Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

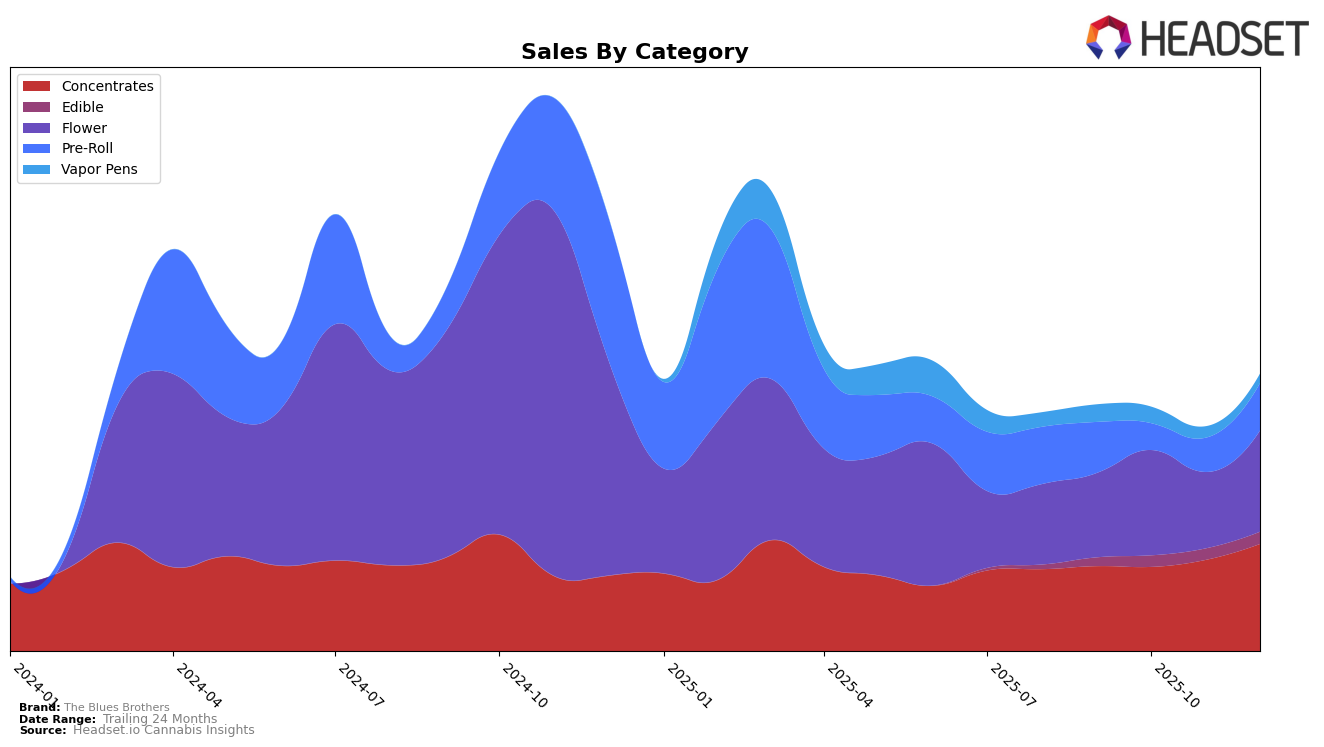

The performance of The Blues Brothers across different states and categories shows a mix of stability and fluctuation. In Massachusetts, the brand's ranking in the Concentrates category has seen some movement, starting at 43rd in September 2025 and dropping to 56th in October, before improving to 45th by December. The sales figures reflect this trend, with a notable dip in October followed by a recovery towards the end of the year. Meanwhile, in Washington, The Blues Brothers entered the top 100 in the Concentrates category in October, maintaining a consistent position through November and December, which indicates a steady presence in the market.

In Maryland, the brand's performance in the Flower category has been relatively stable, maintaining a position just outside the top 50 throughout the last quarter of 2025. This consistency suggests that while The Blues Brothers may not be a top contender, it holds a reliable position in the market. However, the Pre-Roll category in Maryland presents a different story, with the brand not appearing in the rankings for October and November, before re-entering at 51st in December. This fluctuation could indicate challenges in maintaining a competitive edge in this category. Overall, while The Blues Brothers has shown resilience in certain states and categories, there remain areas where the brand could potentially improve its market standing.

Competitive Landscape

In the Maryland flower category, The Blues Brothers have faced a challenging competitive landscape from September to December 2025. Their consistent rank at 50 in September and October, followed by a slight drop to 52 in November and December, indicates a struggle to gain traction amidst strong competition. Notably, Seed & Strain Cannabis Co. has maintained a robust presence, consistently ranking in the top 36 with significantly higher sales figures, underscoring their market dominance. Meanwhile, Belushi's Farm has shown a fluctuating yet stronger performance, with ranks ranging from 39 to 44, suggesting a more stable market position compared to The Blues Brothers. On the other hand, Kings & Queens and Grass have experienced more volatility, with Kings & Queens showing a notable improvement in rank from 58 to 47 in November, before slipping to 53 in December. This competitive environment highlights the need for The Blues Brothers to strategize effectively to improve their market position and sales in Maryland's flower category.

Notable Products

In December 2025, the top-performing product for The Blues Brothers was Obama Runtz Pre-Roll 2-Pack (1g), which secured the number one rank with a notable sales figure of 497 units. Black Ice (3.5g) climbed to the second position from its previous fifth place in November, showing a strong increase in popularity. Oreoz (3.5g) entered the rankings in December at the third position, indicating a successful launch or marketing effort. White Fire OG Solventless Badder (1g) remained stable, moving slightly from third to fourth place, while Black Maple Solventless Badder (1g) dropped from second to fifth, suggesting a shift in consumer preference within concentrates. Overall, these changes reflect dynamic shifts in consumer demand for specific products and categories within The Blues Brothers lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.