Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

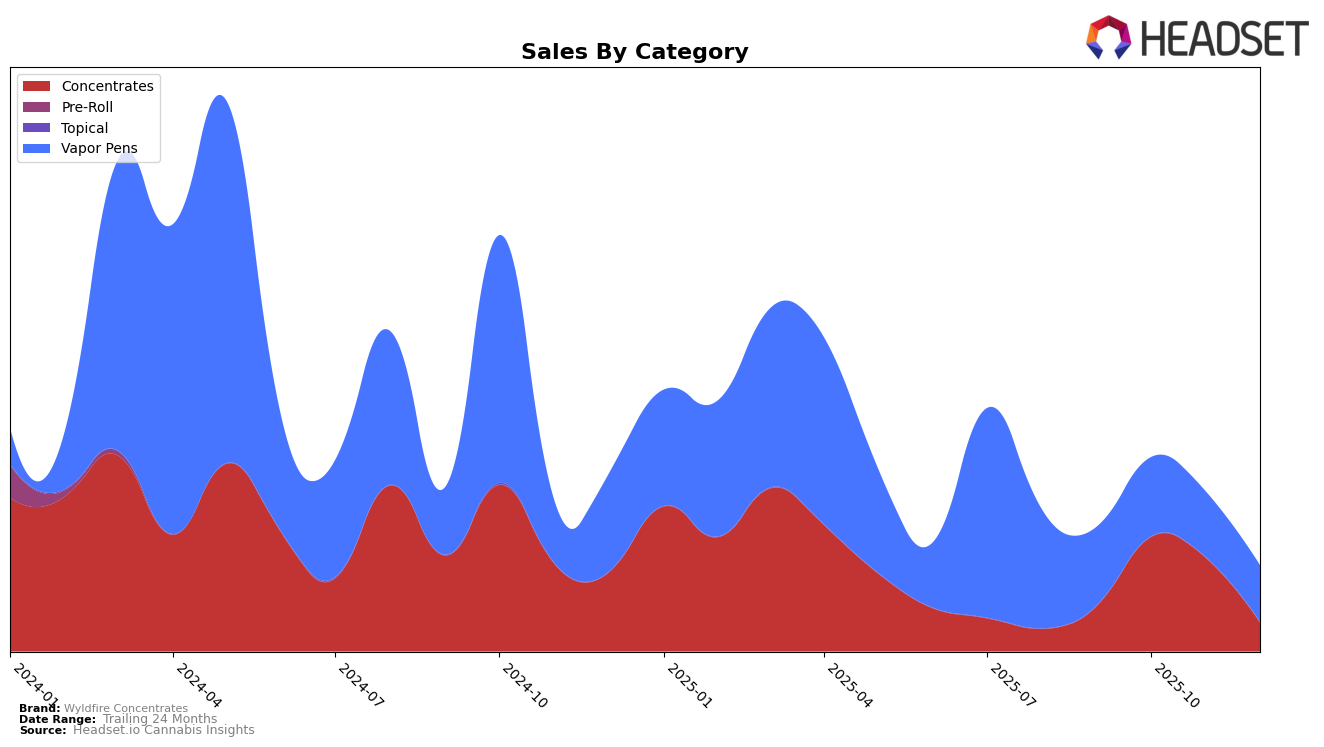

Wyldfire Concentrates has shown notable progress in the Colorado concentrates market. Over the last few months, the brand has ascended from a rank of 64 in September to 48 by November, although it did not maintain a top 30 position by December. This upward movement suggests a growing presence and acceptance among consumers in the concentrates category. The sales figures reflect a significant increase from September to October, which could indicate successful marketing strategies or product launches during that period. However, the absence of a December ranking might suggest that Wyldfire Concentrates struggled to maintain momentum or faced increased competition as the year closed.

In the vapor pens category, Wyldfire Concentrates has been relatively stable in Colorado, maintaining a consistent presence despite not breaking into the top 30. The brand held steady around the 80th position, with a slight dip to 81 in December. This consistency, albeit outside the top tier, might indicate a loyal customer base or steady sales in a competitive market. The decline in sales from October to December could point to seasonal trends or shifts in consumer preferences, which may require strategic adjustments to capture more market share in the coming months.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Wyldfire Concentrates has experienced fluctuating rankings over the last few months of 2025, indicating a dynamic market presence. Starting at 80th place in September, Wyldfire Concentrates maintained this position in October, improved slightly to 76th in November, but then dropped to 81st by December. This volatility is contrasted by competitors such as My Brother's Flower, which consistently outperformed Wyldfire Concentrates, peaking at 76th in October. Meanwhile, Cosmos showed a similar downward trend, missing from the rankings in October but ending the year at 82nd. Nuhi and The CO2 Company also entered the rankings in December, suggesting increased competition. Wyldfire's sales have seen a downward trend, decreasing from October to December, which may have contributed to its decline in rank. This competitive environment underscores the need for Wyldfire Concentrates to strategize effectively to regain and improve its market position.

Notable Products

In December 2025, the top-performing product from Wyldfire Concentrates was Petrol Cookies Live Resin (1g), which secured the number one rank with notable sales of 117 units. Papaya Punch Wax (1g) followed closely, dropping from the first position in November to second in December with 110 units sold. Bubba Fett Live Resin (1g) ranked third, maintaining a consistent presence in the top three for December. Mango Sunrise Live Resin Disposable (1g) and Maui Wowie Distillate Disposable (0.5g) both shared the fourth position, with Maui Wowie moving up from its fifth-place rank in October. Overall, the rankings indicate a strong preference for concentrates, with some shifts in the top positions over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.