Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

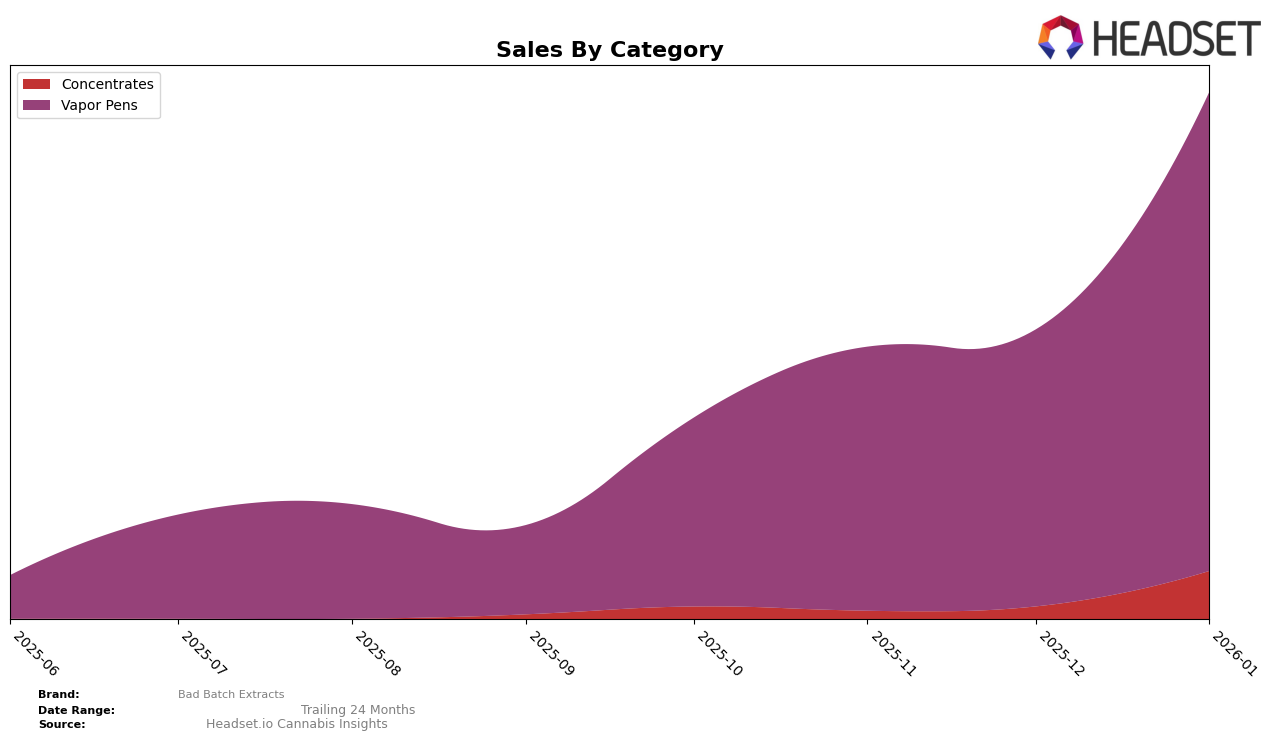

Bad Batch Extracts has shown a notable performance in the Nevada market, particularly within the Vapor Pens category. The brand's ranking improved significantly over the observed months, climbing from 26th place in October 2025 to 14th place by January 2026. This steady upward movement suggests a growing consumer preference or effective market strategies that have bolstered their presence in this category. However, in the Concentrates category, Bad Batch Extracts only appeared in the rankings in January 2026, debuting at 20th place. This absence from the top 30 in previous months could indicate either a recent entry into the category or a prior lack of competitive edge.

While the Vapor Pens category has been a strong point for Bad Batch Extracts in Nevada, the brand's performance in the Concentrates segment seems less consistent. The single appearance in the January 2026 rankings suggests potential for growth or a burgeoning interest in their Concentrates products. The sales figures for Vapor Pens also reflect a positive trend, with a notable increase from November to January, indicating successful market penetration or enhanced consumer loyalty. The absence of Bad Batch Extracts from the top 30 in the Concentrates category for most of the period highlights a potential area for improvement or strategic focus, which could be pivotal for future growth.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Bad Batch Extracts has shown a notable upward trajectory in recent months. While initially ranked 26th in October 2025, the brand climbed to 14th by January 2026, indicating a significant improvement in market position. This upward movement contrasts with brands like INDO, which maintained a relatively stable rank around 12th to 13th, and City Trees, which experienced fluctuations but remained in the top 12. Meanwhile, Royalesque saw a decline from 10th to 15th, and Hustler's Ambition improved from 20th to 16th. The sales growth for Bad Batch Extracts, particularly the jump in January 2026, suggests a growing consumer interest and potential for continued market share gains, positioning it as a rising contender in the Nevada vapor pen market.

Notable Products

In January 2026, Bad Batch Extracts saw the Banana Gelato Distillate Cartridge (1g) leading sales, capturing the top rank with 834 units sold. The Romulan Grapefruit Distillate Cartridge (1g) followed closely in second place, maintaining strong sales performance. Tangie Dream Distillate Cartridge (1g) climbed to the third position from fifth in December 2025, showcasing a significant rise in popularity. Dosi Kush Distillate Disposable (2g) dropped to fourth place from its previous third position, while Banana Gelato Distillate Disposable (2g) slipped from second to fifth. These shifts indicate a dynamic market where consumer preferences are rapidly evolving.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.