Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

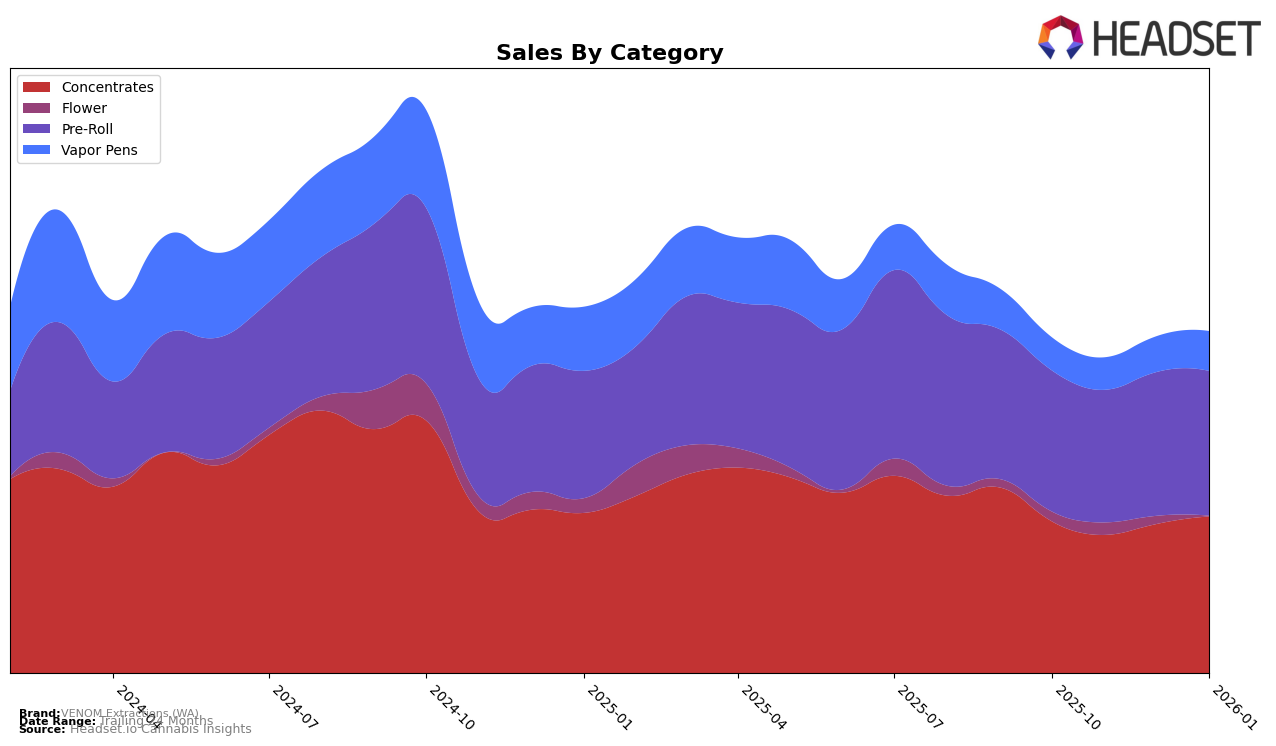

VENOM Extractions (WA) has shown a consistent presence in the Washington market, particularly in the Concentrates category. Over the four-month period from October 2025 to January 2026, the brand maintained a rank within the top 30, although it experienced slight fluctuations. Starting at rank 21 in October, it dipped to 24 in December before climbing back to 23 in January. This indicates a stable yet slightly volatile position in the Concentrates market. The brand's sales performance reflects this trend, with a notable increase in January 2026, suggesting a positive reception of their product offerings towards the end of the period.

In the Pre-Roll category, VENOM Extractions (WA) did not make it into the top 30, indicating a more challenging competitive landscape for the brand in this segment. Despite not achieving a top ranking, the brand showed a promising upward trend in its positioning, moving from rank 51 in October 2025 to rank 43 by January 2026. This trajectory suggests that while the brand is not yet a major player in the Pre-Roll category, it is making strides towards increasing its market share. The sales figures for Pre-Rolls corroborate this gradual improvement, as there was a steady increase in sales from November to January, reflecting growing consumer interest and possibly improved distribution strategies.

Competitive Landscape

In the competitive landscape of the Washington concentrates market, VENOM Extractions (WA) has experienced a relatively stable performance in recent months, maintaining its position around the mid-20s in rank. Despite a slight dip in November 2025, VENOM Extractions (WA) has shown resilience by recovering to the 23rd position by January 2026. This stability is noteworthy when compared to competitors like Hitz Cannabis, which has fluctuated between 17th and 22nd place, and Fire Bros., which has seen a more volatile ranking, dropping out of the top 20 entirely in November and December 2025. Meanwhile, Incredibulk has consistently hovered around the same rank as VENOM Extractions (WA), indicating a closely matched competition. The sales trends suggest that while VENOM Extractions (WA) is not leading the pack, its consistent performance amidst fluctuating competitors positions it as a reliable choice for consumers seeking stability in product availability and quality.

Notable Products

In January 2026, Alaskan Thunder Fuck Cured Resin (1g) maintained its top position in the VENOM Extractions (WA) product lineup, leading the sales with 1136 units sold. ATF Infused Pre-Roll 2-Pack (1g) secured the second spot, consistent with its November 2025 ranking. 9lb Hammer Cured Resin (1g) experienced a slight drop, moving from second place in December 2025 to the third position in January 2026. Peach Ringz Cured Resin (1g) held steady in fourth place, demonstrating consistent performance over the previous months. Pineapple Express Cured Resin (1g) reappeared in the rankings at fifth place, having previously been absent from the top ranks in November and December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.