Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

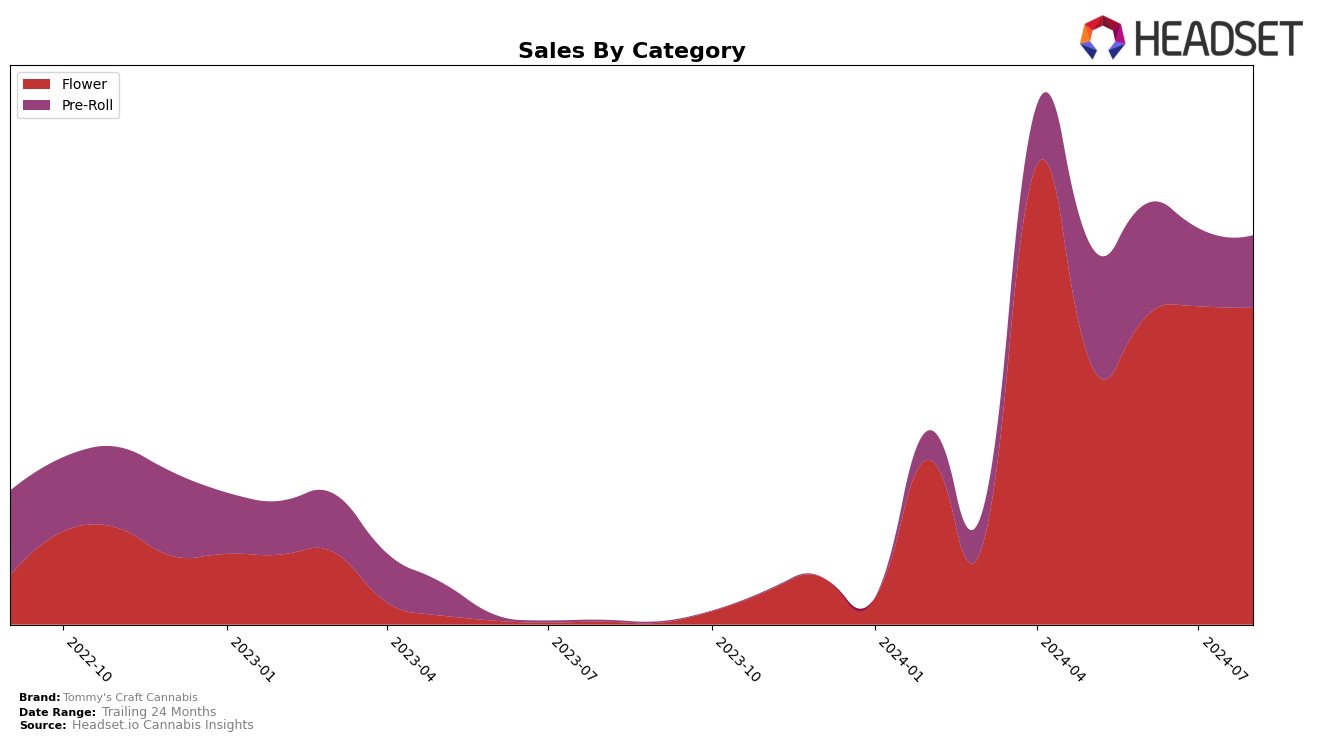

Tommy's Craft Cannabis has shown notable performance in the Flower category within Alberta. Over the span from May to August 2024, the brand's ranking improved from 29th to 23rd before a slight dip to 26th in August. This upward trend in the early months suggests increasing consumer interest and market penetration, although the slight decline in August could indicate heightened competition or market saturation. The sales figures also reflect this pattern, with a steady increase from $220,037 in May to a peak of $268,512 in July, before a minor drop to $266,738 in August. Such movements highlight the brand's resilience and potential for growth in the Flower category.

In contrast, the performance of Tommy's Craft Cannabis in the Pre-Roll category in Alberta presents a different narrative. The brand's ranking fluctuated significantly, starting at 59th in May, improving to 54th in June, but then dropping to 71st in July and slightly recovering to 68th in August. This volatility is mirrored in the sales figures, which decreased from $99,459 in May to $61,352 in August. The brand's inability to maintain a stable position within the top 30 in this category suggests challenges in market appeal or competitive positioning. This contrast between categories underscores the importance of strategic adjustments to enhance performance across different product lines.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Tommy's Craft Cannabis has shown a steady performance, maintaining a rank within the top 30 brands from May to August 2024. Notably, Tommy's Craft Cannabis improved its rank from 29th in May to 23rd in July, before slightly declining to 26th in August. This trend indicates a competitive but stable position in the market. In comparison, Tweed experienced a more volatile performance, fluctuating from 21st in May to 24th in August, suggesting potential instability. Meanwhile, Canaca consistently ranked lower, never breaking into the top 20, which could indicate a weaker market presence. Twd. showed a remarkable improvement, jumping from being unranked in May to 25th in August, highlighting a significant upward trend. Virtue Cannabis maintained a relatively stable rank, fluctuating between 28th and 35th, which suggests a consistent but modest market share. These insights reveal that while Tommy's Craft Cannabis is performing well, it faces stiff competition from both established and emerging brands in the Alberta Flower market.

Notable Products

In August 2024, the top-performing product for Tommy's Craft Cannabis was Dank on a Dime Sativa Pre-Poll 5-Pack (2.5g) in the Pre-Roll category, maintaining its rank from July with sales of 2193 units. The Dank on a Dime Indica Pre-Roll 5-Pack (2.5g) also held steady in the second position, although its sales dropped to 1081 units. Dank on a Dime Sativa Rotating (7g) in the Flower category improved its ranking from fourth to third, showing a positive trend with 1065 units sold. Meanwhile, Dank on a Dime Sativa Rotating (28g) slipped from third to fourth place with a sales figure of 1022 units. Lastly, Dank on a Dime Indica Rotating (7g) re-entered the rankings at fifth place with 979 units sold, after being unranked in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.