Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

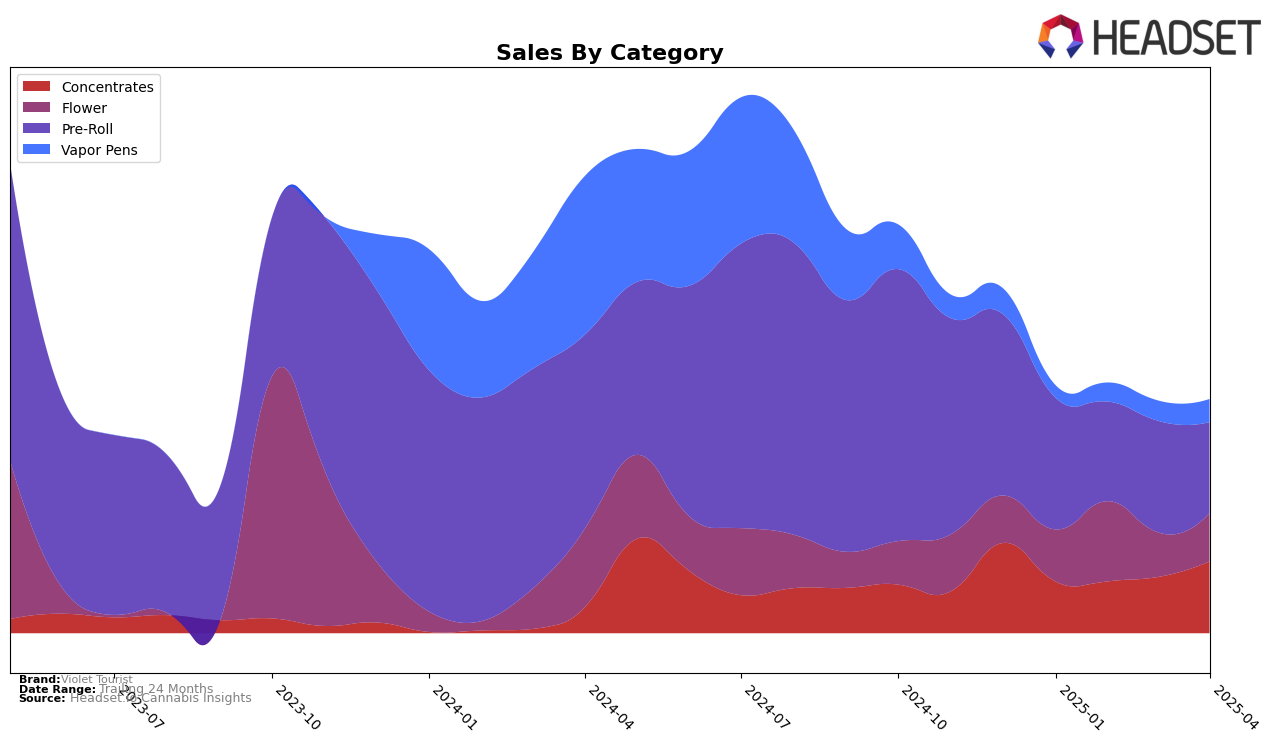

Violet Tourist has shown notable progress in the Concentrates category in Alberta. Starting the year outside the top 30, the brand managed to climb steadily from a rank of 37 in January 2025 to break into the top 30 by April 2025. This upward trajectory is supported by a significant increase in sales, indicating a growing consumer preference for their products in this category. Such a movement into the top 30 is a positive sign of brand strength and market penetration in Alberta. The consistent month-over-month improvement suggests a well-received product strategy or possibly an effective marketing push that has resonated with consumers in this region.

In contrast, Violet Tourist's performance in the Pre-Roll category in Saskatchewan reveals a different story. The brand appeared at rank 63 in January 2025 but did not maintain a presence in the top 30 in subsequent months, indicating challenges in this category within the province. This absence from the rankings could suggest increased competition or a need for strategic adjustments to regain market share. The initial sales figure in January shows potential, so it will be interesting to see if Violet Tourist can leverage this to improve its standing in Saskatchewan's Pre-Roll market in the future.

Competitive Landscape

In the Alberta concentrates market, Violet Tourist has shown a notable upward trajectory in its rankings from January to April 2025, moving from 37th to 30th place. This positive trend in rank is accompanied by a consistent increase in sales, suggesting a strengthening market presence. In contrast, Good Buds experienced fluctuations, peaking at 22nd in February but slipping to 26th by March, indicating potential volatility. Meanwhile, Greybeard maintained a relatively stable position, though consistently lower than Violet Tourist, which could imply a steady but less aggressive growth strategy. Tremblant Cannabis saw a decline from 28th in January to 31st in April, reflecting a downward trend that contrasts with Violet Tourist's ascent. Smoke Show showed a strong recovery from an unranked position in February to 29th in April, which poses a potential competitive threat. Overall, Violet Tourist's consistent improvement in rank and sales positions it favorably against its competitors, highlighting its growing influence in the Alberta concentrates market.

Notable Products

In April 2025, the top-performing product from Violet Tourist was the Sage n' Sour Terp Slush (1g) in the Concentrates category, which rose to the number one position with a notable sales figure of 675 units. The Mini J's - Cool Mint Crush Infused Pre-Roll 5-Pack (1.75g) made a significant leap to second place, despite not being ranked in the previous two months. The Mini J's - Lilac Diesel Pre-Roll 5-Pack (1.75g) moved up to third place, recovering from a fifth-place ranking in March. The Guava Gas Live Resin FSE Cartridge (1g) entered the rankings for the first time in fourth place. Meanwhile, the Mini J's - Lilac Diesel Pre-Roll 10-Pack (3.5g) fell to fourth place from its previous second-place position in January and March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.