Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

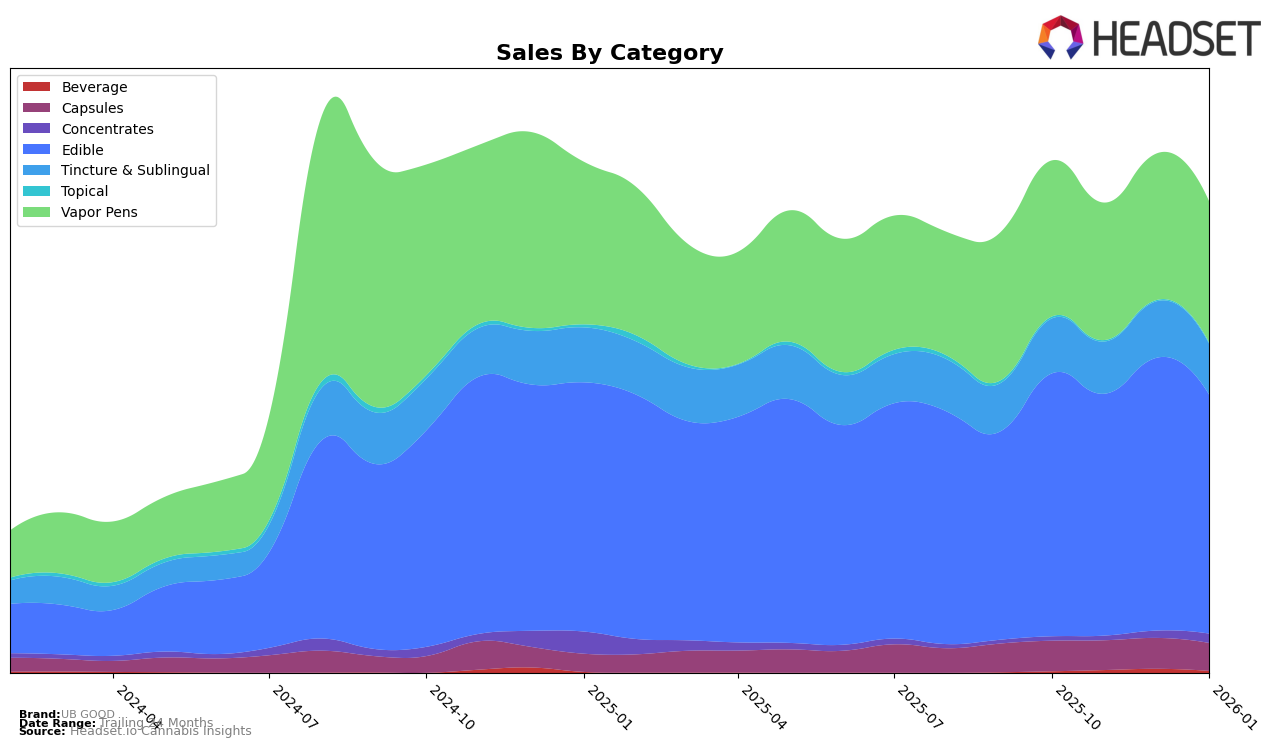

UB GOOD has demonstrated a strong presence in the Ohio market, particularly within the Tincture & Sublingual category, where it maintained the top rank consistently from October 2025 to January 2026. This consistent performance highlights a robust demand and possibly a loyal customer base for their tincture products. In contrast, the brand's performance in the Vapor Pens category showed a slight decline, moving from the 12th position in October and November 2025 to the 14th position by January 2026. This downward trend could indicate increasing competition or changing consumer preferences in this segment.

In the Edible and Capsules categories, UB GOOD experienced a slight drop in rankings over the months. For Edibles, they moved from the 2nd position in October 2025 to the 4th by January 2026, while Capsules saw a similar decline from 2nd to 4th. Despite these shifts, the brand's sales figures remained relatively stable, suggesting that while their market share might have slightly decreased, they are still performing well in terms of revenue. Notably, the absence of rankings in other states or provinces implies that UB GOOD is either not present or not competitive enough to break into the top 30 in those markets, which could be seen as a potential area for growth or concern depending on their strategic goals.

Competitive Landscape

In the competitive landscape of the edible cannabis category in Ohio, UB GOOD has experienced notable fluctuations in its ranking and sales performance over the past few months. Despite starting strong in October 2025 with a rank of 2, UB GOOD saw a slight dip to 3 in November, before regaining its position at 2 in December, only to fall to 4 in January 2026. This variability in rank indicates a highly competitive market environment. Gron / Grön emerged as a formidable competitor, climbing from rank 5 in October to 2 in November and maintaining a strong presence with ranks of 4 and 3 in the following months. Meanwhile, Camino consistently performed well, securing the top 3 positions throughout the period, which suggests a stable consumer preference. Although UB GOOD's sales peaked in December, indicating a strong holiday season, the brand faced challenges in sustaining its momentum into January. This competitive analysis highlights the dynamic nature of the Ohio edible market, where brands like UB GOOD must continuously innovate and adapt to maintain their market position against strong contenders like Gron / Grön and Camino.

Notable Products

In January 2026, UB GOOD's top-performing product remained the Cherry Pomegranate Extra Strength Releaf Gummies 10-Pack (500mg) in the Edible category, maintaining its number one ranking despite a slight drop in sales to 7434 units. The Pineapple Punch Extra Strength Gummies 10-Pack (500mg) also held steady at the second position, showing consistent performance across the months. A notable new entry in the rankings is the Afghan Cheese CDT Distillate Cartridge (1g) in the Vapor Pens category, debuting at third place. The GO - CBD/THC 10:1 Juicy Pear Gummies 20-Pack (1000mg CBD, 100mg THC) returned to the rankings at fourth place, after being unranked in December. Another new entry, the Pineapple Punch Extra Strength Gummies 11-Pack (550mg), secured the fifth position, indicating growing interest in slightly larger pack sizes.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.