Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

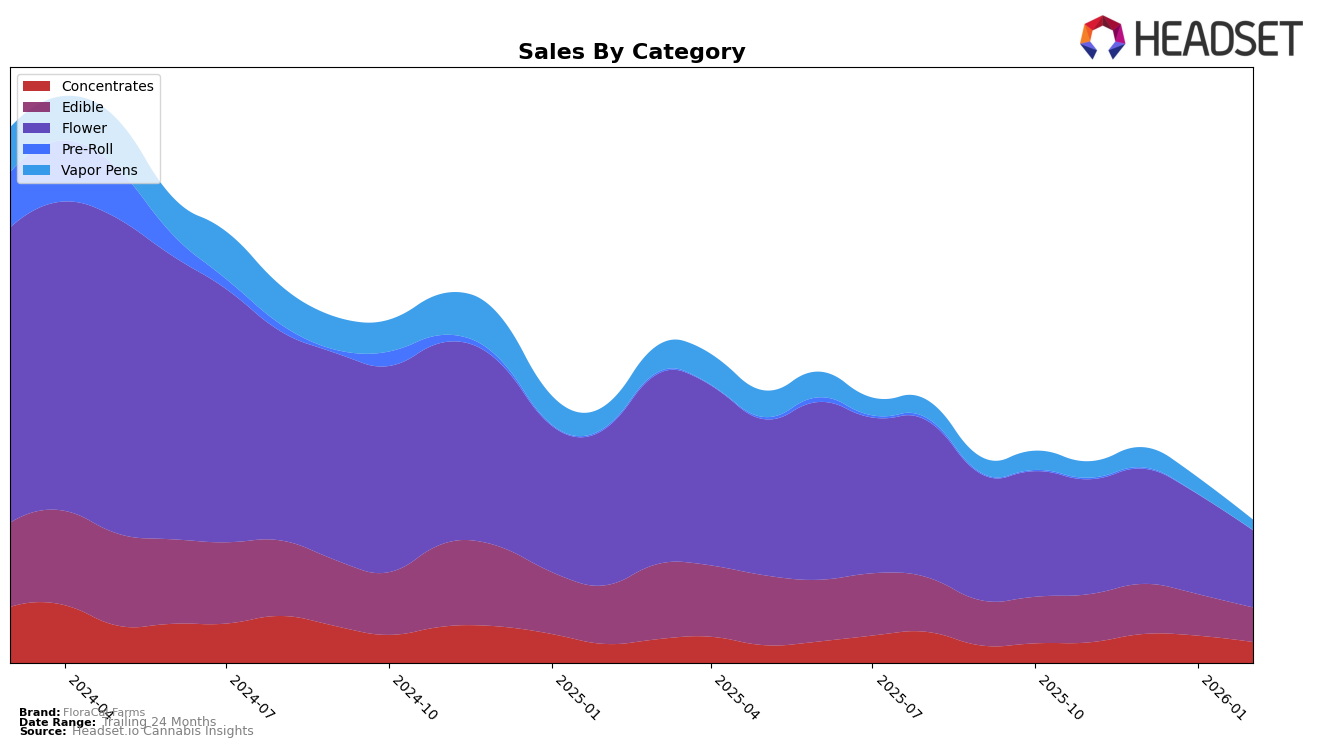

In Illinois, FloraCal Farms has shown a consistent presence in the Concentrates category, maintaining a rank within the top 20 from November 2025 to February 2026. The brand improved its position from 21st in November to 16th in December and February, indicating a solid foothold in this segment. However, the brand's performance in the Edible category has been more volatile. Starting at 28th place in both November and December, FloraCal Farms slipped out of the top 30 by January and further declined to 35th in February. This downward trend suggests challenges in maintaining competitive strength in the Edible market in Illinois.

In contrast, FloraCal Farms has faced struggles in the Massachusetts Edible market, where it hovered around the 35th position from November 2025 to February 2026, never breaking into the top 30. This consistent ranking outside the top tier indicates a need for strategic adjustments to enhance market penetration in Massachusetts. Meanwhile, in the Illinois Flower category, the brand has not been able to enter the top 30, with rankings consistently beyond 35th place. This suggests a significant opportunity for growth, but also highlights the competitive challenges FloraCal Farms faces in this category. The Vapor Pens category in Illinois shows a similar pattern, with rankings not breaking into the top 50, indicating a potential area for strategic focus.

Competitive Landscape

In the competitive landscape of the Illinois flower category, FloraCal Farms has experienced some fluctuations in its market position over recent months. While maintaining a consistent presence, FloraCal Farms ranked 38th in November 2025, improved slightly to 36th in December 2025, but then slipped back to 38th in January 2026 and further to 40th in February 2026. This downward trend in rank is mirrored by a decrease in sales from December to February. In contrast, Seed & Strain Cannabis Co. has shown a similar pattern, starting at 31st and dropping to 39th, but still managing to stay ahead of FloraCal Farms. Meanwhile, Mini Budz demonstrated a notable improvement in January 2026, jumping to 34th place, although it fell back to 41st in February. In House has shown a positive trajectory, improving from 44th in November to 38th in February, surpassing FloraCal Farms. Lastly, Rooted has made significant strides, climbing from 62nd in November to 42nd in February, indicating a strong upward trend. These dynamics suggest that while FloraCal Farms remains a key player, the brand faces increasing competition, with several brands either closing the gap or surpassing it in the rankings.

Notable Products

In February 2026, FloraCal Farms' top-performing product was Pink Lemonade Live Rosin Gummies 10-Pack (100mg) in the Edible category, maintaining its consistent first-place ranking since November 2025 with sales of 3188 units. Following closely, Wild Berry Live Rosin Gummies 10-Pack (100mg) also retained its second-place position throughout the same period. Kush Mints (3.5g) in the Flower category climbed back to third place in February 2026 after slipping to fourth in January. Tropical Punch Live Rosin Gummies 10-Pack (100mg) held steady at fourth place, despite a notable drop in sales. Purple Plague (3.5g) remained in fifth place, showing consistent performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.