Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

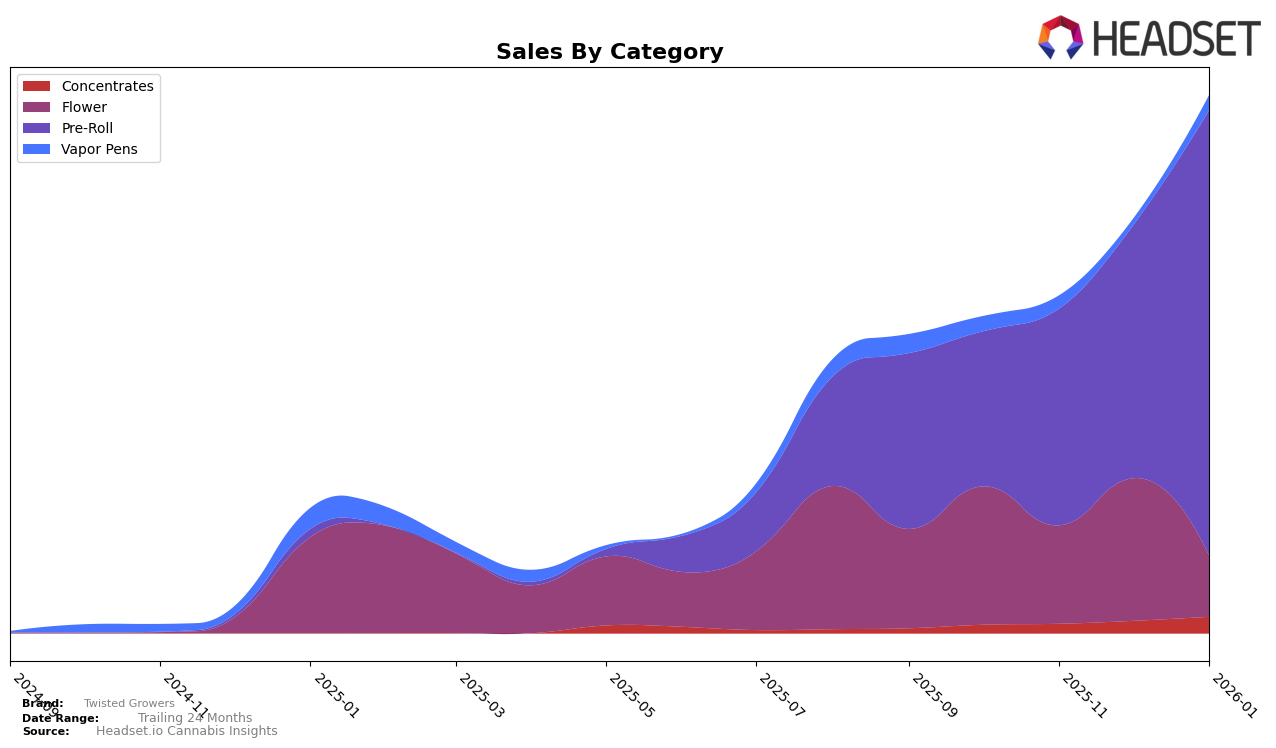

Twisted Growers has shown a notable upward trajectory in the Massachusetts pre-roll category over the past few months. Starting from a rank of 87 in October 2025, the brand ascended to the 30th position by January 2026. This significant climb in the rankings indicates a strong market presence and growing consumer preference. The brand's sales in Massachusetts increased from $78,454 in October to $226,264 by January, reflecting a robust demand for their products. Such a trend suggests that Twisted Growers is effectively capturing market share and could potentially continue this momentum if they maintain their current strategies.

However, it's important to note that Twisted Growers did not appear in the top 30 brands in any other state or category during this period. This absence could be seen as a limitation in their market reach or an opportunity for expansion beyond Massachusetts. While their performance in Massachusetts is commendable, the brand might need to explore strategies to enhance their visibility and ranking in other states to diversify their market presence and reduce dependency on a single market. Such strategic movements could be crucial for sustaining long-term growth and competitiveness in the evolving cannabis industry.

Competitive Landscape

In the Massachusetts Pre-Roll category, Twisted Growers has demonstrated a remarkable upward trajectory in its market rank, moving from a position of 87th in October 2025 to an impressive 30th by January 2026. This significant climb in rank reflects a strategic improvement in sales performance, with Twisted Growers' sales more than doubling over this period. In contrast, competitors like Commcan and Gators (MA) have maintained relatively stable positions, with Gators (MA) consistently ranking in the high 20s, indicating a steady but less dynamic market presence. Meanwhile, Trees Co. (TC) and Bostica have shown fluctuations in their rankings, with Trees Co. (TC) achieving a notable rise to 29th in January 2026, suggesting competitive pressure in the market. This competitive landscape highlights Twisted Growers' potential to continue its upward momentum, capitalizing on its recent sales growth to challenge more established brands in the Massachusetts Pre-Roll sector.

Notable Products

In January 2026, Twisted Growers' top-performing product was Fluffernutter Pre-Roll (1g), which climbed to the number one position with sales of 5059 units. Purple Sunset Pre-Roll (1g) followed closely, maintaining a strong presence by moving from third place in November 2025 and first in December 2025 to second in January 2026. Apple Ice Cream Pre-Roll (1g) made a notable entry into the top rankings, securing the third spot. Super Boom Pre-Roll (1g) remained consistent, holding the fourth position from its previous rank in November 2025. Fruit Salad Pre-Roll (1g) experienced a drop in rankings, moving from second in December 2025 to fifth place in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.