Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

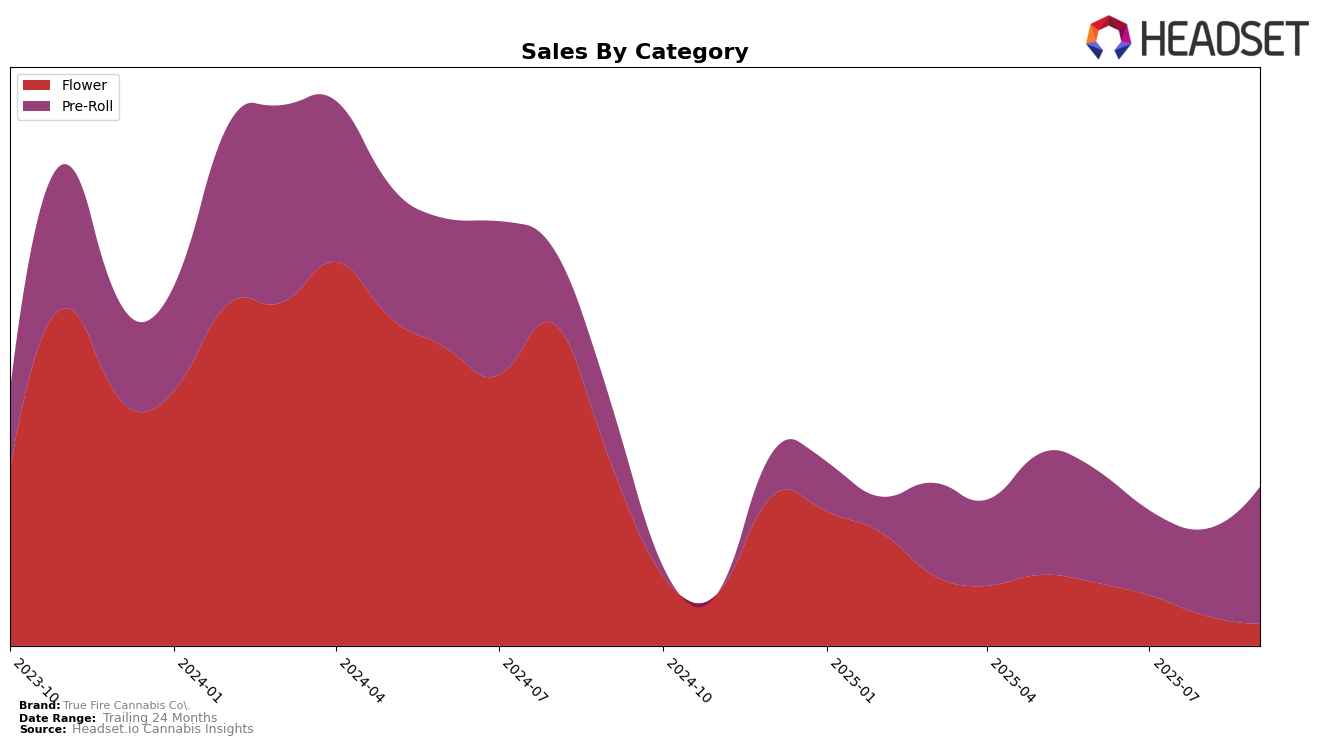

True Fire Cannabis Co. has demonstrated varying performance across different categories and regions. In the Ontario market, the brand's Flower category has seen a consistent decline in rankings from June to September 2025, moving from 87th to 96th place. This downward trend is accompanied by a decrease in sales each month, indicating potential challenges in maintaining market share in this competitive category. Meanwhile, in the Pre-Roll category within the same region, True Fire Cannabis Co. experienced fluctuations in their ranking, dropping out of the top 30 in August but rebounding slightly to 97th by September. Such movements suggest that while there is competition, there might be opportunities for the brand to capitalize on its comeback.

In Saskatchewan, True Fire Cannabis Co.'s performance in the Pre-Roll category presents a different narrative. The brand was not ranked in July, but it managed to secure a significant improvement by September, climbing to 28th place. This notable rise in ranking, coupled with a substantial increase in sales, highlights a positive trajectory and suggests that the brand is gaining traction in this market. The contrasting performances across these regions and categories underscore the dynamic nature of the cannabis market and the importance of strategic positioning. While the brand faces challenges in Ontario, its growth in Saskatchewan offers a promising outlook for future expansion.

Competitive Landscape

In the competitive landscape of the Ontario pre-roll market, True Fire Cannabis Co. has experienced fluctuations in its ranking, indicating a dynamic market presence. Starting at 96th in June 2025, the brand saw a slight dip to 99th in July, was absent from the top 20 in August, and then climbed back to 97th in September. This pattern suggests a volatile market position, possibly influenced by the performance of competitors. Notably, Dom Jackson maintained a stronger and more consistent presence, ranking between 82nd and 92nd over the same period, with sales figures consistently higher than True Fire Cannabis Co. Meanwhile, Valhalla Flwr entered the top 100 in September at 96th, potentially posing a new competitive threat. The absence of Cookies and Kolab from the top rankings in recent months further highlights the competitive shifts within the market. These dynamics underscore the importance for True Fire Cannabis Co. to strategize effectively to improve its market position and capitalize on the evolving competitive environment.

Notable Products

In September 2025, the top-performing product for True Fire Cannabis Co. was Crispy Cream Pre-Roll (0.5g), which climbed to the first rank with sales reaching 4934 units. Mega Breath Pre-Roll (0.5g) slipped to the second position after consistently holding the top spot from June to August. 33 Splitter Pre-Roll 3-Pack (1.5g) improved its rank to third, showing a significant increase from its fifth position in August. Tai Punch Pre-Roll (0.5g) made its debut in the rankings at the fourth spot. Mega Breath Pre-Roll 3-Pack (1.5g) maintained its fifth position, consistent with its previous month's ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.