Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

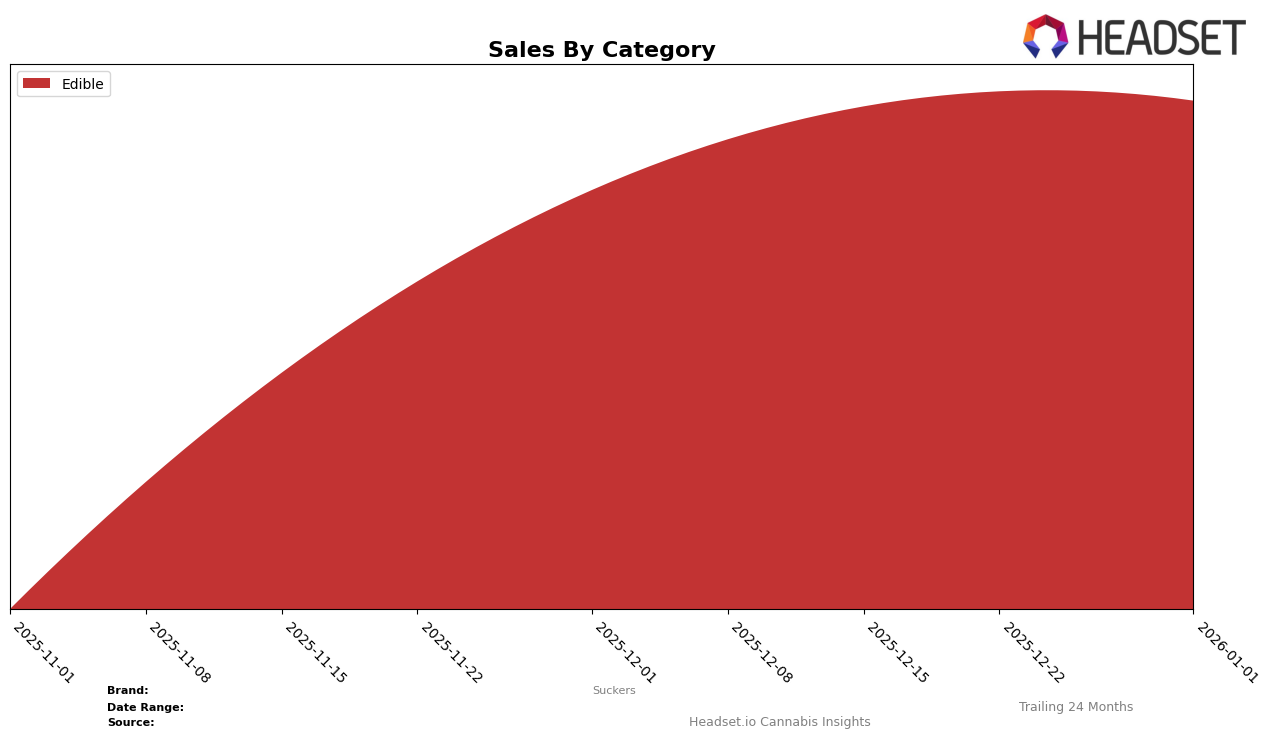

Suckers has shown a notable performance improvement in the Edible category within Maryland. After not being ranked in the top 30 brands for October and November 2025, Suckers entered the rankings at 33rd position in December 2025 and further improved to 30th position by January 2026. This upward trajectory indicates a positive reception and growing popularity among consumers in Maryland's edible market, suggesting that the brand is gaining traction and potentially increasing its market share.

The absence of Suckers from the top 30 rankings in October and November could have initially been a cause for concern, but their subsequent entry and rise in the rankings demonstrate resilience and potential strategic adjustments that are paying off. The increase in sales from December to January aligns with their improved ranking, reflecting a successful period for the brand in Maryland. However, the brand's performance in other states or categories remains undisclosed, leaving room for further exploration into how Suckers is faring in different markets and product lines.

Competitive Landscape

In the Maryland edible market, Suckers has shown a promising upward trend in its rankings, climbing from being absent in the top 20 in October and November 2025 to securing the 33rd position in December 2025 and improving to the 30th spot by January 2026. This positive trajectory suggests a growing acceptance and popularity among consumers. In comparison, Valhalla maintained a relatively stable presence, fluctuating slightly but remaining out of the top 20, while Organic Remedies and Hedy also showed sporadic appearances in the rankings. Notably, Happy Eddie consistently ranked within the top 20, albeit with a slight decline over the months. Suckers' steady rise in rank, coupled with an increase in sales from December to January, indicates a strengthening market position, potentially driven by effective marketing strategies or product innovations that resonate well with consumers in this competitive landscape.

Notable Products

In January 2026, the top-performing product for Suckers was Cloudberry Hard Lozenges 10-Pack (100mg), maintaining its leading position from December with notable sales of 342 units. Sour Apple Zing Hard Candy 10-Pack (100mg) rose to the second spot from third place in the previous month, demonstrating a significant increase in demand. Very Cherry Hard Lozenges 10-Pack (100mg) slipped to third place, despite being the top seller in November. Sour Apple Zing Hard Lozenges (100mg) held steady in fourth place for two consecutive months. These shifts highlight a dynamic market where consumer preferences for Suckers' edible products are evolving.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.