Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

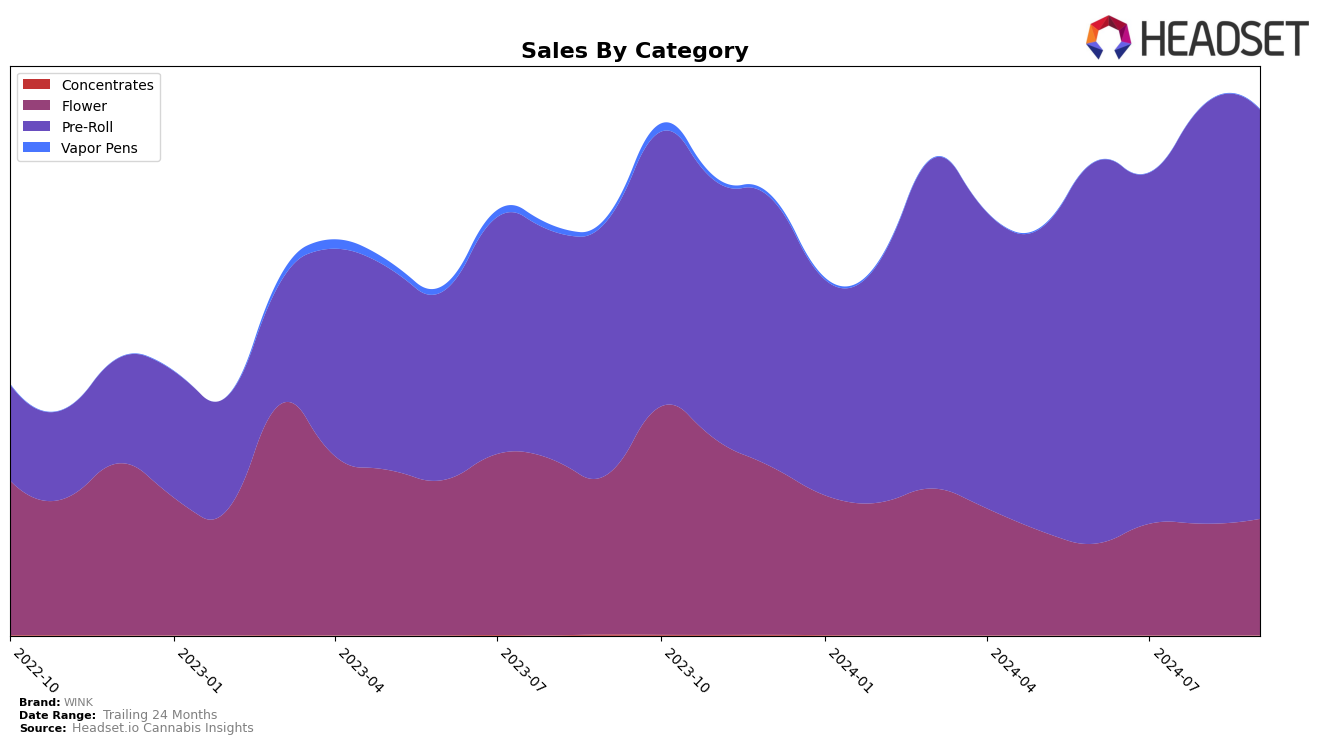

WINK's performance across various categories and states/provinces has shown both promising and challenging trends. In Alberta, WINK's Flower category has seen a steady improvement in rankings, moving from 55th in June 2024 to 53rd by September 2024. This upward trend is mirrored in their sales figures, which increased significantly from June to September. Conversely, their Pre-Roll category in British Columbia has seen a decline in rankings, slipping from 30th in June to 39th in September, accompanied by a decrease in sales over the same period. This indicates a need for strategic adjustments in the British Columbia market to regain momentum.

In Ontario, WINK's presence in the Flower category is notably absent from the top 30 rankings for most months, which could be a potential area for growth or concern depending on market dynamics. Meanwhile, their Pre-Roll category, although ranked lower than in Alberta, has maintained a consistent presence in the top 75, albeit with a downward trend from 62nd in June to 75th in September. This consistent yet declining rank suggests a stable but competitive market environment in Ontario that may require enhanced marketing or product differentiation strategies to improve WINK's standing.

Competitive Landscape

In the competitive landscape of the pre-roll category in Alberta, WINK has shown a notable upward trend in its ranking over the past few months, moving from 34th in June 2024 to 28th by September 2024. This positive trajectory is indicative of a strategic improvement in market presence and consumer preference. In comparison, FIGR has also improved its rank from 37th to 26th, suggesting a competitive edge that slightly surpasses WINK's progress. Meanwhile, Castle Rock Farms experienced fluctuations, peaking at 21st in June but dropping to 30th by September, which may reflect inconsistent market strategies or consumer reception. OHJA and Astro Lab have maintained relatively stable positions, with OHJA showing a slight decline from 28th to 29th and Astro Lab maintaining a consistent rank around the mid-20s. These dynamics suggest that while WINK is gaining ground, it faces stiff competition from brands like FIGR, which are also on an upward trajectory, necessitating continued strategic efforts to enhance its market share and consumer engagement.

Notable Products

In September 2024, WINK's top-performing product was the Craft Animal Face Cookies Blunt in the Pre-Roll category, which ascended to the first position with sales of 14,986 units. This product consistently held the second rank in the preceding months before claiming the top spot. The Grapes and Cream Blunt, also in the Pre-Roll category, slipped to the second position after maintaining the top rank from June to August. Tangerine Cookies in the Flower category remained steady at third place, showing a slight increase in sales over the months. The Melon Driver Infused Cannagar, a newcomer to the rankings, climbed to fourth place, while the Dead Hot Strawberries Pre-Roll debuted at fifth in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.