Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

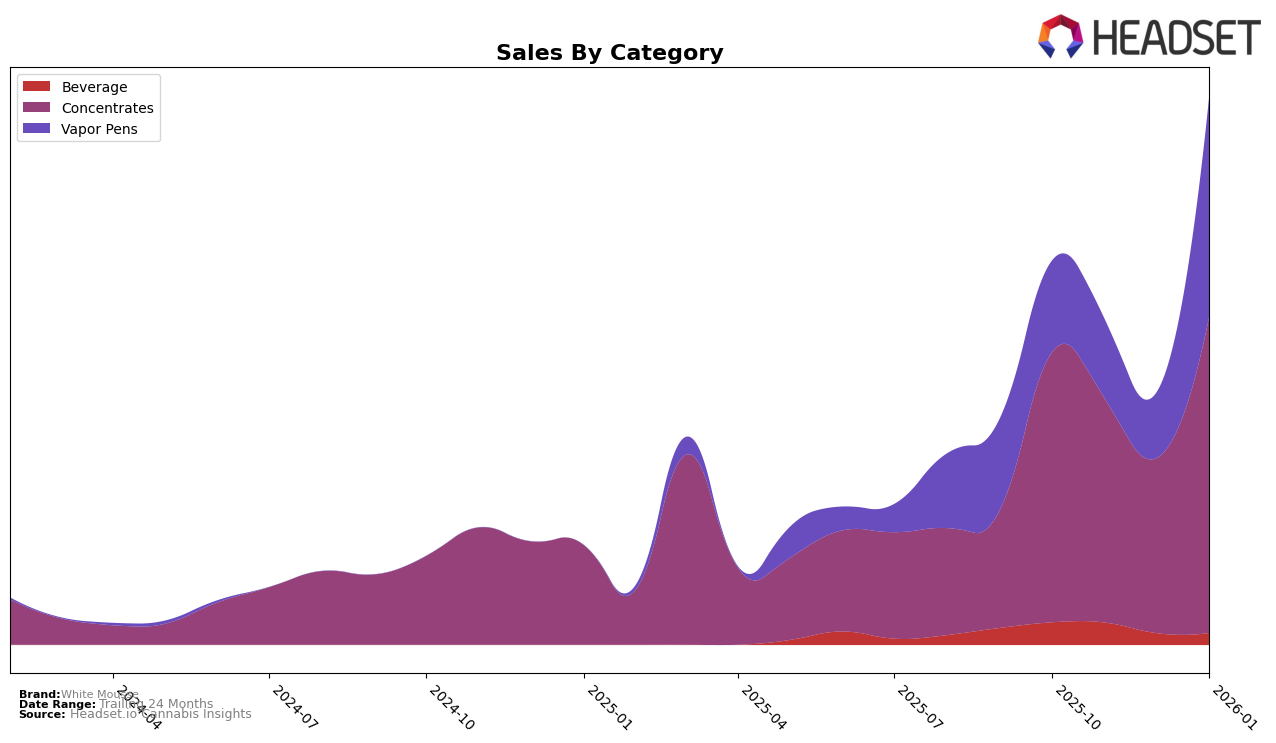

White Mousse has shown fluctuating performance across different categories and states, with some notable movements. In the Concentrates category in Colorado, White Mousse managed to climb back into the top 30 by January 2026 after slipping out of it in the preceding months. This upward trend is indicative of a possible strategic adjustment or market response that has positively impacted their sales, which saw a significant increase from December 2025 to January 2026. However, their performance in the Vapor Pens category in Colorado has been less consistent, with rankings hovering outside the top 30 until a notable jump to 61st place in January 2026, suggesting a recent positive shift that may warrant further observation.

The varying performance across categories also highlights differences in consumer preferences or competitive pressures in the Colorado market. While White Mousse's return to the top 30 in Concentrates suggests a strengthening position, their previous absence from the top rankings indicates challenges that may have been overcome recently. Conversely, the Vapor Pens category shows a more volatile trajectory, with rankings mostly outside the competitive bracket, yet the recent improvement to 61st place could signal the beginning of a growth phase. These movements suggest that while White Mousse has room for improvement, particularly in the Vapor Pens category, there are signs of resilience and potential growth opportunities in the Concentrates sector.

Competitive Landscape

In the competitive landscape of the Colorado concentrates market, White Mousse has shown a notable improvement in its ranking from December 2025 to January 2026, jumping from 38th to 30th position. This upward movement is significant, especially when compared to competitors like Seed and Smith (LBW Consulting), which maintained a relatively stable rank around the 27th and 28th positions, and Newt Brothers Artisanal, which saw a slight improvement from 32nd to 29th. Despite Next1 Labs LLC experiencing a drop from 29th to 32nd, White Mousse's sales trajectory indicates a promising recovery, with January 2026 sales figures showing a significant increase compared to the previous months. This positive trend suggests that White Mousse is effectively capturing more market share, positioning itself as a rising contender in the concentrates category.

Notable Products

In January 2026, Lost Tribe Cured Wax (1g) emerged as the top-performing product for White Mousse, with sales reaching 463 units. Following closely, Sub Zero Sugar Wax (1g) and Frosty Earth Cured Wax (1g) secured the second and third ranks, respectively. Sonic Blaster Sugar Wax (1g) and Gorilla Snowman Sugar Wax (1g) rounded out the top five, indicating a strong preference for concentrates. Notably, these products were not ranked in the previous months, suggesting a new surge in popularity. The shift highlights a significant change in consumer preferences towards these specific concentrate offerings from White Mousse.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.