Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

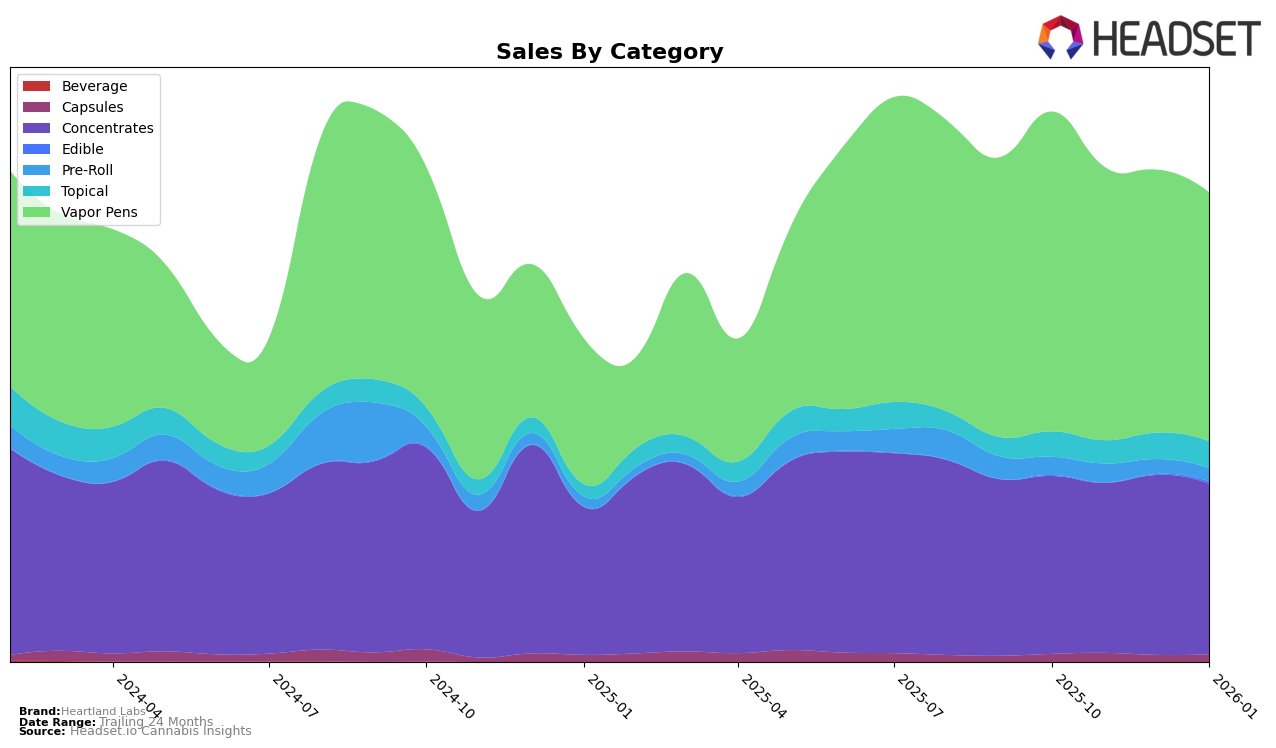

Heartland Labs has shown a varied performance across different product categories in Missouri. In the Concentrates category, they maintained a steady position, ranking consistently around the 10th and 11th spots from October 2025 to January 2026. This stability indicates a strong foothold in the Concentrates market. However, in the Vapor Pens category, they experienced a slight decline, dropping from the 23rd position in October 2025 to the 26th position by January 2026. This downward trend might suggest increasing competition or shifting consumer preferences in the Vapor Pens segment.

The performance in the Pre-Roll category tells a different story, where Heartland Labs did not manage to break into the top 30, with rankings fluctuating in the 60s and 70s over the observed months. This indicates a potential area for improvement or a reevaluation of their strategy within this category. Conversely, the Topical category showed remarkable consistency, with Heartland Labs holding firm at the 3rd position throughout the four-month period. This suggests a strong market presence and possibly a loyal customer base for their topical products in Missouri.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Heartland Labs has experienced a notable shift in its market position over the past few months. Initially ranked 23rd in October 2025, Heartland Labs saw a decline in its rank to 27th by November and December, before slightly recovering to 26th in January 2026. This fluctuation in rank coincides with a downward trend in sales, indicating potential challenges in maintaining market share. In contrast, Timeless showed a similar pattern of volatility, starting at 21st and dropping to 24th by January, yet maintaining higher sales figures compared to Heartland Labs. Meanwhile, Curio Wellness demonstrated a steady climb from 34th to 27th, with consistent sales growth, suggesting an effective strategy in capturing market interest. Proper Cannabis maintained a stable rank around the mid-20s, with sales figures slightly higher than Heartland Labs, indicating a more stable market presence. Notably, Franklin's made significant strides, moving from 40th to 28th, with a substantial increase in sales, highlighting a potential emerging competitor. These dynamics suggest that Heartland Labs may need to reassess its strategies to regain and enhance its competitive position in Missouri's vapor pen market.

Notable Products

In January 2026, Heartland Labs saw the Indica FECO RSO Syringe (1g) maintain its position as the top-performing product in the Concentrates category, achieving sales of 2090 units. The Sativa FECO RSO Syringe (1g) followed closely, holding steady at the second rank. Notably, the Hybrid FECO RSO Syringe (1g) climbed to the third position from fourth in December 2025. Meanwhile, the Granddaddy Purple Distillate Cartridge (1g) emerged as a new entrant in the top five, securing the fourth rank. The Blue Dream Distillate Cartridge (1g) rounded out the top five, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.