Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

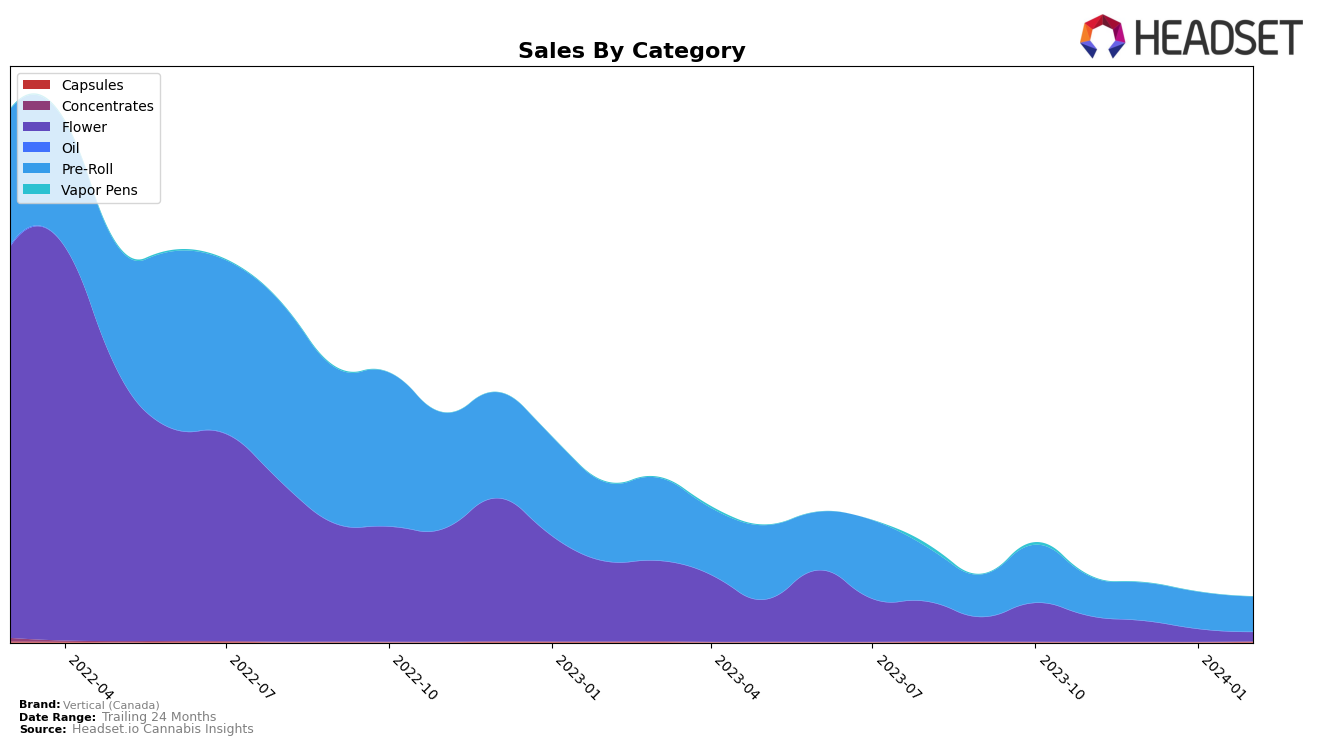

In Alberta, Vertical (Canada) has shown a varied performance across different cannabis product categories. In the Flower category, their ranking dropped out of the top 30 brands after November 2023, indicating a decline in their market presence or competitive performance in this category within the province. This could be considered a setback, given that their initial ranking was 94 with sales amounting to $26,469. On the other hand, their Pre-Roll products have maintained a presence in the rankings from November 2023 to February 2024, albeit with fluctuations. The rankings dipped to 96 in February 2024 from an initial rank of 90 in November 2023, suggesting challenges in maintaining their market position despite a peak in January 2024 at rank 81. This indicates a dynamic competitive environment for Vertical in the Pre-Roll category in Alberta, with sales peaking at 44,056 in January before dropping to 31,075 in February 2024.

In contrast, Vertical (Canada)'s venture into the Ontario market with their Capsules category appears to be off to a promising start, securing a rank of 28 in February 2024, their debut ranking month. This entry into the top 30 without prior rankings in the preceding months suggests a successful launch or an immediate positive reception from the market, albeit with modest sales of 702 units. Meanwhile, their performance in the Oregon market, specifically in the Pre-Roll category, has seen significant fluctuations. Starting at rank 69 in November 2023 and experiencing a dip to 86 in January 2024, they managed a notable recovery to rank 65 by February 2024. This recovery indicates a resilience and potential growth in consumer preference or strategic adjustments by Vertical in Oregon, contrasting with their more unstable performance in Alberta.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, Vertical (Canada) has experienced fluctuations in its market positioning, highlighting the dynamic nature of the cannabis industry in this region. Initially ranked 90th in November 2023, Vertical improved its standing to 81st by January 2024, only to fall back to 96th in February 2024. This volatility in rankings is indicative of the fierce competition and changing consumer preferences within the market. Notably, FIGR has shown a consistent improvement, moving from a rank of 97th to 90th, while Phyto Extractions made a significant entrance in January 2024 at 94th and improved to 89th by February. Original Stash and Sheeesh! have also seen shifts in their rankings, with Sheeesh! demonstrating a notable decline from 55th to 99th over the observed period. These movements underscore the competitive pressures faced by Vertical (Canada), as it navigates a market characterized by both established players and emerging brands vying for consumer attention.

Notable Products

In February 2024, Vertical (Canada) saw the Cold Creek Kush Pre-Roll 5-Pack (2.5g) maintain its position as the top-selling product across all categories, with sales reaching 1824 units. Following closely, the Cold Creek Kush (1g) secured the second rank consistently from December 2023 to February 2024, indicating stable consumer preference within the Flower category. The Day and Night Pre-Roll 10-Pack (5g) made a notable jump to the third position in February, despite not being ranked in January, showcasing a significant increase in demand. The Day + Night Pre-Roll 5-Pack (5g) also saw an improvement, moving up to the fourth rank in February from its initial fifth position in November 2023. Lastly, the Silk Haze Pre-Roll 5-Pack (5g) entered the top five in February, underscoring a growing interest in diverse Pre-Roll options offered by Vertical (Canada).

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.