Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

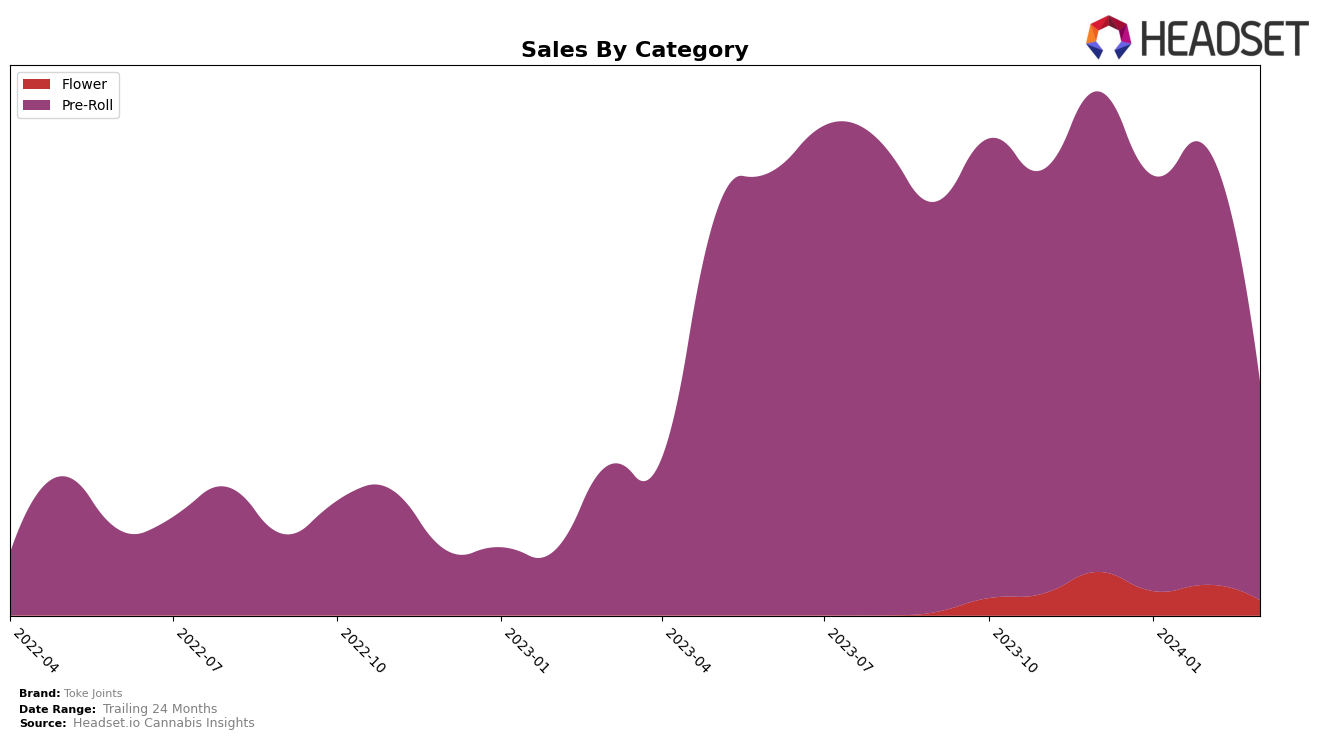

In Colorado, Toke Joints has shown a notable performance across two distinct categories: Flower and Pre-Roll. Specifically, in the Pre-Roll category, Toke Joints has consistently ranked within the top 30 brands from December 2023 through March 2024, albeit with some fluctuation. Starting at rank 10 in December, it experienced a slight dip to rank 14 in January, improved to rank 12 in February, but then significantly dropped to rank 29 by March 2024. This downward trend in ranking, especially the sharp drop to rank 29, coupled with a decrease in sales from 169,438 in February to 85,391 in March, signals a potential challenge in maintaining its market position within the Pre-Roll category. Conversely, the brand's presence in the Flower category shows a less consistent performance, with it not ranking in the top 30 for January and February 2024, and only appearing at ranks 94 and 97 in December 2023 and March 2024, respectively. This inconsistency in ranking, along with a decrease in sales from 16,901 in December to 11,891 in March, highlights a significant area for improvement.

While the data provides insight into Toke Joints' performance within the Colorado market, it is crucial to understand the broader implications of these rankings and sales figures. The fluctuating rankings in the Pre-Roll category suggest that while Toke Joints has a foothold in this market, maintaining and improving its position will require strategic efforts, especially considering the drastic rank drop observed in March 2024. On the other hand, the Flower category presents a different challenge, with the brand struggling to consistently break into the top 30. This indicates a potential need for reevaluation of strategies within this category to boost visibility and sales. Although specific sales figures and detailed analysis for each month and category are reserved, the outlined trends provide a clear indication of where Toke Joints stands in the competitive Colorado cannabis market and hint at the strategic adjustments needed to enhance its market presence and performance.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Colorado, Toke Joints has experienced notable fluctuations in its market position from December 2023 to March 2024, moving from 10th to 14th, then improving to 12th, and finally settling at 29th rank. This trajectory indicates a challenging period for Toke Joints, especially when compared to its competitors. For instance, Natty Rems maintained a consistent performance in the top 15 for the first three months before experiencing a significant drop to 33rd place in March. On the other hand, Kayak Cannabis showed a remarkable upward trend, moving from a distant 50th place in December to 30th by March, signaling a strong improvement in its market position. Meanwhile, Willie's Reserve and Binske both faced declines, with Willie's Reserve falling out of the top 20 after January and Binske experiencing a steady drop to 28th place by March. These shifts highlight the dynamic nature of the Pre-Roll market in Colorado, with Toke Joints needing to navigate carefully amidst these competitive currents to regain and improve its standing.

Notable Products

In Mar-2024, Toke Joints saw Pakastani Chitral Kush Pre-Roll (1g) leading their sales with 1563 units sold, marking it as the top product for the month. Following closely, Super Boof Pre-Roll (1g), which was ranked 1st in Feb-2024, dropped to the 2nd position with notable sales. White Truffle Pre-Roll (1g), Mandarin Cookies Pre-Roll (1g), and Fruit Salad Pre-Roll (1g) were ranked 3rd, 4th, and 5th respectively, showcasing a diverse preference among consumers. Notably, Super Boof Pre-Roll (1g) had shown a consistent presence in the top rankings since Dec-2023, indicating a strong consumer preference. The shifts in rankings from previous months highlight changing consumer trends and preferences within Toke Joints' product offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.