed dynamic shifts in rankings over the past months, with notable improvements and debuts in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.