Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

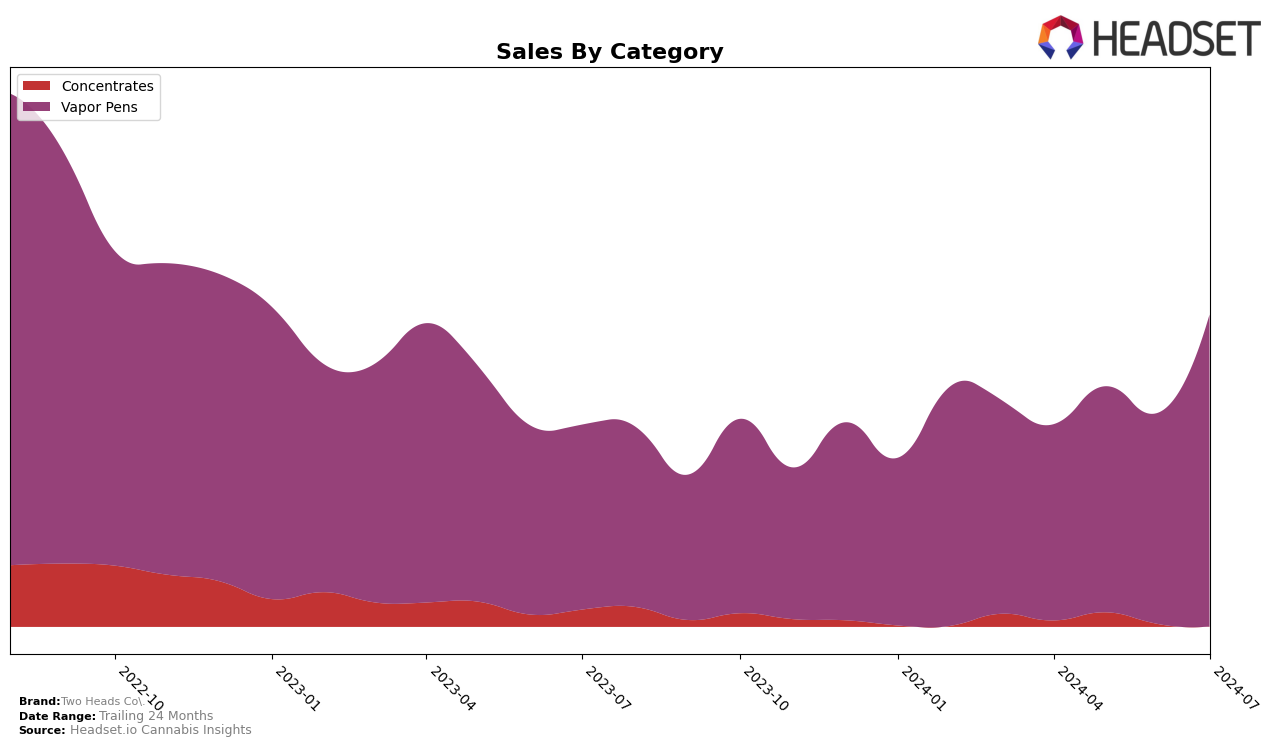

Two Heads Co. has shown varied performance across different categories in Washington. In the Concentrates category, the brand has struggled to break into the top 30 rankings, with positions ranging from 63rd to 77th over the past four months. This indicates a need for strategic adjustments to improve their market share in this segment. However, despite not making it into the top 30, the sales figures for Concentrates have shown some fluctuations, peaking in May 2024 before declining again in the following months.

Conversely, Two Heads Co. has performed significantly better in the Vapor Pens category in Washington. The brand consistently ranked in the 30s, with a notable jump to 26th place in July 2024. This upward movement is a positive indicator of the brand's growing presence and acceptance in the Vapor Pens market. The sales trend also supports this, as the revenue from Vapor Pens saw a substantial increase in July 2024, suggesting effective market strategies and consumer preference for their products in this category.

Competitive Landscape

In the highly competitive Vapor Pens category in Washington, Two Heads Co. has shown a notable improvement in its market position over the past few months. Despite starting at rank 37 in April 2024, the brand has climbed to rank 26 by July 2024, indicating a positive trajectory in consumer preference and market penetration. This upward movement is significant when compared to competitors like Optimum Extracts (WA), which maintained a relatively stable but higher rank, fluctuating between 22 and 26 during the same period. Similarly, Leafwerx and 5Th House Farms also exhibited stable rankings but did not show the same level of upward momentum as Two Heads Co. Additionally, Herb's Oil experienced some volatility, fluctuating between ranks 27 and 33, which contrasts with the steady improvement of Two Heads Co. This positive trend for Two Heads Co. suggests a growing consumer base and increasing sales, positioning it as a rising player in the Washington Vapor Pens market.

Notable Products

For July 2024, the top-performing product from Two Heads Co. is the Strawberry Banana THC Distillate Cartridge (1g) in the Vapor Pens category, which achieved the highest sales of $1236. The Maui Wowie Distillate Cartridge (1g) followed closely in second place, maintaining its strong performance from previous months. High-C Distillate Cartridge (1g) secured the third position, showing a consistent rise in rankings over the months. The CBD Zkittles Distillate Cartridge (1g), which had been the top product in May and June, fell to fourth place in July. The Zkittlez Distillate Cartridge (1g) re-entered the rankings in fourth place, indicating a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.