Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

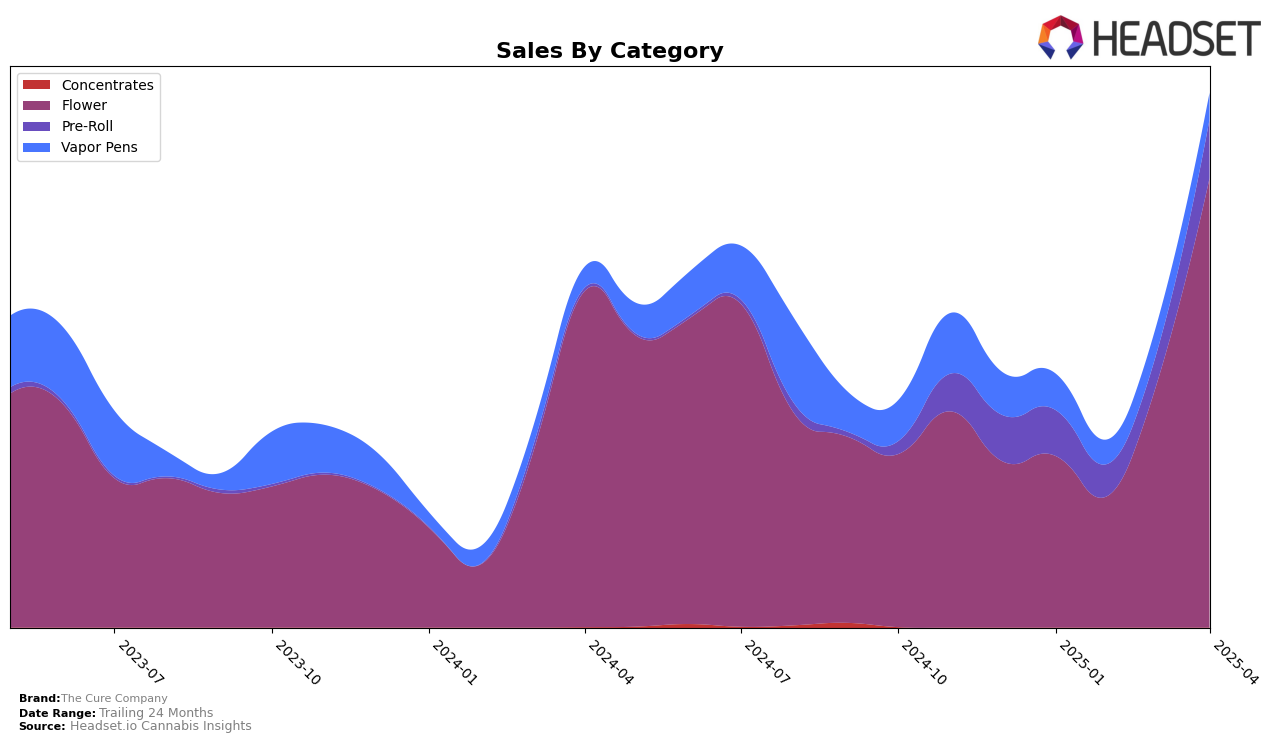

The Cure Company has shown a significant upward trajectory in the Massachusetts market, particularly in the Flower category. Starting from a rank of 79 in January 2025, the brand did not make it to the top 30 in February, but it rebounded strongly to rank 51 in March and impressively climbed to 25 by April. This upward movement is mirrored by a substantial increase in sales, with April sales reaching $444,003. This suggests that The Cure Company is gaining traction and possibly increasing its market share in the Flower category within Massachusetts.

In contrast, the Pre-Roll category in Massachusetts presents a different picture. The Cure Company was ranked 91 in January and did not appear in the top 30 for February and March, indicating a less competitive stance in this category. However, by April, they re-entered the rankings at 80, which might signify the beginning of a recovery or a strategic refocus in this segment. Despite the absence in the rankings for two months, the sales figures for April show a slight uptick, suggesting potential for future growth if the brand continues to build on this momentum.

Competitive Landscape

The Cure Company has shown a remarkable upward trajectory in the Massachusetts flower category, climbing from a rank of 79 in January 2025 to 25 by April 2025. This significant improvement in rank is indicative of a strategic push in sales and market presence, as evidenced by the substantial increase in sales from January to April. In contrast, Nature's Heritage maintained a relatively stable position, hovering around the mid-20s, while Grassroots saw a steady rise, reaching a rank of 23 in April. Meanwhile, Shaka Cannabis Company experienced a decline from 12th to 24th place, suggesting potential challenges in maintaining their earlier momentum. Garden Remedies also made a notable leap from 69th to 26th, indicating a competitive resurgence. The Cure Company's rapid ascent in rank and sales underscores its growing influence and competitive edge in the Massachusetts market, positioning it as a formidable player among established brands.

Notable Products

In April 2025, Curelato (3.5g) emerged as the top-performing product for The Cure Company, achieving the number one rank with a notable sales figure of 3104.0. The Cure OG (3.5g) followed closely in second place, improving from a third-place rank in March 2025. LA Pop Rocketz (3.5g) secured the third position, climbing from fifth place in the previous month. Alien OG Pre-Roll (1g) was ranked fourth, showing its first appearance in the rankings since February 2025. Rainbow Pie (3.5g), which led the sales in March, dropped to fifth place in April, indicating a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.