Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

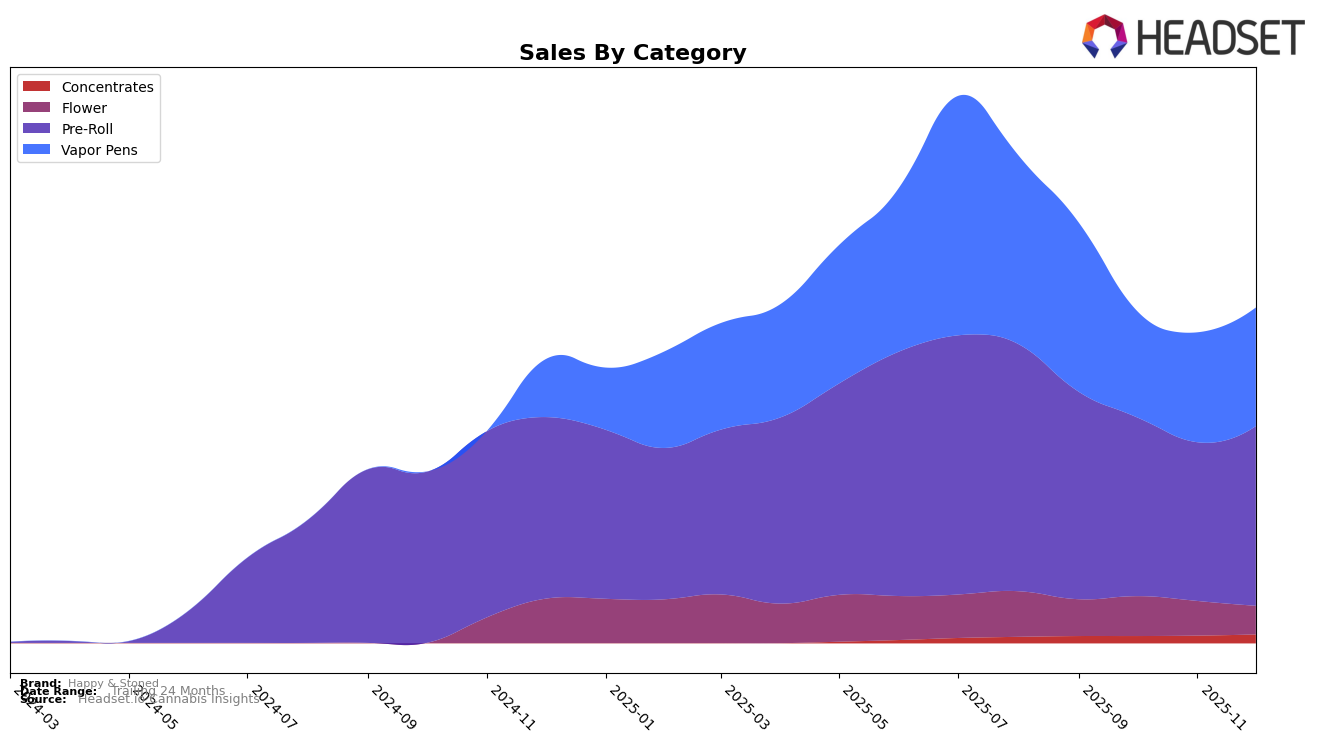

In Alberta, Happy & Stoned's performance in the Pre-Roll category showed a notable upward trend from September to December 2025, improving its rank from 95th to 69th. This improvement is significant given the competitive nature of the market. In contrast, their Vapor Pens category experienced a slight decline in rank from 40th to 44th over the same period, despite an increase in sales in December. This suggests that while there is consumer interest, the brand might face stiff competition or changing consumer preferences in this category.

In British Columbia, Happy & Stoned's Pre-Roll category saw inconsistent rankings, with the brand not appearing in the top 30 in October 2025, which could be seen as a setback. However, they regained their presence by December, ranking 60th. Meanwhile, their Vapor Pens category showed a similar pattern, missing the top 30 in October but bouncing back to 27th by December. In Ontario, the brand maintained a steady position in the Concentrates category, holding around the mid-40s rank, while their Flower category saw a decline from 76th to 86th, indicating potential challenges or shifts in consumer demand. The Pre-Roll and Vapor Pens categories in Ontario also witnessed a gradual decline, suggesting that while the brand has a foothold, it may need strategic adjustments to improve its standing.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Happy & Stoned has experienced fluctuating rankings over the last few months of 2025, which could impact its market positioning and sales trajectory. Starting from a rank of 39 in September, Happy & Stoned saw a decline to 46 in November before slightly recovering to 44 by December. This downward trend contrasts with the performance of competitors like Color Cannabis, which improved its rank from 52 to 46 during the same period, and Sixty Seven Sins, which, despite a drop in sales, maintained a higher rank, moving from 29 to 42. Meanwhile, Shatterizer and Common Ground also showed varying performance, with Shatterizer maintaining a relatively stable position and Common Ground experiencing a decline. These dynamics suggest that while Happy & Stoned faces challenges in maintaining its rank, there is potential for strategic adjustments to capitalize on market opportunities and improve its standings against competitors.

Notable Products

In December 2025, Quick Rips Sativa Pre-Roll 4-Pack (2g) emerged as the top-performing product for Happy & Stoned, maintaining its first-place ranking from October, with sales reaching 10,477 units. Quick Rips Indica Pre-Roll 4-Pack (2g) held steady at the second position, mirroring its performance from November. Joyride Pre-Roll (1g) climbed to the third spot, showing improvement from its previous fourth-place rank in both October and November. Slumpz Pre-Roll (1g), despite being the top product in September and November, dropped to fourth place in December. Juicy Fuel Pre-Roll 2-Pack (2g) re-entered the rankings at fifth place, having been absent in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.