Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

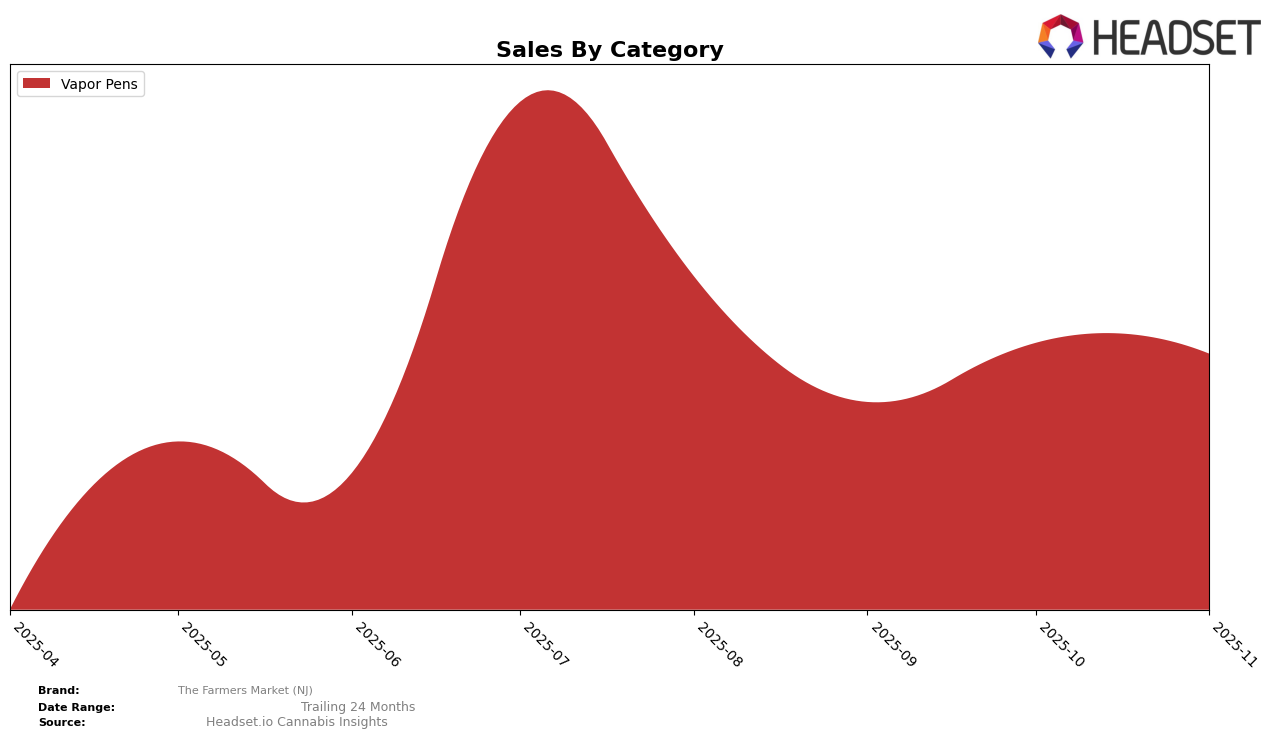

The Farmers Market (NJ) has shown a fluctuating performance in the Vapor Pens category within the state of New Jersey. Over the months from August to November 2025, the brand's ranking has hovered around the 30s, with a notable improvement in November when it secured the 30th position, just making it into the top 30. This indicates a slight upward trend, suggesting that the brand is gaining some traction in this competitive category. However, the ranking in September was 33, which indicates that the brand was not in the top 30, showcasing a challenge in maintaining consistent top-tier performance.

Sales figures for The Farmers Market (NJ) reflect a similar pattern of variability. Despite a dip in September, where sales dropped to $110,427, there was a recovery in October with sales reaching $133,545. This rebound was not entirely sustained into November, as sales slightly decreased to $129,317. The fluctuations in both rankings and sales suggest that while there is potential for growth, the brand faces significant competition and market dynamics that may impact its stability and growth trajectory in New Jersey.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, The Farmers Market (NJ) has shown a steady performance, maintaining a rank within the top 35 from August to November 2025. Notably, in November 2025, The Farmers Market (NJ) climbed to the 30th position, improving from 32nd in October. This upward trend is significant, especially when compared to competitors like ONYX (NJ), which saw a decline from 21st in August to 28th in November. Meanwhile, Superflux has been gradually improving its position, moving from 40th in August to 31st in November, closely trailing The Farmers Market (NJ). Another competitor, Breakwater, also showed a notable rise from 74th in August to 32nd in November, indicating a competitive push in the market. The Farmers Market (NJ)'s consistent ranking amidst these shifts suggests a resilient market presence, though the brand must remain vigilant as competitors like 710 Labs re-entered the top 35 in November, potentially intensifying competition.

Notable Products

In November 2025, Blue Berry Muffin Distillate Disposable (1g) emerged as the top-performing product for The Farmers Market (NJ), climbing from its previous third-place position in October to first place with a notable sales figure of 847 units. Black Berry Gelato Distillate Disposable (1g) also saw an impressive rise, moving up from fourth to second place. Pineapple Express Distillate Disposable (1g) improved its ranking from fifth in October to third in November. Grape Ape Distillate Disposable (1g) maintained its fourth-place ranking from October, despite not being ranked in that month. Conversely, Georgia Peach MAC Distillate Disposable (1g) experienced a significant drop, falling from the top spot in October to fifth place in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.