Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

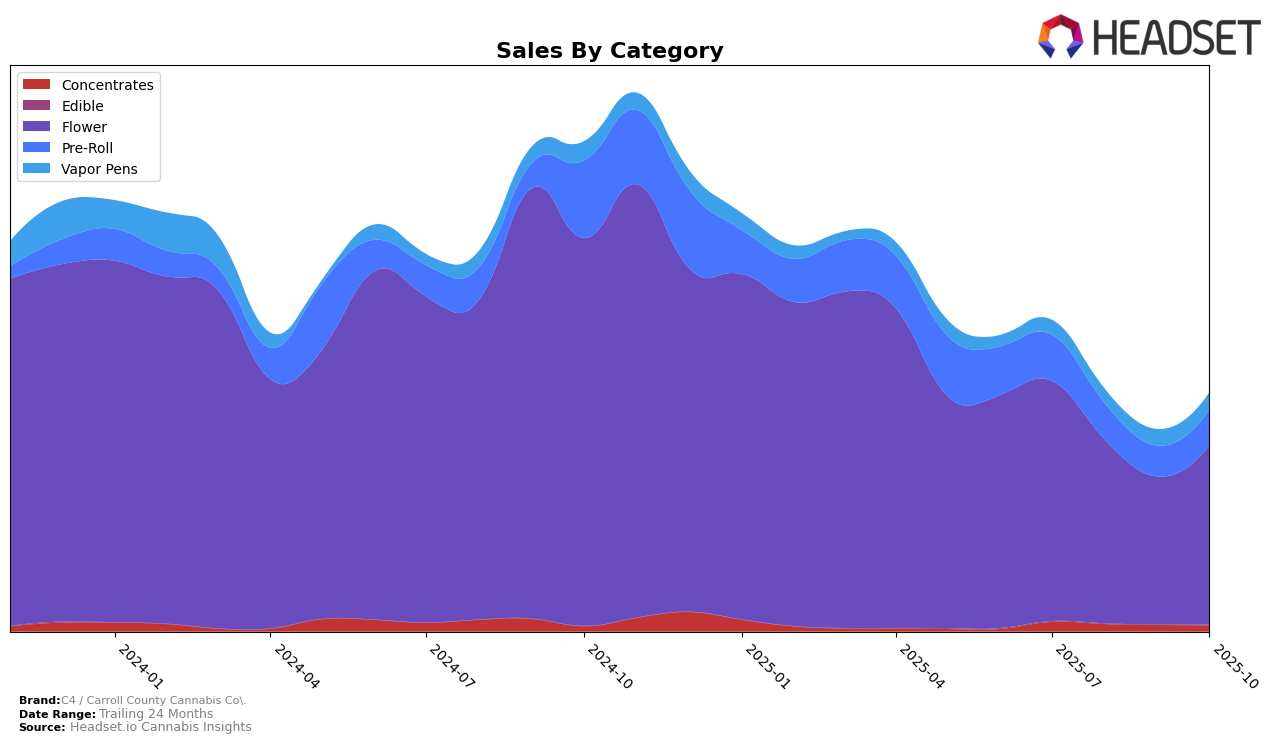

C4 / Carroll County Cannabis Co. has experienced a varied performance across different categories and states over the past few months. In California, the brand's presence in the concentrates category has been inconsistent, with rankings fluctuating from 88th in July to 96th in August, and then slightly improving to 90th in September, but ultimately falling out of the top 30 by October. This downward trend is concerning, as the brand was unable to maintain its position within the top ranks, indicating potential challenges in maintaining competitiveness or market presence in California's concentrates market.

In contrast, C4 / Carroll County Cannabis Co. has shown a more stable performance in Missouri, particularly in the flower category. The brand consistently ranked within the top 30, moving from 22nd position in July to 27th in October. This steady presence suggests a solid foothold in Missouri's flower market, although the slight dip in rank could indicate increasing competition or shifting consumer preferences. Additionally, in the pre-roll category, the brand has maintained a position within the top 50, with a slight improvement from 46th in September to 44th in October, showing resilience in this segment despite a competitive landscape.

Competitive Landscape

In the competitive landscape of the Missouri flower category, C4 / Carroll County Cannabis Co. has experienced fluctuating rankings over the past few months, indicating a dynamic market environment. In July 2025, C4 held the 22nd position but saw a decline to 29th in August, maintaining this rank in September before slightly improving to 27th in October. This trend suggests a need for strategic adjustments to regain a stronger foothold. Notably, Habitat demonstrated a significant rise from 35th in July to 22nd in August, maintaining a strong presence through October. Meanwhile, Sublime and Buoyant Bob have shown relatively stable rankings, with Sublime consistently outperforming C4 in October by ranking 26th. Sundro Cannabis also maintained a competitive position, closely trailing C4 in October. These insights highlight the importance for C4 to innovate and enhance its market strategies to improve its competitive standing and drive sales growth in the Missouri flower market.

Notable Products

In October 2025, the top-performing product for C4 / Carroll County Cannabis Co. was Member Berry (Bulk) from the Flower category, which climbed to the number one spot with sales figures reaching 2125 units. Bubba Fett Pre-Roll (0.5g) in the Pre-Roll category was the second best-seller, dropping from its previous top position in September. Super Lemon Haze (3.5g) secured the third rank in the Flower category, showing a significant rise from its previous unranked status in recent months. Member Berry (3.5g) followed closely in the fourth position, maintaining its presence in the top ranks. Super Lemon Haze (Bulk) rounded out the top five, experiencing a slight decline from its earlier second position in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.