Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

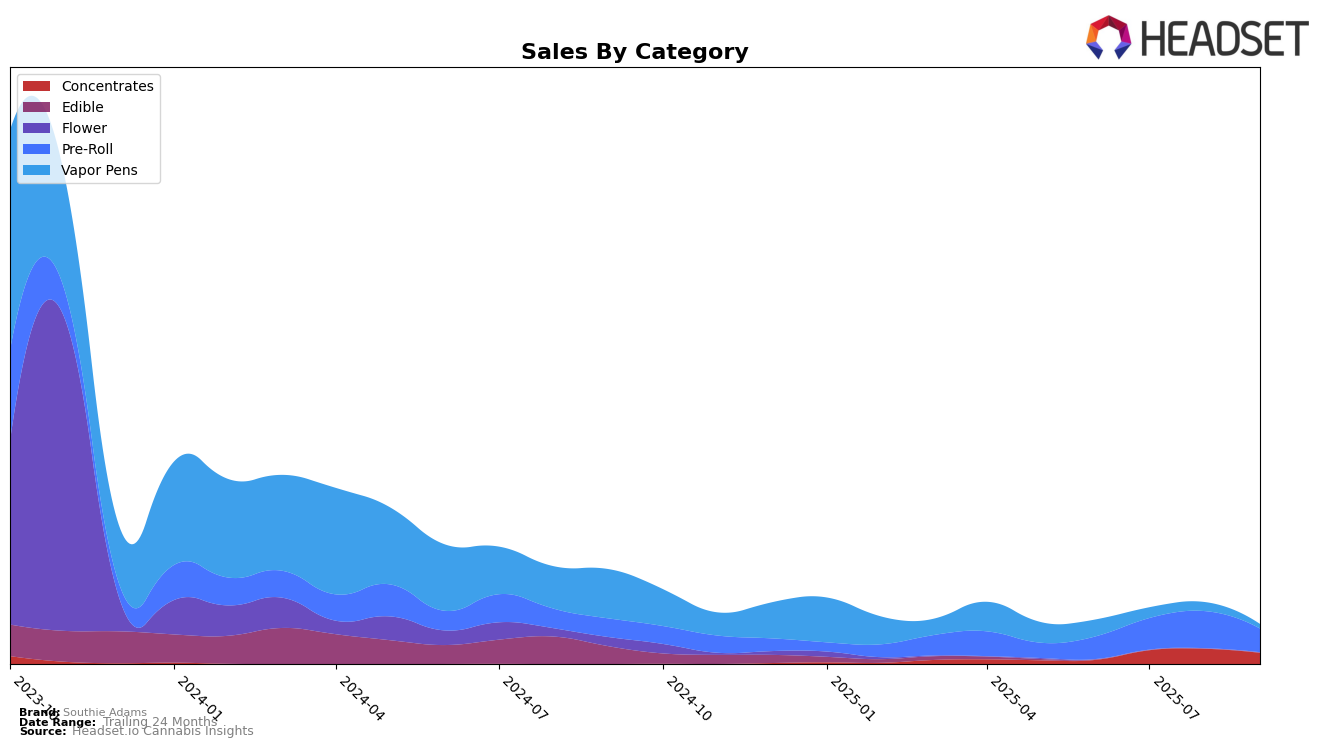

Southie Adams has shown varied performance across different categories and states. In the Massachusetts market, the brand has managed to secure a place in the top 30 for Concentrates, showing a consistent presence from July through September 2025, although it barely held onto the 30th spot in September. The Vapor Pens category, however, tells a different story, with Southie Adams failing to make the top 30 from August onwards. This decline indicates potential challenges or increased competition in the Vapor Pens market within Massachusetts. The fluctuations in rankings suggest that while Southie Adams is making strides in certain categories, it faces hurdles in maintaining a strong position across all product lines.

In New Jersey, Southie Adams has experienced a more favorable trajectory in the Pre-Roll category. Starting from a rank of 59 in June 2025, the brand climbed to 42 by August before slipping back to 59 in September. This rise and fall highlight the competitive nature of the Pre-Roll market in New Jersey, where Southie Adams has shown potential to advance but needs to sustain its momentum to remain competitive. The brand's ability to reach 42nd place in August suggests that with strategic adjustments, it could potentially break into higher rankings in the future. This mixed performance across states and categories underscores the dynamic nature of the cannabis market and the importance of strategic positioning for brands like Southie Adams.

Competitive Landscape

In the competitive landscape of the New Jersey pre-roll category, Southie Adams has shown a dynamic performance from June to September 2025. Initially ranked 59th in June, Southie Adams improved its position to 42nd by August, demonstrating a significant upward trend in sales performance, before slipping back to 59th in September. This fluctuation highlights a potential volatility or seasonality in consumer preferences. In contrast, URBNJ maintained a relatively stable presence, peaking at 46th in August and ending at 52nd in September, indicating consistent consumer loyalty. Meanwhile, Lobo and Cheetah were not in the top 20 during this period, with Lobo's rank declining steadily, suggesting a potential decrease in market share. Jersey Smooth emerged in the rankings in August at 72nd, climbing to 51st by September, which could signal a new competitive threat. These insights suggest that while Southie Adams has experienced both growth and challenges, maintaining its upward trajectory will require strategic adjustments in response to emerging competitors and market dynamics.

Notable Products

In September 2025, the top-performing product for Southie Adams was the Planet of the Grapes Pre-Roll (0.5g), climbing to the number one rank with sales reaching $390. The GMO Blunt 4-Pack (2g) showed significant improvement, moving from fifth place in August to second place in September. The Purple Milk Fatty Blunt (3g) secured the third position, marking its debut in the rankings. Lemongrab Blunt 5-Pack (2.5g) followed closely in fourth place. Meanwhile, the Black Cherry Runtz Pre-Roll 4-Pack (2g) experienced a drop, falling from second place in July to fifth in September, indicating a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.