Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

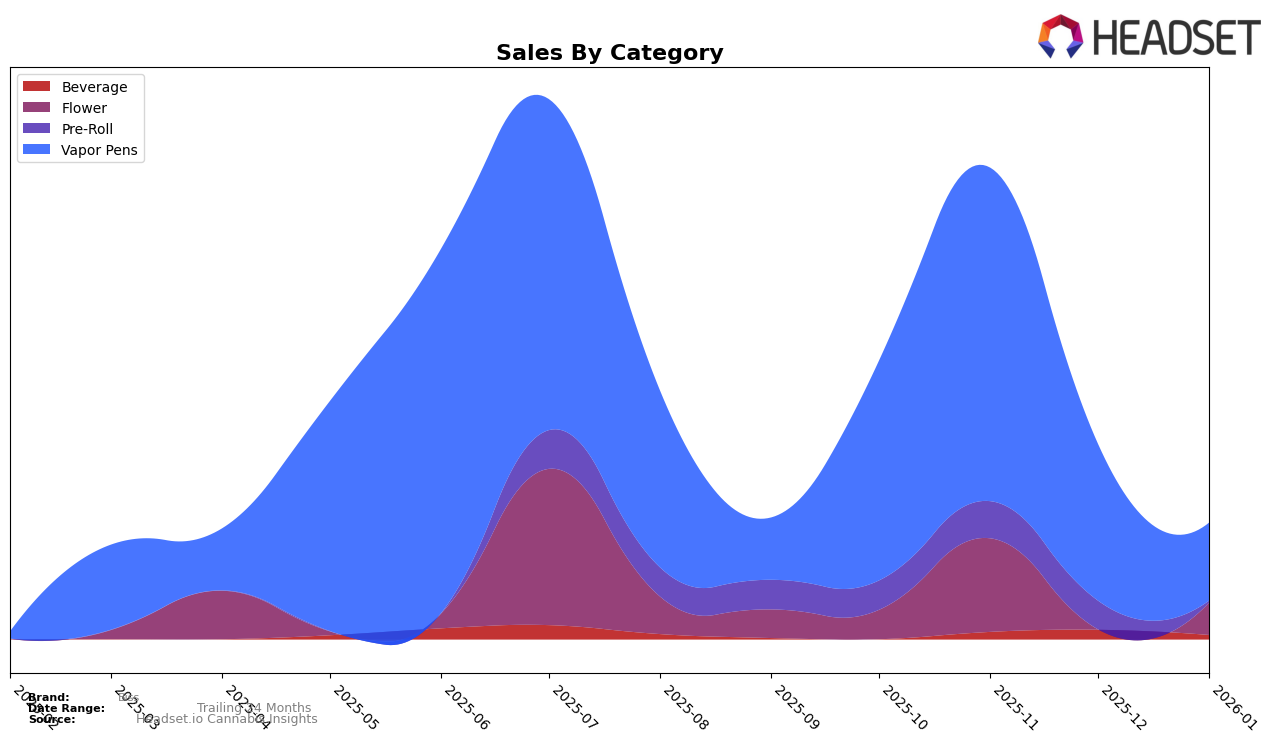

Biss has demonstrated varied performance across different product categories and states. In the Flower category in New Jersey, the brand did not secure a spot in the top 30 from October 2025 through January 2026, indicating challenges in gaining traction in this competitive segment. This absence from the rankings suggests that Biss might need to reassess its strategies in the Flower category within this market. On the other hand, the Vapor Pens category shows a more dynamic trend. While Biss was ranked 67th in October 2025, it climbed to 56th in November before dropping to 74th in December and further to 84th in January 2026. This fluctuation highlights the volatility in consumer preferences and market conditions in New Jersey, suggesting potential opportunities for Biss to stabilize and improve its position.

Analyzing the sales data provides additional insights into Biss's market performance. In the Vapor Pens category, despite the drop in rankings from November to January, there was a significant increase in sales from October to November, followed by a decline in the subsequent months. This trend may indicate an initial successful campaign or product launch that was not sustained over the following months. The sales figures suggest that Biss experienced a peak in consumer interest, which could be leveraged to understand what drove the temporary increase and how it can be replicated or improved upon. However, without seeing Biss in the top 30 for the Flower category, it is clear that the brand faces distinct challenges that may require strategic adjustments to enhance visibility and competitiveness in this sector.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, Biss has experienced significant fluctuations in its market position from October 2025 to January 2026. Initially ranked 67th in October, Biss saw an improvement to 56th in November, indicating a positive reception or effective marketing strategies during that period. However, by December, its rank dropped to 74th, and further declined to 84th in January 2026, suggesting challenges in maintaining consumer interest or facing increased competition. Notably, Raw Garden was not in the top 20 during this period, indicating a potential opportunity for Biss to capitalize on the absence of a strong competitor. Meanwhile, Kynd Cannabis Company and Nuvata maintained relatively stable positions, with Kynd Cannabis Company consistently ranked in the 60s and 70s, and Nuvata showing slight fluctuations around the 70s. New Earth also remained a steady competitor, with ranks in the 70s throughout the period. The sales trends suggest that while Biss had a spike in sales in November, the subsequent decline in both rank and sales highlights the need for strategic adjustments to regain market share and consumer loyalty in the New Jersey vapor pen market.

Notable Products

In January 2026, the top-performing product for Biss was Pineapple Express Distillate Disposable (1g) in the Vapor Pens category, which rose to the number one rank with sales of 132 units. Road Trip in the Flower category secured the second position, marking its first appearance in the rankings. Blue Dream Distillate Disposable (1g) in Vapor Pens, previously ranked second in December 2025, slipped to third place. Tropical Mixer in the Beverage category maintained a stable presence, moving from fifth to fourth place. Meanwhile, Daydream Drift Pre-Roll (1g), which had consistently held the top spot in previous months, fell to fifth position in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.