Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

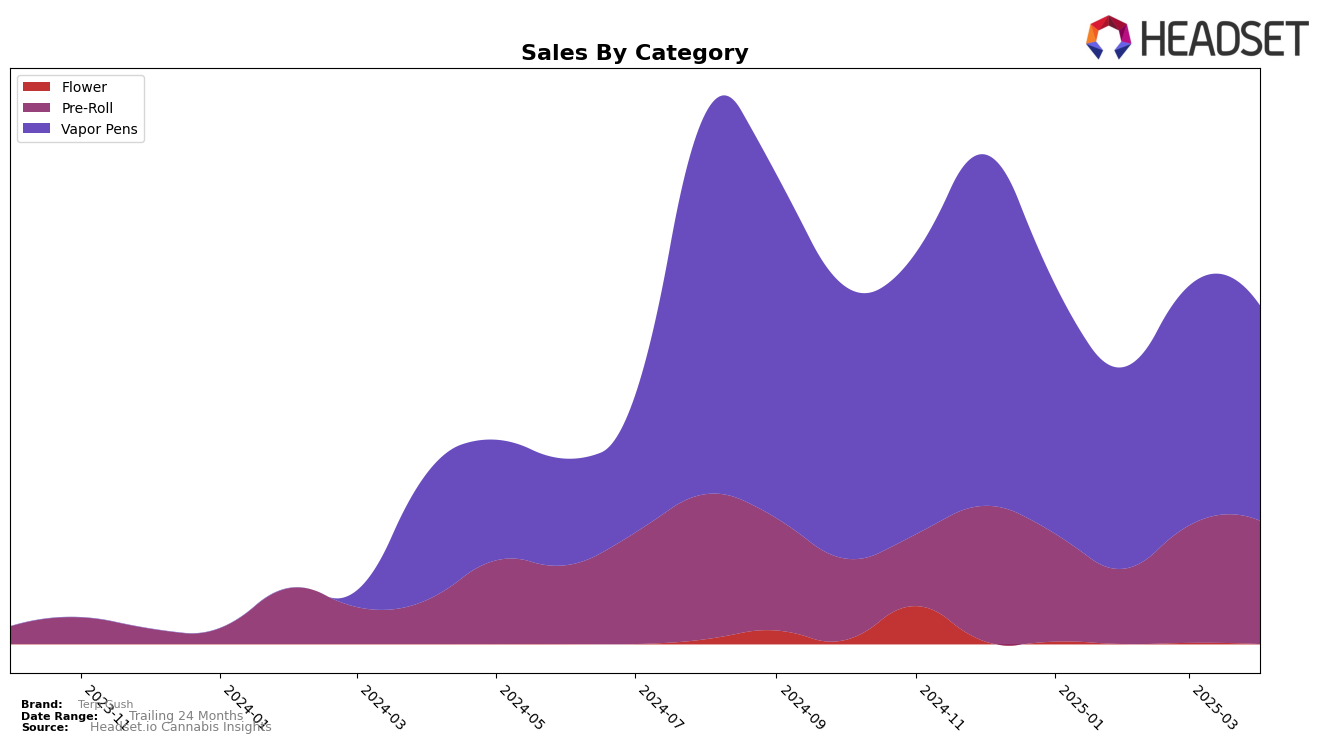

Terp Gush has demonstrated varied performances across different categories and regions. In the Vapor Pens category in Ontario, the brand has consistently remained outside the top 30 rankings, with positions hovering around the mid-40s to 50s range from January to April 2025. This suggests that while there is some presence in the market, Terp Gush's Vapor Pens have not yet broken into the higher echelons of popularity in Ontario. The sales figures reflect this struggle, with a noticeable dip in February, followed by slight recoveries in March and April. This trend indicates a need for strategic adjustments to gain a stronger foothold in this category.

In contrast, Terp Gush has shown promising growth in the Pre-Roll category in Saskatchewan. The brand's ranking improved significantly from 43rd in January to 25th by April 2025. This upward trajectory is mirrored in the sales figures, which have more than doubled from January to April, signaling a growing consumer preference for their Pre-Roll products. The ability to climb the ranks into the top 30 in Saskatchewan suggests that Terp Gush is successfully capturing market share and resonating with consumers in this category. This positive momentum in Saskatchewan could serve as a blueprint for expanding their success into other regions and categories.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Terp Gush has experienced a fluctuating presence, with its rank oscillating between 46th and 50th from January to April 2025. Despite these shifts, Terp Gush has maintained a relatively stable sales trajectory compared to its competitors. Notably, Wagners consistently outperformed Terp Gush, holding ranks between 41st and 46th, indicating a stronger market position. Meanwhile, Coterie demonstrated significant growth, jumping from 69th in January to 44th in April, suggesting a rising threat to Terp Gush's market share. On the other hand, Frootyhooty experienced a decline, dropping to 53rd by April, which may present an opportunity for Terp Gush to capitalize on. As the market evolves, Terp Gush's ability to adapt and innovate will be crucial in navigating these competitive dynamics.

```

Notable Products

In April 2025, the top-performing product for Terp Gush was the Banana Cream Pie Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, which achieved the number one rank with sales of 1522 units. This product experienced a significant jump from its previous rankings, moving from fifth place in February and second in March. The Frosted Swirl Live Resin Cartridge (1g) in the Vapor Pens category, which had consistently held the top rank from January to March, dropped to the second position in April. The Blueberry Burst Pre-Roll 3-Pack (1.5g) maintained its third-place ranking for the second consecutive month, showing stable performance. Meanwhile, the Raspberry Guava GLTO Infused Pre-Roll 3-Pack (1.5g) held steady in fourth place, while the Terp Burst Liquid Diamonds Cartridge (1g) remained in fifth place but saw a decrease in sales compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.