Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

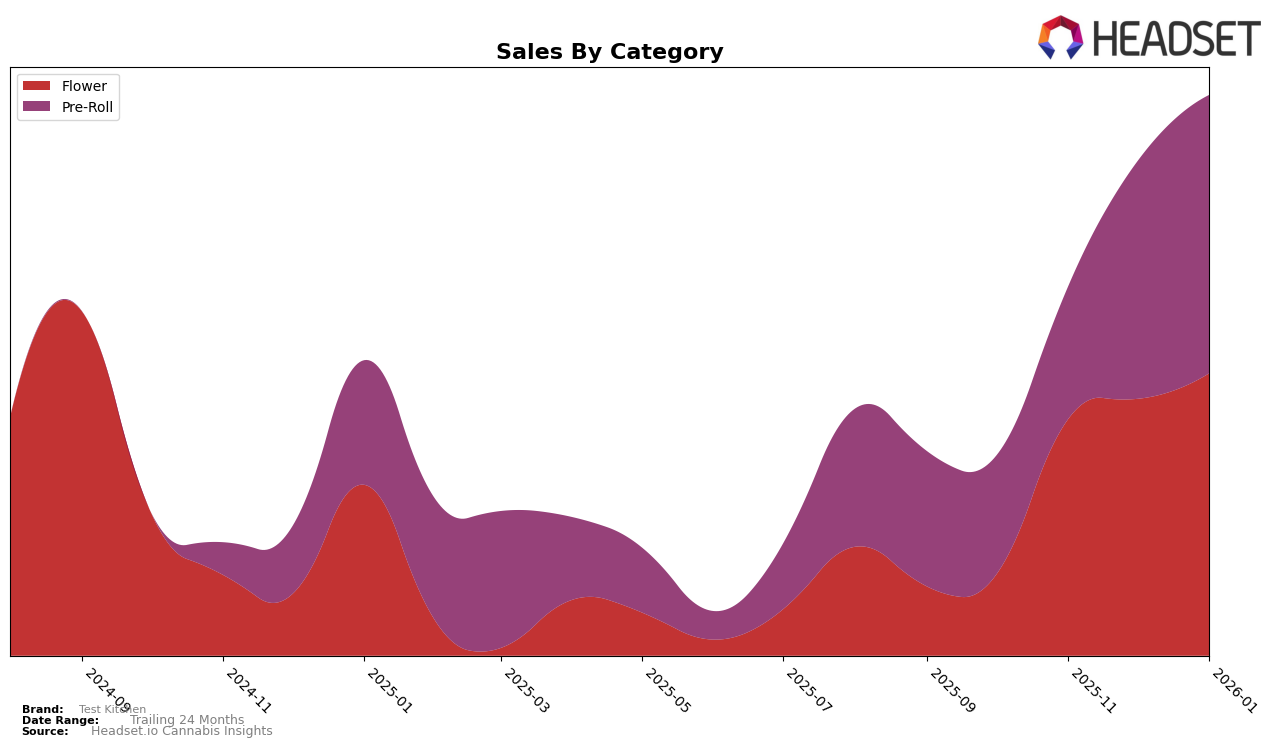

Test Kitchen has shown a notable performance across different product categories in New Jersey. In the Flower category, the brand has consistently improved its position, climbing from 70th in October 2025 to 45th by January 2026. This upward trajectory suggests a strengthening presence in the market, despite not breaking into the top 30. This improvement aligns with a significant increase in sales, nearly tripling from October to January, indicating growing consumer interest and acceptance. However, the brand still faces challenges in achieving a top-tier status within this competitive category.

In the Pre-Roll category, Test Kitchen has demonstrated even more impressive progress. Starting at 41st place in October 2025, the brand ascended to 22nd by January 2026, successfully entering the top 30 and highlighting its growing influence. This movement is corroborated by a substantial rise in sales, reflecting effective strategies or product offerings that resonate well with consumers. The brand's ability to secure a spot within the top 30 in this category is a positive indicator of its potential to further solidify its standings in New Jersey's cannabis market.

Competitive Landscape

In the competitive landscape of the New Jersey flower category, Test Kitchen has demonstrated a notable upward trajectory in rank and sales over the past few months. Starting from a rank of 70 in October 2025, Test Kitchen surged to 45 by November, briefly dipped to 48 in December, and then reclaimed its 45th position in January 2026. This consistent improvement is underscored by a substantial increase in sales, which nearly tripled from October to January. In contrast, Heavyweight Heads showed a slower but steady climb from rank 68 to 47, with sales more than doubling over the same period. Meanwhile, Hillview Farms experienced a decline in rank from 56 to 49, with fluctuating sales figures, indicating potential volatility. High Wired maintained a relatively stable position, hovering around the low 40s, while Victory (NJ) saw a slight decline from 37 to 43, despite a strong sales performance in November and December. These dynamics suggest that Test Kitchen's strategic initiatives may be effectively capturing market share, positioning it as a formidable contender in the New Jersey flower market.

Notable Products

In January 2026, the top-performing product from Test Kitchen was Perle di Sole Pre-Roll (1g) in the Pre-Roll category, maintaining its number one ranking from December 2025 with notable sales of 1863 units. Zikigai Pre-Roll (1g) rose to the second position, improving from its third-place ranking in December, with a significant sales boost. A5 Pre-Roll (1g) also showed an upward trend, climbing to third place from fifth, with increased sales figures. Ogz x Rainbow Belts x Blue Andeeze Pre-Roll (1g) entered the rankings at fourth place, indicating strong performance. Meanwhile, Z Pie x Lemon Cherry Gelato Pre-Roll (1g) dropped from second to fifth place, reflecting a decrease in its sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.