Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

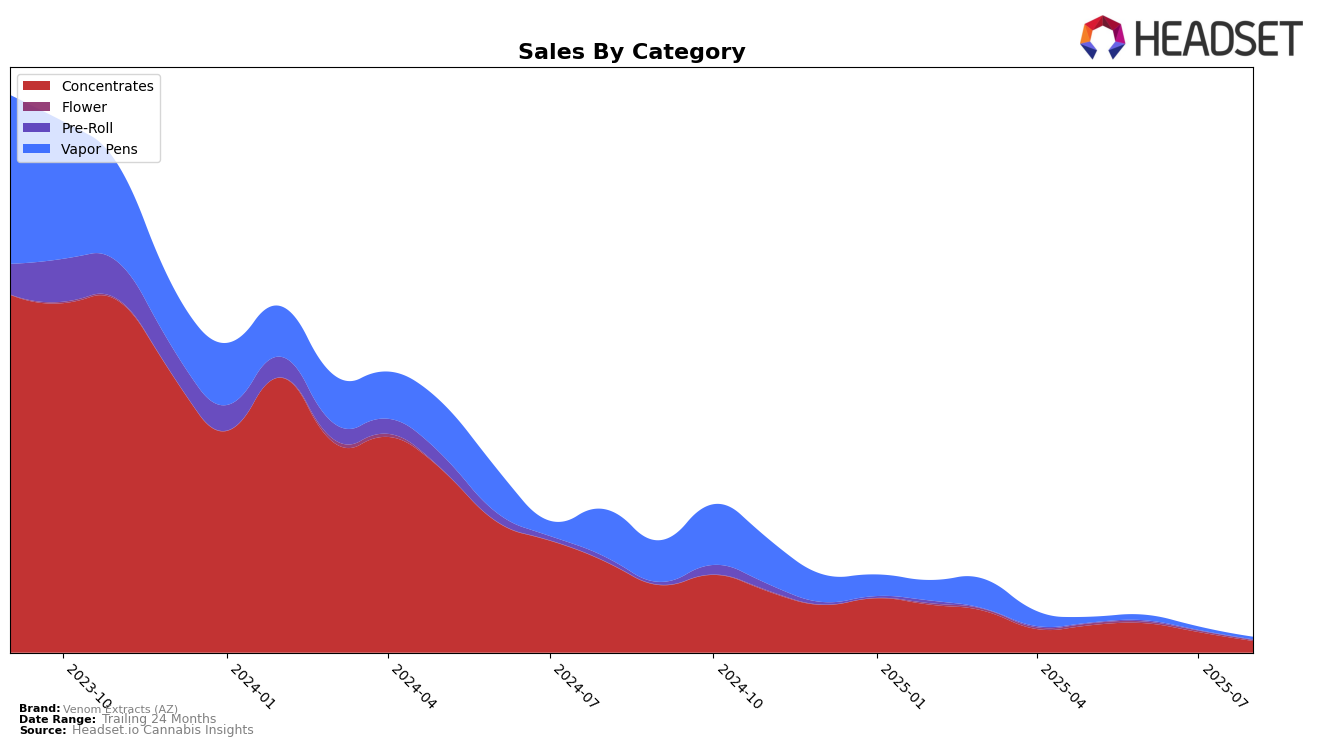

Venom Extracts (AZ) has demonstrated varying performance across different categories in the state of Arizona. Within the Concentrates category, the brand has seen a decline in rankings, moving from 21st in May 2025 to 30th by August 2025. This downward trend is accompanied by a notable reduction in sales, with August 2025 figures showing a significant decrease from May 2025. Such a movement indicates potential challenges in maintaining market share in the Concentrates sector. However, the fact that Venom Extracts maintained a position within the top 30 brands suggests that while they are facing competitive pressures, they still hold a presence in the market.

In contrast, the performance of Venom Extracts in the Vapor Pens category in Arizona has been less prominent, as the brand did not rank within the top 30 from July 2025 onwards. This absence from the top rankings could be seen as a setback, suggesting that the brand might need to strategize differently to capture consumer interest in this segment. Despite this, the sales figures for Vapor Pens in May and June 2025 were relatively stable, indicating a loyal customer base that could be leveraged for future growth. Overall, while Venom Extracts faces challenges in certain areas, there remains potential for recovery and expansion in the Arizona market.

Competitive Landscape

In the competitive landscape of the Arizona concentrates market, Venom Extracts (AZ) has experienced notable fluctuations in its ranking and sales performance. From May to August 2025, Venom Extracts (AZ) saw a decline in rank from 21st to 30th, with a corresponding decrease in sales. This downward trend contrasts with competitors like Goldsmith Extracts, which, despite a dip in July, managed to recover slightly by August. Meanwhile, MADE entered the top 20 in July, only to drop to 29th in August, indicating volatility in the market. Big Bud Farms and SUNO remained outside the top 20, but Big Bud Farms showed a steady improvement in rank over the months. These dynamics suggest that while Venom Extracts (AZ) faces challenges, there is room for strategic adjustments to regain its competitive edge in the Arizona concentrates market.

Notable Products

In August 2025, the top-performing product from Venom Extracts (AZ) was Sour Leopard Budder (1g) in the Concentrates category, which climbed to the number one rank from its previous fifth position in both June and July. Diamond OG Distillate (1g) also performed well, securing the second rank, a slight drop from its third position in July. Purple Gelato Diamond Sauce (1g) made a notable entry in the rankings at third place, while G6 OG PHO Sugar Wax (1g) followed closely at fourth. Sex Panther Distillate Syringe (1g) experienced a drop to the fifth rank after previously being the top-ranked product in June. Sour Leopard Budder (1g) achieved notable sales of 293 units in August, highlighting its strong performance in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.