Oct-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

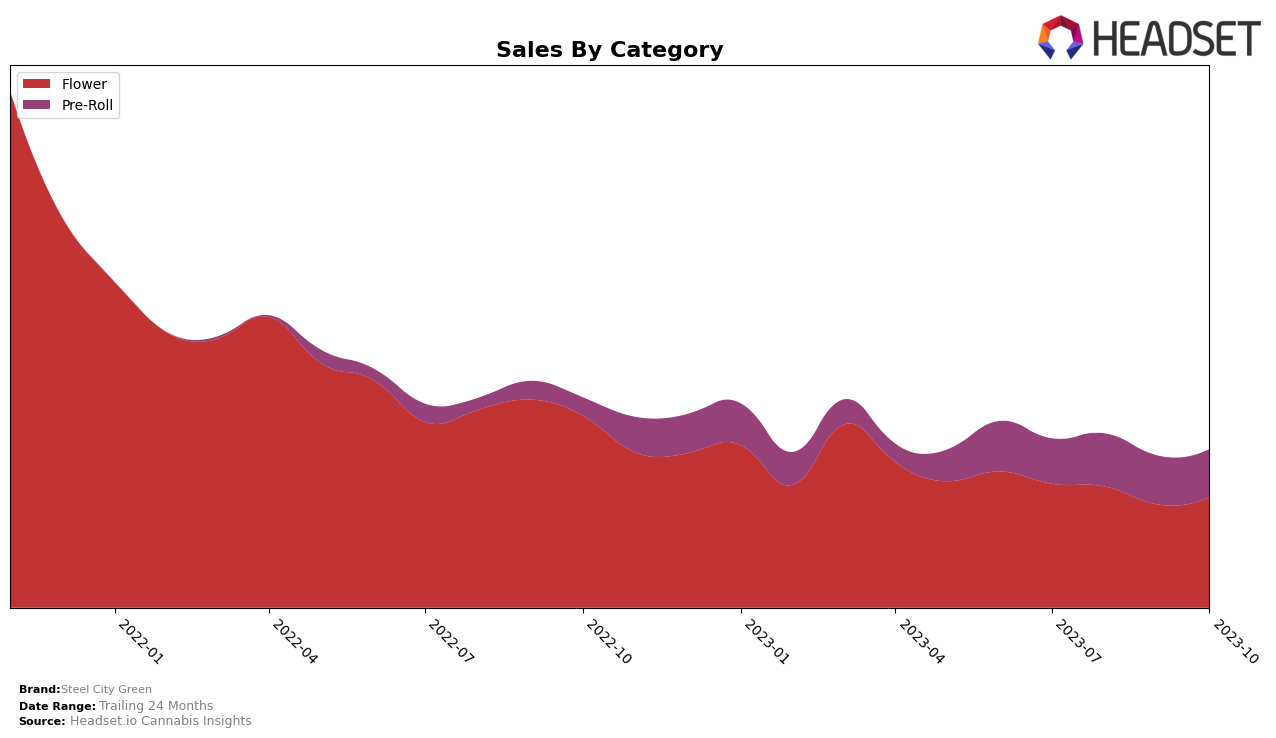

When looking at the performance of Steel City Green in the Flower category, there are some interesting trends to note. In Ontario, the brand's ranking slipped from 45th in July 2023 to 57th in October 2023, indicating a decrease in popularity in this market over the period. This is also reflected in the sales figures, which show a decline from July to October. On the other hand, in Saskatchewan, Steel City Green's ranking improved, moving from 27th to 18th over the same period. This indicates that the brand was able to gain some traction in this market, which is a positive sign.

Turning to the Pre-Roll category, Steel City Green's performance varies across provinces. In Ontario, the brand's ranking worsened from 78th in July 2023 to 83rd in October 2023. This suggests that the brand might be facing stiff competition in this category in Ontario. Meanwhile, in Saskatchewan, Steel City Green's ranking improved significantly, jumping from 62nd in July to 30th in October. This substantial rise in the rankings suggests that Steel City Green's Pre-Rolls are becoming increasingly popular in this market, which could be a promising development for the brand.

Competitive Landscape

In the Flower category within the Ontario market, Steel City Green has seen a consistent downward trend in both rank and sales from July to October 2023. Notably, the brand's rank has slipped from 45th to 57th, indicating that it was not among the top 20 brands in this category and state for these months. Comparatively, Truro Cannabis Co. has shown a similar trend, but with a slight improvement in rank by October, overtaking Steel City Green. Station House and Freedom Cannabis have both improved their ranks and maintained higher sales than Steel City Green. Interestingly, BZAM, despite a higher initial rank and sales, has seen a significant drop, ending up just slightly above Steel City Green in October. These trends suggest a competitive and dynamic market, with Steel City Green needing to strategize effectively to improve its position.

Notable Products

In October 2023, the top-performing product from Steel City Green was the Legendary Larry Grind (7g) which maintained its first place ranking from previous months, with sales reaching 4182 units. The second best-seller was the Kings+ - Extreme Pre-Roll 4-Pack (4g), moving up from third place in August to second in October, selling 2177 units. The Kings+ - Extreme Pre-Roll (1g) dropped one position to third place, with a total of 1675 units sold. The Legendary Larry (7g) held steady at fourth place, with a slight increase in sales to 1408 units. Finally, the Legendary Larry Pre Roll 5-Pack (4g) entered the top five in September and maintained its position in October, selling 1024 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.