Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

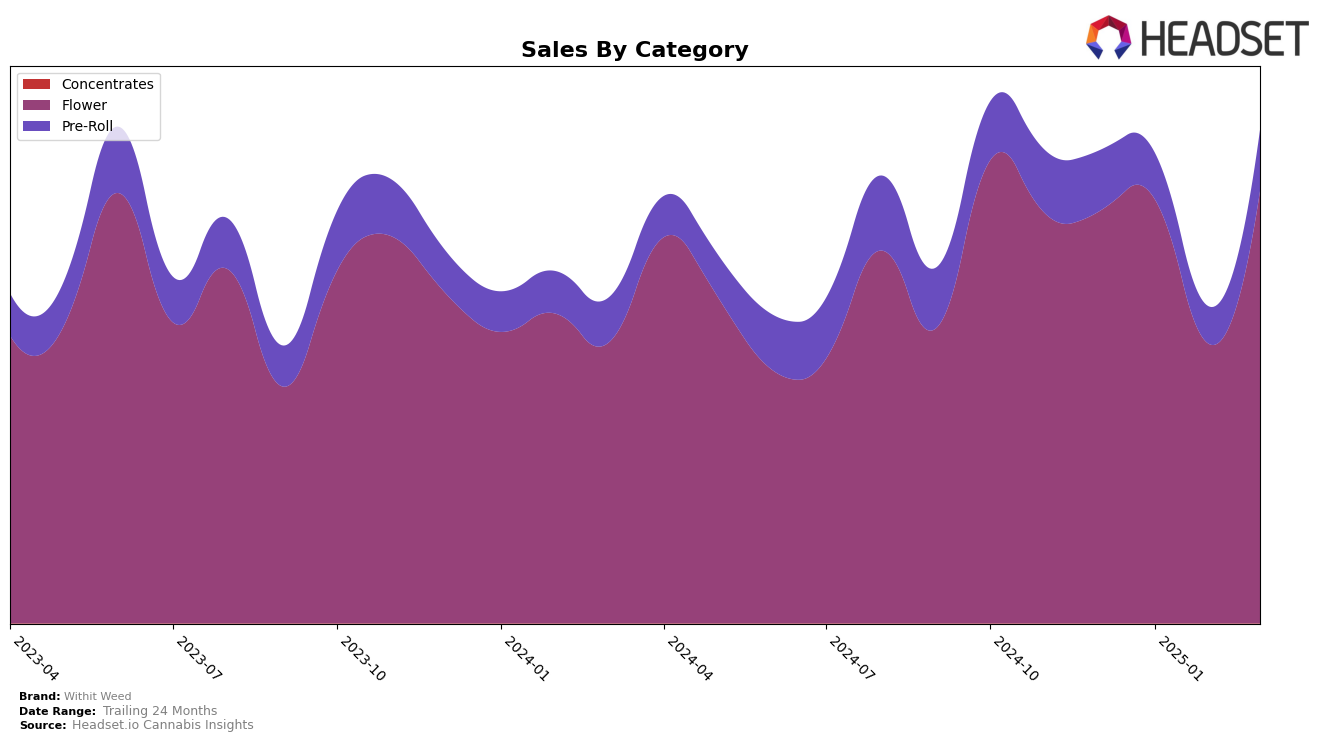

Withit Weed has shown a notable performance in the Washington market, particularly in the Flower category. After starting December 2024 at rank 33, they managed to break into the top 30 by January 2025. Although they slipped to rank 40 in February, they rebounded to 27 by March. This fluctuation suggests a competitive landscape in the Flower category, yet Withit Weed's ability to regain a higher ranking by March indicates resilience and potential growth. Their sales in March 2025 reached $233,767, reflecting a positive trend despite the earlier dip in February.

In contrast, the Pre-Roll category has been more challenging for Withit Weed in Washington. The brand was ranked 99 in December 2024 and did not appear in the top 30 for January and February 2025, which indicates they were outside the leading brands during those months. However, by March 2025, they managed to climb to rank 90. This movement suggests that while Withit Weed faces significant competition in the Pre-Roll category, there might be emerging opportunities for improvement as evidenced by their slight rise in March. The sales figures, although not as robust as in the Flower category, show a small increase from $32,790 in December to $32,972 in March, hinting at a gradual upward trajectory.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Withit Weed has shown a dynamic performance from December 2024 to March 2025. Starting at rank 33 in December, Withit Weed improved its position to 30 in January, experienced a dip to 40 in February, but rebounded to 27 in March. This fluctuation indicates a competitive struggle but also a capacity for recovery. Notably, Mt Baker Homegrown has been on an upward trajectory, climbing from rank 48 in December to 29 in March, suggesting a growing market presence that could pose a challenge to Withit Weed. Meanwhile, Bodega Buds maintained a relatively stable rank, hovering around the mid-20s, which signifies consistent performance. Royal Tree Gardens and Sweetwater Farms have seen a decline in rank, with Sweetwater Farms dropping out of the top 20 by February. These shifts highlight the competitive volatility in the market, where Withit Weed's ability to regain rank in March could be leveraged to enhance its market strategy and sales initiatives.

Notable Products

In March 2025, the top-performing product from Withit Weed was Mimosa Popcorn 28g, maintaining its first-place rank from previous months with sales of 432 units. Mac Daddy Budlets 28g emerged strongly, securing the second position despite not being in the top ranks earlier. Mac Daddy 3.5g, which was the top-ranked product in February 2025, dropped to third place in March. Mimosa 3.5g entered the rankings at fourth place, showing a notable rise in sales. Blackberry Kush Budlets 28g, previously absent from the top rankings, rounded out the top five in March 2025, indicating a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.