Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

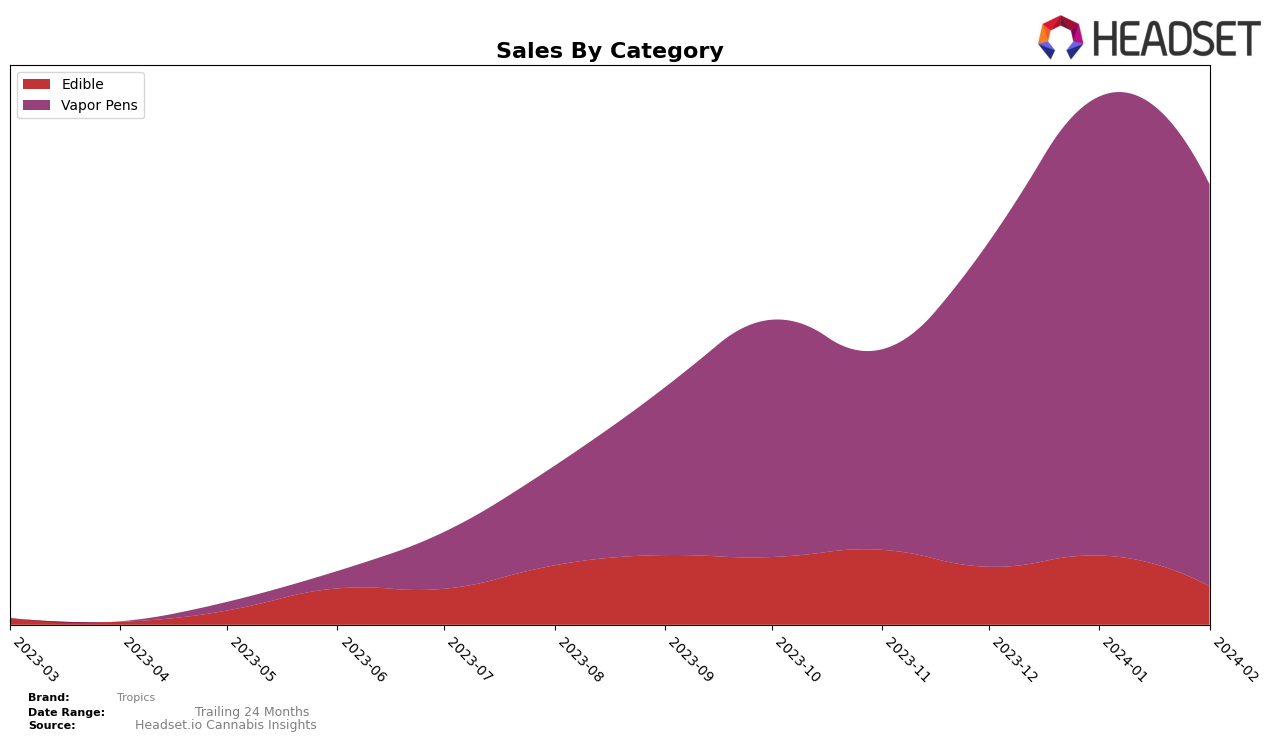

In Arizona, the Tropics brand has demonstrated a notable presence across two distinct categories: Edibles and Vapor Pens. The performance in the Edibles category, however, shows a fluctuation outside the top 30 rankings, with positions ranging from 41st to 46th from November 2023 to February 2024. This inconsistency could be interpreted as a struggle to capture a significant market share within Arizona's competitive edible landscape, especially considering a sales dip in February 2024 to $8,923, the lowest in the observed period. On the other hand, Tropics' Vapor Pens category tells a different story, showcasing a positive trajectory as the brand climbed from a 33rd position in November 2023 to a 26th in January 2024, before slightly dropping to 27th in February 2024. This upward movement, coupled with a significant increase in sales reaching $94,189 in February 2024, suggests growing consumer acceptance and preference within this category.

While the Vapor Pens category reveals Tropics' potential for growth and market penetration in Arizona, the Edibles category highlights the challenges faced by the brand in securing a top spot among consumers' preferences. The contrasting performance across these categories underscores the importance of strategic market positioning and product differentiation. Tropics' success in Vapor Pens, marked by consistent sales growth and improved rankings, indicates a strong alignment with consumer demands in this segment. Conversely, the fluctuating and lower rankings in the Edibles category suggest a need for reevaluation of product offerings or marketing strategies to enhance competitiveness. Overall, Tropics' journey across Arizona's cannabis market landscape presents a mixed bag of outcomes, with promising advancements in one category shadowed by stagnation in another, offering valuable insights into the brand's areas of strength and opportunities for improvement.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Arizona, Tropics has shown a notable trajectory in terms of rank and sales, despite the fierce competition. Starting from November 2023, Tropics was ranked 33rd but improved its position to 27th by February 2024, showcasing a significant upward movement. This change in rank is particularly impressive when considering the performance of its competitors. For instance, AiroPro (formerly IndigoPro) experienced a fluctuating rank, ultimately improving to 29th by February 2024. Meanwhile, Sauce Essentials and Venom Extracts maintained more stable positions in the top 30, with Sauce Essentials slightly outperforming Tropics in February 2024. The Pharm also showed a notable performance, securing the 25th position by February 2024. Tropics' sales trajectory, moving from lower initial sales to significantly higher numbers by February 2024, indicates a growing consumer interest and market share, despite not overtaking its competitors. This trend suggests a positive outlook for Tropics, highlighting its potential for further growth and competitiveness in the Arizona Vapor Pens market.

Notable Products

In February 2024, Tropics saw the Fat Cherries Live Hash Rosin Disposable (0.5g) maintain its top position in the Vapor Pens category, with notable sales of 900 units. Following closely, the Purple Ice Water Rosin Disposable (0.5g) climbed from third to second place, indicating a growing consumer preference. The Fatso Live Hash Rosin Disposable (0.5g) made a notable jump into the top three, despite not being ranked in January 2024. The Purple Petrol Live Hash Rosin Disposable (0.5g) and Fatso Live Hash Rosin Cartridge (0.5g) also showed significant movement, landing in the fourth and fifth positions respectively, after varying performances in the preceding months. These shifts highlight changing consumer preferences within Tropics' Vapor Pens offerings, signaling a dynamic market landscape.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.