Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

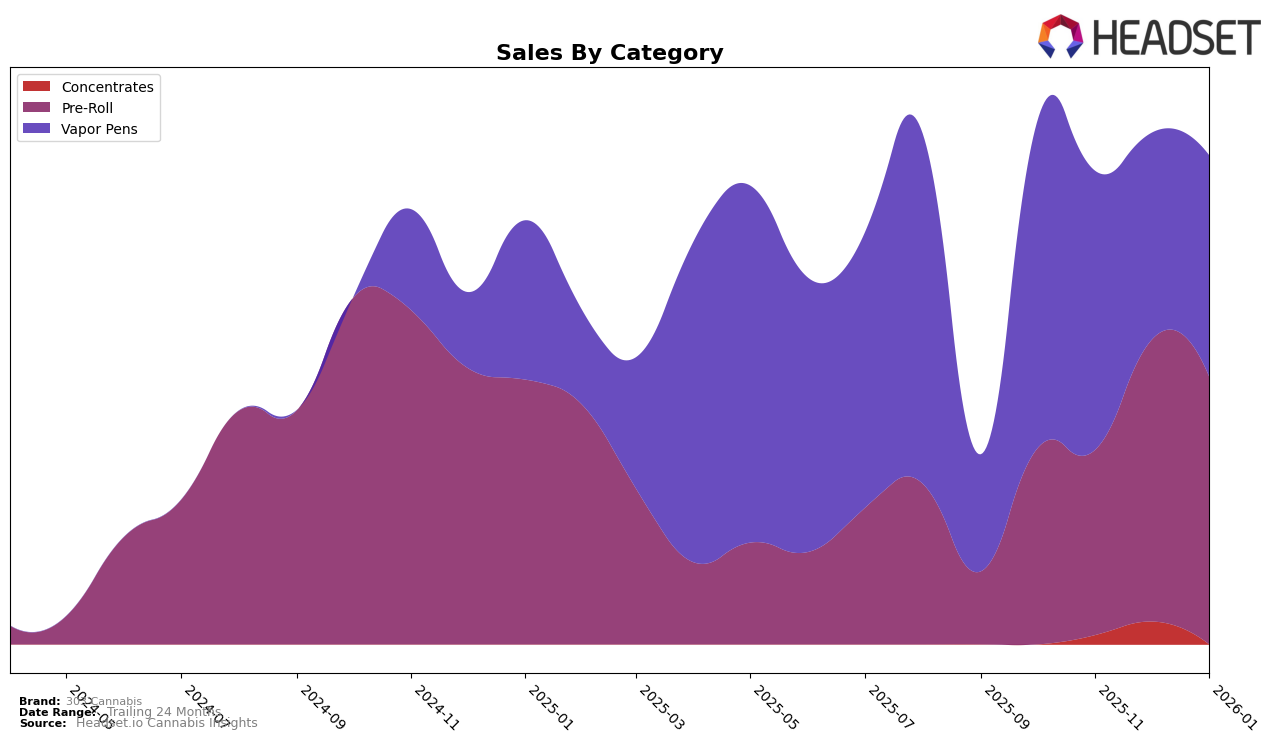

303 Cannabis has shown notable improvement in the Pre-Roll category within Colorado. Over the span from October 2025 to January 2026, the brand climbed from the 35th to the 26th position. This upward trajectory is particularly impressive as it indicates a consistent gain in market share, moving them into the top 30 by December. This suggests a strengthening demand or perhaps an effective strategy in product offerings or marketing. The brand's sales figures in this category also reflect a healthy increase, with a notable jump in December, which might have contributed to their improved ranking.

In contrast, the Vapor Pens category presents a different narrative for 303 Cannabis within Colorado. The brand's ranking remained outside the top 30, fluctuating between the 45th and 53rd positions over the same period. This indicates a more challenging environment or possibly greater competition in Vapor Pens, where 303 Cannabis has been unable to break into the more competitive ranks. Despite this, there was a slight rebound in sales in January, suggesting potential for future improvement or adjustment in strategy. The disparity in performance across these categories highlights the dynamic nature of the cannabis market and the varying challenges brands face in different segments.

Competitive Landscape

In the competitive landscape of the Colorado Pre-Roll category, 303 Cannabis has shown a promising upward trend in rankings from October 2025 to January 2026. Starting at rank 35 in October, 303 Cannabis improved its position to rank 26 by January, indicating a positive momentum in market presence. This upward trajectory contrasts with competitors like Binske, which experienced a decline from rank 19 in October to falling out of the top 20 by January. Similarly, Vera consistently remained outside the top 20, while TICAL fluctuated, peaking at rank 20 in December before dropping to 29 in January. Meanwhile, My Brother's Flower showed a slight improvement, ending at rank 24 in January. The sales figures for 303 Cannabis also reflect this positive trend, with a notable increase in December, suggesting that their strategic efforts are resonating well with consumers in the Colorado market.

Notable Products

In January 2026, the top-performing product for 303 Cannabis was Dankarooz Pre-Roll (1g) in the Pre-Roll category, reclaiming its top spot from November 2025 with an impressive sales figure of 9,435 units. Trifecta Pre-Roll (1g) emerged as the second best-seller, marking its debut in the rankings for January. Dosi Cake Pre-Roll (1g) maintained a steady position at third place, showing consistency from December 2025. Gary Payton Pre-Roll (1g) entered the rankings at fourth place, demonstrating a strong performance as a new contender. Meanwhile, Grape Diesel Distillate Cartridge (1g) in the Vapor Pens category rounded out the top five, slipping one spot from its November 2025 rank.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.