Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

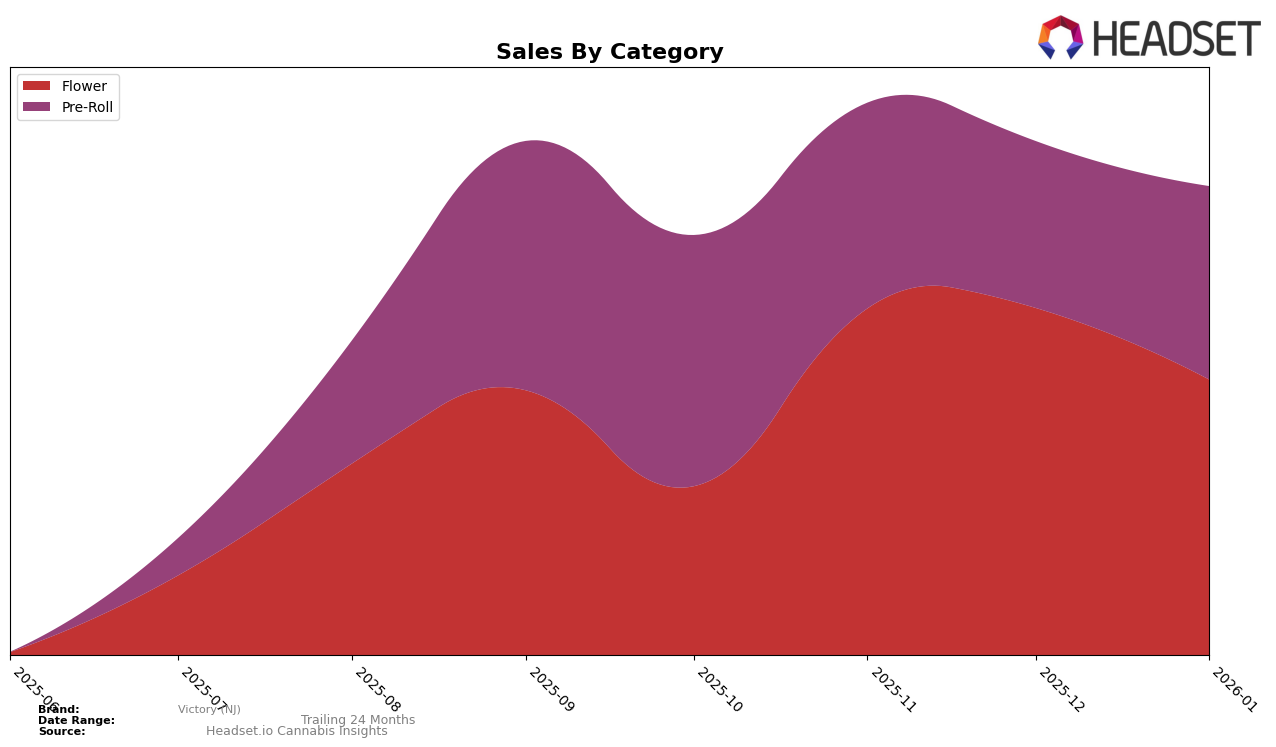

Victory (NJ) has demonstrated varied performance across different categories in New Jersey. Within the Flower category, the brand has shown significant movement, improving its ranking from 53rd in October 2025 to 37th in November 2025, before experiencing a slight decline to 43rd by January 2026. This fluctuation indicates a competitive landscape in the Flower category, where Victory (NJ) is making strides but still faces challenges to consistently remain in the top tiers. The sales figures reflect this volatility, with a notable peak in November 2025 followed by a decrease in January 2026, suggesting that while there is potential for growth, consistent performance remains a hurdle.

In contrast, Victory (NJ)'s performance in the Pre-Roll category in New Jersey has been relatively stable. The brand maintained a presence within the top 30, although it experienced minor fluctuations, slipping from 23rd in October 2025 to 29th by January 2026. This steadiness, despite the slight dip, indicates a stronger foothold in the Pre-Roll category compared to Flower. The sales trend in this category shows a decrease from October to December 2025, followed by a slight recovery in January 2026. This pattern suggests that while Victory (NJ) is managing to keep its rank, there is room for improvement to bolster its sales consistently.

Competitive Landscape

In the competitive landscape of the New Jersey flower category, Victory (NJ) has demonstrated a notable fluctuation in its market position over the past few months. Starting at rank 53 in October 2025, Victory (NJ) made a significant leap to rank 37 by November, aligning closely with The Botanist, which held a steady position in the mid-30s. However, Victory (NJ) experienced a slight decline to rank 43 by January 2026, a movement that coincides with a decrease in sales from December to January. This drop in rank and sales suggests a potential challenge in maintaining momentum against competitors like High Wired, which consistently hovered around the 40s rank. Meanwhile, Test Kitchen showed a steady climb from rank 70 to 45, indicating a growing presence in the market. Victory (NJ)'s fluctuating rank and sales highlight the competitive pressure in the New Jersey flower market, emphasizing the need for strategic marketing efforts to regain and sustain higher market positions.

Notable Products

In January 2026, Sour Blueberry (3.5g) from the Flower category emerged as the top-performing product for Victory (NJ), climbing from a consistent second place in previous months to secure the number one spot with sales of 1793 units. The Acapulco Gold Pre-Roll 5-Pack (3g) maintained a strong performance, ranking second, despite a slight dip in sales compared to October 2025. Acapulco Gold (3.5g), also from the Flower category, saw a drop to third place after leading in November and December 2025. Bubba Kush (3.5g) held steady in fourth place, showing resilience with a notable improvement in sales over the past few months. The Bubba Kush Pre-Roll 5-Pack (3g) remained in fifth place, consistent with its December 2025 ranking, indicating stable demand for pre-roll products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.