Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

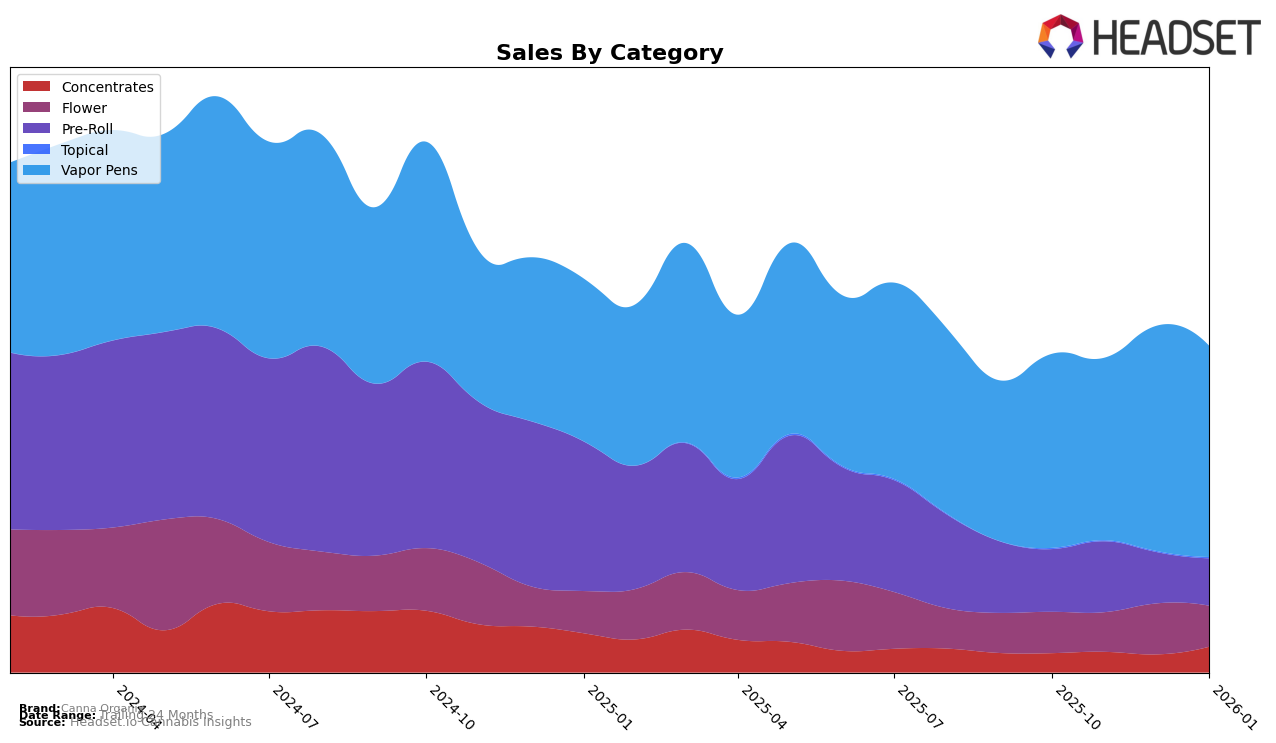

Canna Organix has shown varied performance across different product categories in Washington. In the Concentrates category, the brand did not appear in the top 30 rankings for October 2025, indicating a weaker presence during that month. However, there was a notable upward trajectory from November 2025 to January 2026, where they moved from 97th to 81st place. This suggests a gradual improvement in their market positioning, even though they remain outside the top 30. Such movements could imply increased consumer interest or strategic changes that are starting to bear fruit.

In contrast, Canna Organix's performance in the Vapor Pens category has been more stable, maintaining a position within the top 35 throughout the observed months. They improved slightly from 33rd in October 2025 to 31st by January 2026, reflecting consistent consumer demand or effective marketing strategies. The Pre-Roll category tells a different story, with fluctuating rankings—72nd in October, improving to 60th in November, but then slipping again to 76th and 74th in December and January, respectively. This inconsistency might highlight challenges in maintaining product appeal or competition dynamics within this segment. Such insights are crucial for understanding the brand's strategic positioning and potential areas for growth or improvement.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Canna Organix has shown a consistent performance with a gradual improvement in rank from 33rd in October 2025 to 31st in January 2026. This upward trend is indicative of a steady increase in market presence despite fluctuations in sales, which peaked in December 2025. Competitors like Honey Tree Extracts and Trichome Extracts / Canna Pacific have maintained stronger positions, with Honey Tree Extracts ranking as high as 26th in October 2025. Meanwhile, Falcanna and Incredibulk have been trailing behind Canna Organix, with Falcanna consistently ranking lower and Incredibulk not breaking into the top 30. This competitive positioning suggests that while Canna Organix is improving, there is still significant ground to cover to challenge the top-tier brands in the Washington vapor pen market.

Notable Products

In January 2026, Durban Poison Live Resin Cartridge (1g) emerged as the top-performing product for Canna Organix, maintaining its number one rank from December 2025 with sales of 676 units. Blue Dream Sauced & Tossed Infused Pre-Roll 2-Pack (1g) rose to the second position, showing an improvement from its third-place ranking in December. Forbidden Fruit Live Resin Cartridge (1g) slipped slightly to third place, after being ranked second the previous month. Canna Whupass - Pink Lemonade Distillate Cartridge (1g) held steady at the fourth rank, similar to December's performance. Pear Herer Distillate Cartridge (1g) entered the top five for the first time, marking its debut at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.