Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

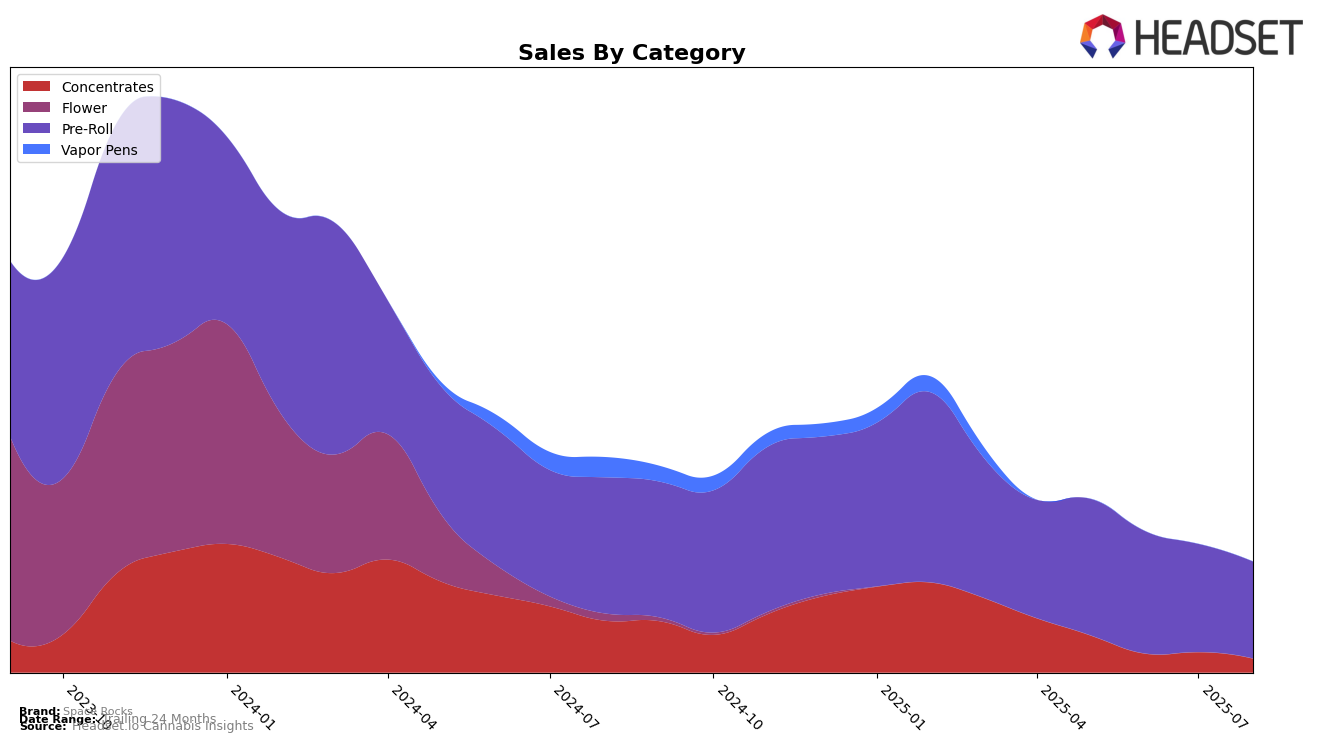

In the Arizona market, Space Rocks has experienced fluctuating performance across different product categories. In the Concentrates category, the brand has struggled to maintain a foothold within the top 30, with rankings slipping from 32nd in May 2025 to 38th by August 2025. This downward trend is concerning, especially when considering the significant drop in sales from May to August. Conversely, in the Pre-Roll category, Space Rocks has shown more stability, maintaining a presence within the top 30 throughout the same period. Although their rank slightly fluctuated, the brand managed to hold on to the 28th position in both July and August, suggesting a more consistent performance in this category despite a gradual decrease in sales.

The performance of Space Rocks in the Concentrates category in Arizona indicates challenges in maintaining market share, as evidenced by the brand's inability to break into the top 30 in August. This contrasts with the Pre-Roll category, where Space Rocks has demonstrated resilience, managing to stay within the top 30 despite a decline in sales figures. The stability in the Pre-Roll category could point to a more loyal customer base or effective market strategies that keep the brand competitive. While the brand's performance in Concentrates may need strategic reevaluation, the consistency in Pre-Rolls could be leveraged to bolster their market presence further. Understanding the dynamics of these categories in different states might offer deeper insights into their overall brand strategy.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Arizona, Space Rocks has experienced fluctuations in its market position, maintaining a rank between 26th and 28th from May to August 2025. Despite a consistent presence in the top 30, Space Rocks faces stiff competition from brands like 22Red, which has shown a positive trend, climbing from 32nd to 27th and then stabilizing around 25th and 27th, indicating stronger sales momentum. Meanwhile, House Exotics experienced a notable drop from 13th to 29th, suggesting potential volatility in their sales strategy. Earthgrow maintains a steady position slightly ahead of Space Rocks, indicating consistent performance. These dynamics highlight the competitive pressure on Space Rocks to innovate and enhance their market strategy to improve their ranking and sales performance in the Arizona Pre-Roll market.

Notable Products

In August 2025, Rocketz - Headhunter Infused Pre-Roll (1g) emerged as the top-performing product for Space Rocks, climbing from second place in July to first place with sales reaching 2,438 units. Gelonaid Infused Pre-Roll (1g) also saw an improvement, moving up from fifth in July to third in August. Rocketz - Star Chem Diesel Diamond Infused Pre-Roll (1g) entered the rankings in second place, showcasing its strong market entry. Animal Kush Mints Infused Pre-Roll (1g) debuted at fourth place, indicating growing popularity. Meanwhile, Red Bananas Infused Pre-Roll (1g) appeared in the rankings for the first time at fifth place, albeit with lower sales figures compared to its competitors.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.