Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

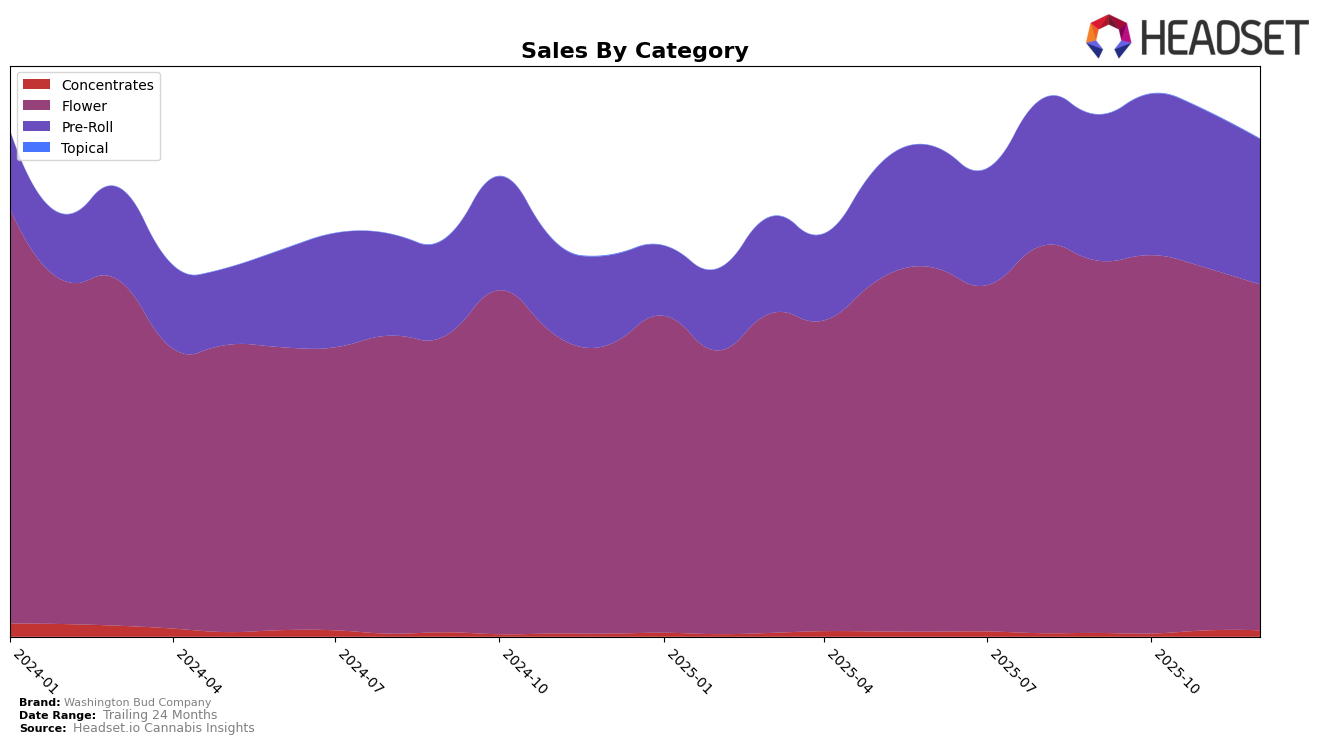

In the competitive landscape of Washington, Washington Bud Company has shown a fluctuating performance in the Flower category. Over the last few months of 2025, the brand's ranking slightly declined, moving from 49th in September to 53rd by December. Despite this drop, the company maintained a consistent presence in the top 50, which suggests stability in a saturated market. However, the gradual decrease in sales from $138,620 in September to $128,763 in December indicates a need for strategic adjustments to regain a stronger foothold in the Flower category.

In the Pre-Roll category, Washington Bud Company has demonstrated a more stable trajectory, albeit outside the top 30 rankings. Beginning at the 70th position in September, the brand improved slightly to 65th in October before settling at 67th by December. This consistency in rankings, despite not breaking into the top tiers, reflects a steady demand for their Pre-Roll products. The sales figures, which peaked in October, suggest that the brand may have capitalized on specific market trends during that period, highlighting potential areas for growth and further market penetration strategies.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Washington Bud Company has experienced a relatively stable but challenging position in the market. Over the last four months of 2025, Washington Bud Company maintained its rank within the 48th to 53rd positions, indicating a consistent presence but also highlighting room for growth compared to competitors. Notably, Freddy's Fuego (WA) has shown a significant upward trend, improving its rank from 51st in September to 44th by December, coupled with a notable increase in sales, which could pose a competitive threat. Meanwhile, Smokey Point Productions (SPP) has seen a decline in rank, dropping out of the top 50 by December, which might offer an opportunity for Washington Bud Company to capture some of its market share. Additionally, Khalifa Kush and Bodega Buds have fluctuated in rankings, with Khalifa Kush experiencing a downward trend, potentially allowing Washington Bud Company to strategize for a more competitive edge. Overall, while Washington Bud Company remains a steady player, the dynamic shifts among its competitors suggest that strategic adjustments could enhance its market position.

Notable Products

In December 2025, the Mimosa Pre-Roll 2-Pack (1g) emerged as the top-performing product for Washington Bud Company, securing the number one rank with sales of 790 units. The Afghani Hashplant (3.5g), which had consistently held the top spot from September to November, slipped to second place in December. The Afghani Hash Plant Pre-Roll 2-Pack (1g) maintained its third position from November to December. Gorilla Girl Pre-Roll 2-Pack (1g) held steady at fourth place, continuing its ranking from the previous month. Meanwhile, Gorilla Girl (3.5g) re-entered the rankings at fifth place in December after being unranked in November, indicating a resurgence in its sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.