Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

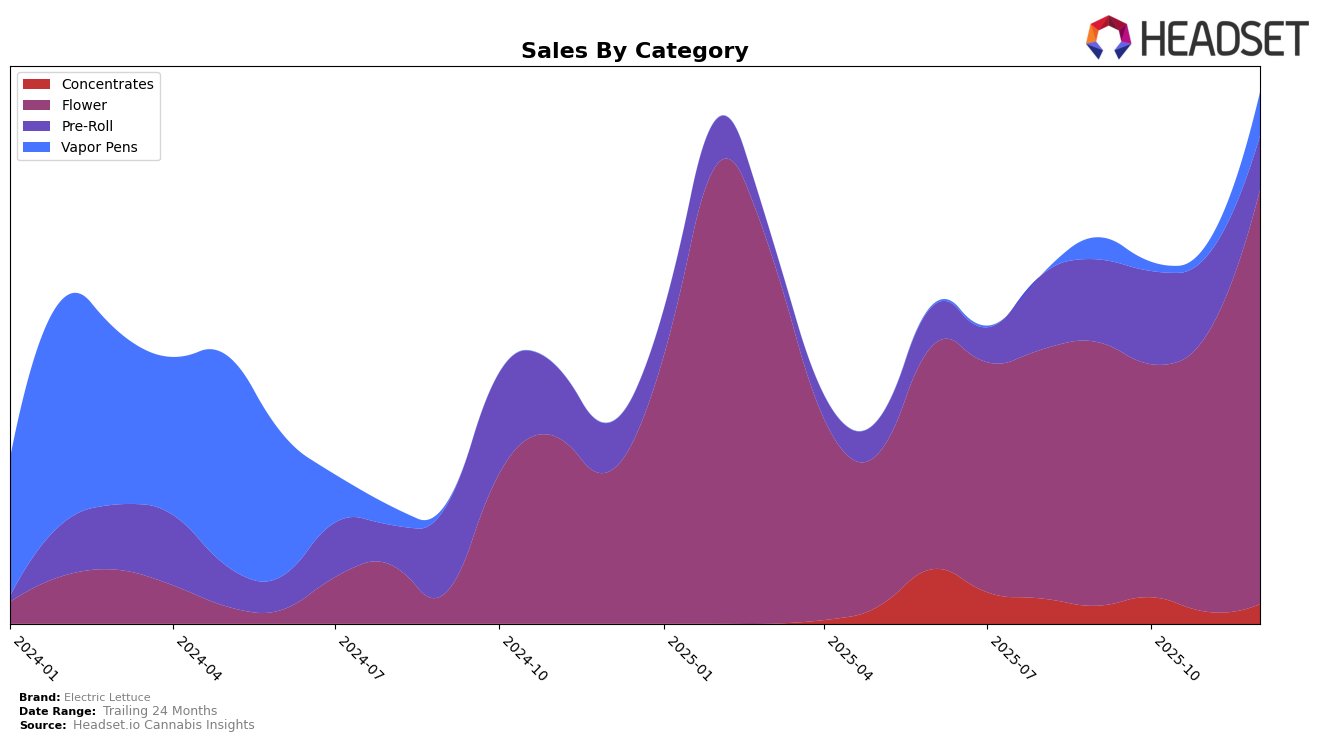

Electric Lettuce has shown a fluctuating performance across different provinces, particularly in the flower category. In Alberta, the brand did not make it into the top 30 rankings from September to December 2025, indicating a challenging market presence in the flower category. This could be seen as a negative sign, suggesting the brand may need to reassess its strategy in Alberta. Conversely, in Saskatchewan, Electric Lettuce experienced a positive trajectory, rising from 33rd place in September to 21st by December. This upward movement highlights a strengthening position in the Saskatchewan market for their flower products.

In the pre-roll category within Saskatchewan, Electric Lettuce was ranked 57th in September 2025 but did not appear in the top 30 in subsequent months. This absence could suggest a decline in their pre-roll market share or a shift in consumer preferences. Despite this, the flower sales in Saskatchewan showed a notable increase, particularly from October to December, signaling an area of growth for the brand. These insights suggest a mixed performance across categories and provinces, with significant room for improvement in certain areas while maintaining growth momentum in others.

Competitive Landscape

In the competitive landscape of the Flower category in Saskatchewan, Electric Lettuce has shown a notable upward trajectory in its rankings and sales from September to December 2025. Starting from a rank of 33 in September, Electric Lettuce improved significantly to reach the 21st position by December, indicating a strategic push that has resonated well with consumers. This rise is particularly impressive when compared to competitors like North 40 Cannabis, which held a steady position in the top 20, and Elevator, which saw a decline from 8th to 20th place over the same period. Meanwhile, 3Saints experienced fluctuations, missing the top 20 in October but returning to 22nd place in December. The competitive dynamics suggest that Electric Lettuce's strategic initiatives are effectively capturing market share, as evidenced by its sales growth trajectory, which saw a remarkable increase, especially in December, closing the gap with higher-ranked brands.

Notable Products

In December 2025, Electric Lettuce's top-performing product was Lemon Supreme Diesel Pre-Roll (1g) in the Pre-Roll category, maintaining its number one rank from November despite a slight decrease in sales to 769 units. Electric Blend Milled (28g) in the Flower category moved up significantly, achieving the second rank with sales reaching 573 units, after not being ranked in October and November. Lemon Supreme Diesel (3.5g), also in the Flower category, held the third position, dropping slightly from its previous second-place standing in November. Toasted Vanilla Distillate Cartridge (1g) entered the top rankings for the first time at fourth place in the Vapor Pens category, indicating a successful product launch or increased demand. Strawberry Banana (7g) in the Flower category rounded out the top five, slipping from third in November, highlighting a competitive landscape within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.