Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

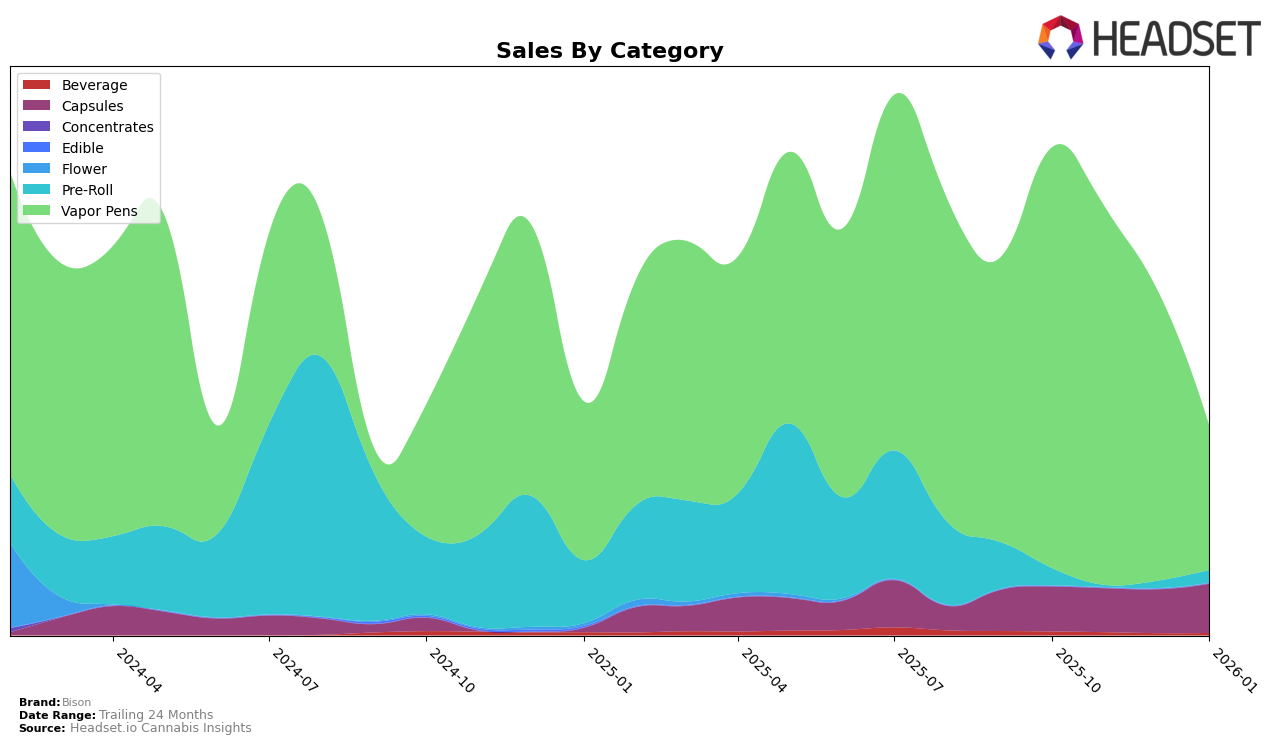

Bison's performance in Missouri demonstrates a strong presence in the Capsules category, maintaining a consistent third-place ranking from October 2025 through January 2026. This stability suggests a solid foothold in this category, with sales peaking in January 2026. However, in the Vapor Pens category, Bison's ranking has shown a downward trend, slipping from 28th in October 2025 to 46th by January 2026. This decline in Vapor Pens is accompanied by a significant drop in sales, indicating potential challenges in maintaining market share in this category. Notably, Bison did not rank in the top 30 for Pre-Rolls after October 2025, which might indicate a need for strategic adjustments in their product offerings or marketing strategies within this category.

The data highlights a mixed performance for Bison across different product categories in Missouri. While their Capsules continue to perform well, the challenges in Vapor Pens and Pre-Rolls could impact their overall market strategy. The absence of a top 30 ranking in Pre-Rolls after October 2025 could be seen as a setback, suggesting that Bison might need to explore new approaches to regain competitiveness in this segment. Overall, the brand's ability to maintain a strong position in Capsules while addressing the declines in other categories will be crucial for sustaining its presence in the Missouri market.

Competitive Landscape

In the Missouri vapor pens category, Bison has experienced a notable decline in both rank and sales over the months from October 2025 to January 2026. Starting at a rank of 28 in October, Bison slipped to 46 by January, indicating a significant drop in market position. This decline is mirrored in their sales figures, which decreased from a high in October to a lower figure in January. In contrast, Amaze Cannabis maintained a relatively stable ranking, only dropping from 36 to 44, while Cloud Cover (C3) remained consistent at rank 48 throughout the same period. Interestingly, The Clear showed a positive trend, climbing from rank 74 to 51, with a corresponding increase in sales, which could indicate a shift in consumer preference that Bison might need to address. This competitive landscape suggests that Bison may need to reassess its strategies to regain its footing in the Missouri vapor pens market.

Notable Products

In January 2026, the top-performing product from Bison was Forbidden Fruit Distillate Disposable 2g in the Vapor Pens category, climbing to the number one rank with sales of 719 units. Pineapple Express Distillate Disposable 2g, also in the Vapor Pens category, took the second spot, experiencing a drop from its previous first-place ranking in December 2025. EOCO High Dose Capsules 7-Pack 430mg saw an improvement, moving up to third place from its consistent fifth-place standing in the preceding months. Inspired Pre-Roll 1g maintained its fourth position from December 2025, while Sleepy Pre-Roll 1g entered the rankings for the first time in fifth place. This month showcased significant shifts, particularly within the Vapor Pens category, where Forbidden Fruit overtook Pineapple Express as the top seller.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.