Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

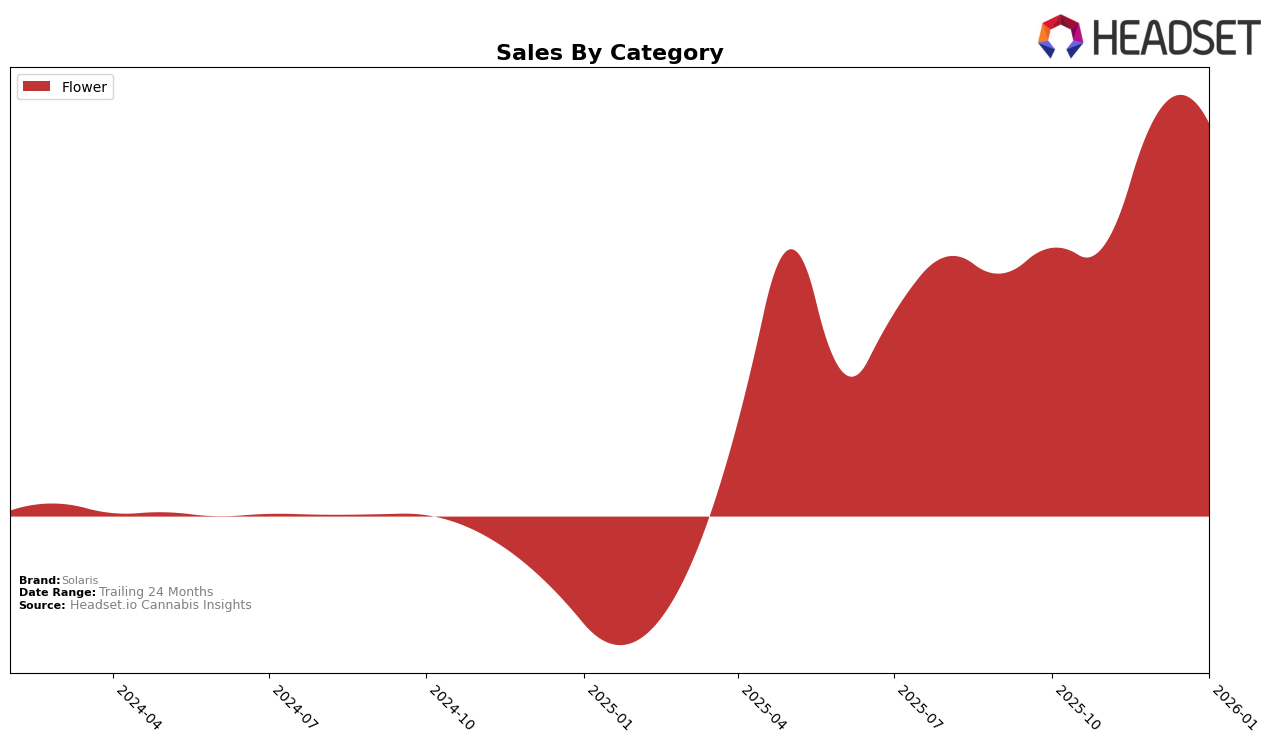

Solaris has shown a dynamic performance across various states and categories, with notable fluctuations in its rankings. In Nevada, the brand experienced a significant rise in the Flower category, moving from the 17th position in November 2025 to an impressive 8th position in December 2025, before slightly dropping to 11th in January 2026. This suggests a strong performance during the holiday season, with a surge in sales that helped boost its ranking. However, the slight decline in January could indicate a return to normalcy post-holiday or increased competition. Such movements highlight the brand's ability to capitalize on peak sales periods, though maintaining momentum remains a challenge.

Interestingly, Solaris's absence from the top 30 in other states or categories during this period might point to either a strategic focus on Nevada's Flower market or a need for broader market penetration. The brand's sales in Nevada saw a significant increase from October to December 2025, suggesting a successful strategy in capturing consumer interest, even if it wasn't uniformly replicated in other regions. While this data provides a glimpse into their market performance, it also raises questions about their strategy and potential areas for growth in the coming months. For more detailed insights, further analysis across different states and categories would be beneficial to understand Solaris's broader market impact and future trajectory.

Competitive Landscape

In the Nevada flower category, Solaris has shown a dynamic shift in its competitive positioning over the past few months. Starting from a rank of 16 in October 2025, Solaris improved to 8 by December 2025, before slightly declining to 11 in January 2026. This fluctuation in rank is indicative of a competitive market where brands like Redwood and Kushberry Farms are also vying for top positions. Notably, Redwood experienced a significant rise from 22 in November to 9 in January, suggesting a strong upward trend that Solaris must contend with. Meanwhile, FloraVega / Welleaf and Lavi have seen more volatility, with ranks dropping out of the top 20 in December, indicating potential opportunities for Solaris to capitalize on their inconsistencies. Overall, Solaris's ability to maintain a relatively stable sales performance amidst these fluctuations highlights its resilience and potential for growth in the competitive Nevada flower market.

Notable Products

In January 2026, Solaris saw Runtz Popcorn (14g) take the top spot in sales, marking its debut in the rankings with a notable sales figure of 2100 units. Scooby Snax (14g) maintained its strong performance, holding steady at the second position, although it had previously fluctuated between second and fifth place in the preceding months. Apples & Bananas (14g), once the leader in October and November 2025, secured the third position, showing a slight decline in its ranking. Blueberry Muffin (14g) re-entered the rankings in fourth place after a previous absence, while Nimbus Snacks (14g) rounded out the top five, also making a return after not ranking in December. These shifts indicate a dynamic market with Runtz Popcorn (14g) emerging as a new favorite among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.