Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

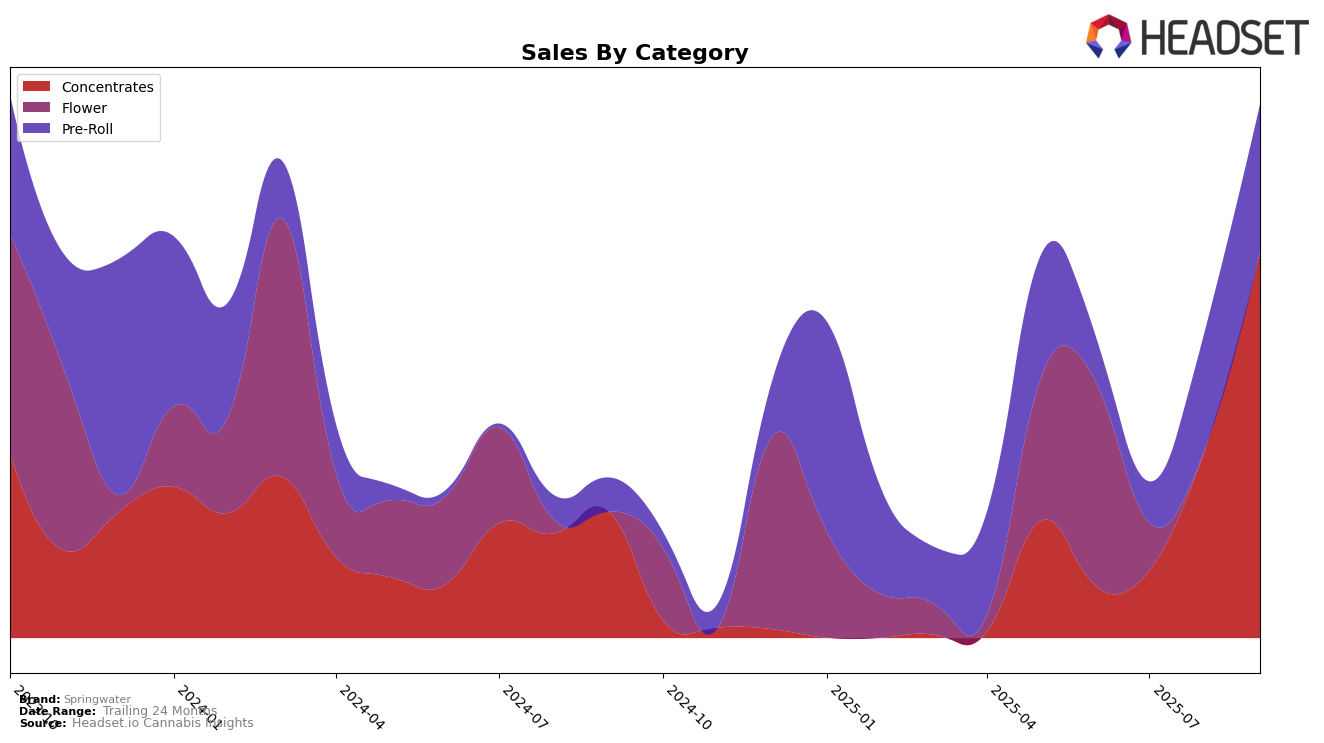

Springwater has shown notable performance in the Oregon market, particularly in the concentrates category. While the brand was not ranked in the top 30 for June and July 2025, it made a significant leap to 30th place by September 2025. This upward trajectory indicates a strong growth trend, as evidenced by the increase in sales from July to September. The brand's ability to break into the top 30 in a competitive market like Oregon signifies a promising development for Springwater, showcasing its potential to capture a larger market share in the coming months.

In contrast, the pre-roll category presents a different picture for Springwater in Oregon. The brand was not within the top 30 rankings for June and July, and by August, it was ranked 82nd, improving slightly to 71st in September. Although there is some progress, the brand's presence in the pre-roll category remains relatively weak compared to its performance in concentrates. This disparity highlights a potential area for strategic focus and improvement, as gaining traction in the pre-roll segment could further enhance Springwater's overall market position.

Competitive Landscape

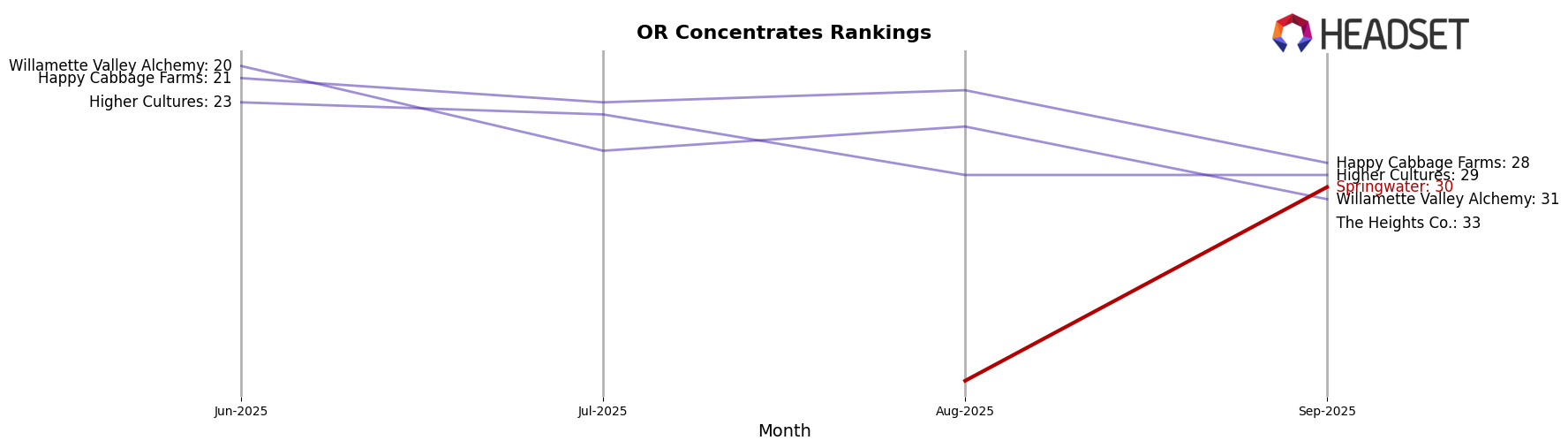

In the Oregon concentrates market, Springwater has shown a remarkable upward trajectory in recent months. After not ranking in the top 20 in June and July 2025, Springwater made a significant leap to rank 46th in August and further improved to 30th in September. This upward movement indicates a robust growth in sales, contrasting with competitors like Willamette Valley Alchemy and Happy Cabbage Farms, both of which experienced a decline in rankings over the same period. Notably, Willamette Valley Alchemy fell from 20th in June to 31st in September, while Happy Cabbage Farms dropped from 21st to 28th. Meanwhile, Higher Cultures maintained a relatively stable position, ranking 29th in both August and September. Springwater's ascent suggests a growing consumer preference and market presence, making it a brand to watch in the coming months as it continues to challenge established players in the Oregon concentrates market.

Notable Products

In September 2025, Springwater's top-performing product was the Divine Banana Pre-Roll (1g), which climbed to the number one spot with sales reaching 2,429 units. Following closely was the Daily Grape #9 Pre-Roll (1g), securing the second position. Sour Tangie Pre-Roll (1g), which was previously ranked second in August, dropped to third place. Boston Cream Pie Pre-Roll (1g) improved its standing, moving up to fourth place from fifth. Jet Fuel Gelato Pre-Roll (1g) entered the rankings at fifth position, showcasing a new entry into the top five for September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.