Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

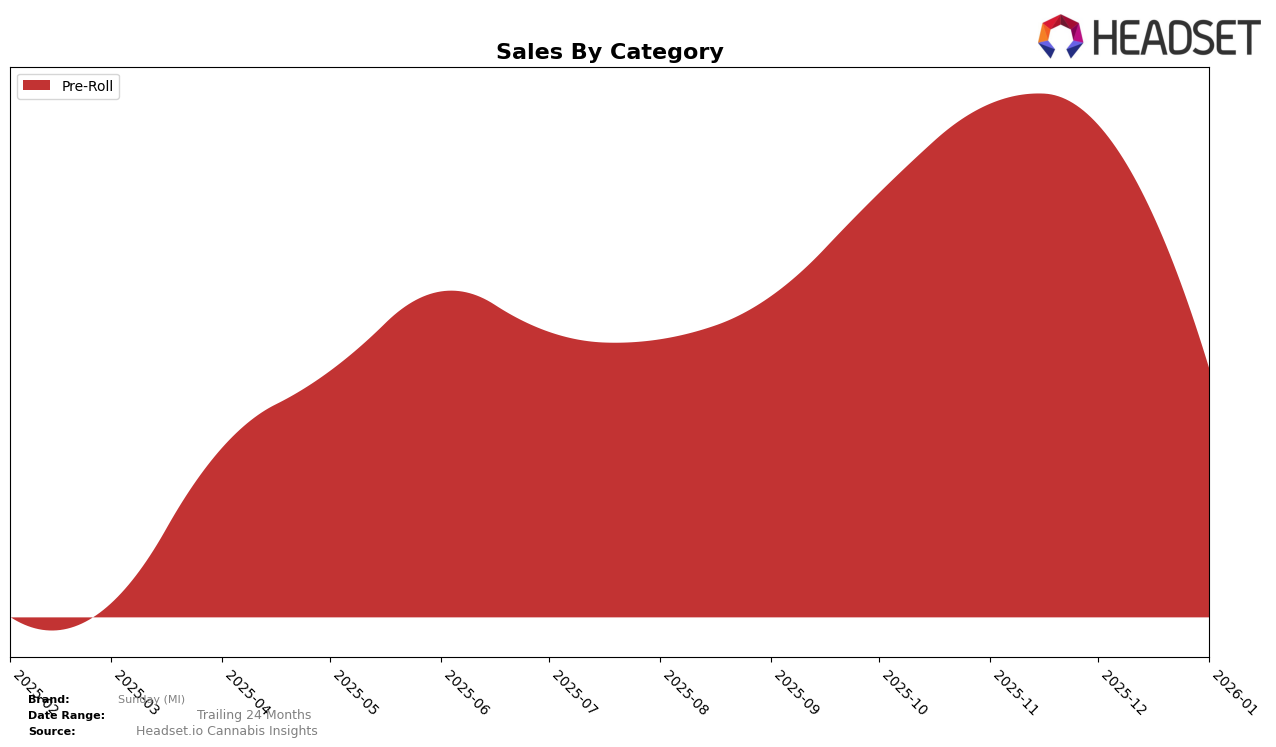

Sunday (MI) has shown notable fluctuations in its performance within the Pre-Roll category in Michigan. In October 2025, the brand was ranked 22nd, and it made a significant leap to 13th place in November. Although there was a slight dip to 15th in December, Sunday (MI) managed to maintain a strong presence in the top 30, even as it dropped to 30th in January 2026. This trajectory indicates a volatile yet resilient performance, with the brand managing to stay relevant in the competitive Pre-Roll market. The ability to climb into the top 15 suggests effective strategies or product offerings that resonated with consumers during the holiday season.

Despite the brand's ability to stay within the top 30, the drop to 30th place in January 2026 might raise concerns about sustaining momentum. The sales figures reflect a peak in November, followed by a decrease in December and a more pronounced decline in January. This trend could imply seasonal demand fluctuations or increased competition. The absence of rankings in other states suggests that Sunday (MI) has not yet expanded its reach beyond Michigan or that its presence is not strong enough to break into the top 30 in other markets. This could be an area of opportunity for the brand to explore and potentially expand its market footprint.

Competitive Landscape

In the competitive landscape of the Michigan Pre-Roll category, Sunday (MI) has experienced significant fluctuations in its ranking and sales performance over the recent months. Starting from October 2025, Sunday (MI) held a respectable position at rank 22, which then improved to rank 13 in November, and slightly declined to rank 15 in December. However, by January 2026, Sunday (MI) saw a notable drop to rank 30, indicating a potential challenge in maintaining its market position. This decline is particularly significant when compared to competitors like Redemption and Rocket (MI), who consistently remained in the top 30, with Rocket (MI) even improving its rank from 37 in October to 29 by January. Meanwhile, Ice Kream Hash Co. and Wojo Co have shown variable rankings but have not surpassed Sunday (MI) in terms of peak rank positions. Despite Sunday (MI)'s strong sales in November and December, the sharp decline in January suggests a need for strategic adjustments to regain its competitive edge and stabilize its market presence.

Notable Products

In January 2026, Sunday (MI)'s top-performing product was the Zelicious Pre-Roll 28-Pack (28g), which ascended to the number one rank after being second in December 2025, with a notable sales figure of 1,359 units. Following closely, the Sour Lemons Pre-Roll 28-Pack (28g) maintained its position at rank two, despite a decrease in sales from previous months. The Ice Cream Cake Pre-Roll 28-Pack (28g) entered the rankings for the first time, securing the third position. Meanwhile, the Lemon Tree Pre-Roll 28-Pack (28g) experienced a drop from the top position in November 2025 to fourth place in January 2026. Lastly, the Green Ribbon BX Pre-Roll 28-Pack (28g) debuted in the rankings at fifth place, indicating a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.